Winds of Change: Disrupting the Incumbents

by Harlem Capital

By 2024 Fellow Amir Williams & Partner Jarrid Tingle

In the ever-evolving tech world, the landscape shifts in the blink of an eye. While industry giants often dominate with their market share and resources, they can be surprisingly vulnerable to the winds of change. This is the thrilling arena of incumbent disruption, where nimble startups challenge the established order and rewrite the rules of the game.

Defining the Disruption

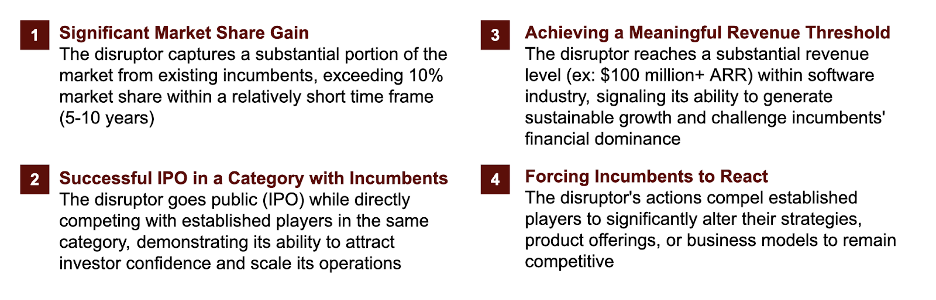

We see incumbent disruption as a process where a new software startup doesn’t just enter the market but shakes its entire foundation. It’s about more than just carving out a niche; it’s about achieving at least one of these four major outcomes:

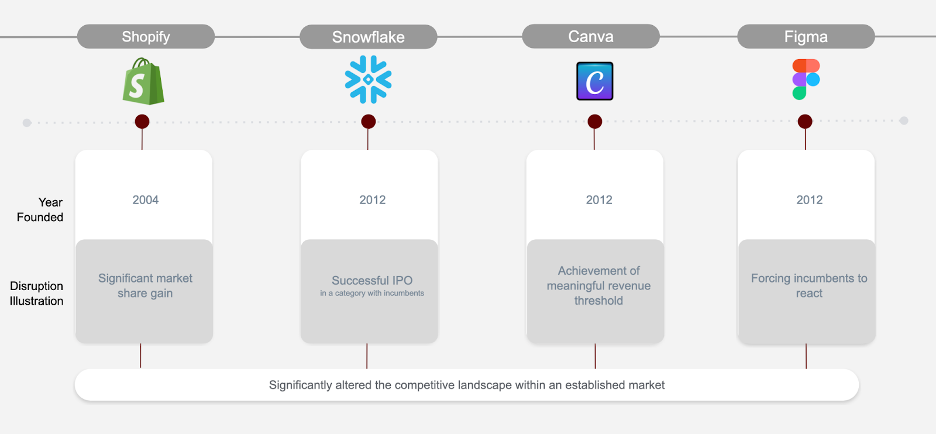

- Market Share Grab: Think Shopify, going from underdog to owning over 20% of the U.S. e-commerce platform market

- Successful IPO in a Crowded Space: Consider Snowflake, boldly stepping onto the public stage despite facing fierce competition from giants like Amazon

- Revenue Powerhouse: Canva, having surpassed the billion-dollar revenue mark in 2021 and continuing its impressive growth trajectory, is a prime illustration of this outcome

- Forcing a Reaction: Figma made Adobe scramble to launch their own collaborative design tool, showcasing disruption in action

Why Disruption Matters

Incumbent disruption is a critical force in the software industry. Many established companies, despite holding significant market share, often struggle to innovate at the pace of evolving customer needs. This creates opportunities for nimble startups to challenge the status quo and reshape the industry landscape. Our report on incumbent disruption examines the strategies and tactics these disruptors employ, aiming to uncover insights that can guide future innovators. It’s also worth noting that all conglomerates had to begin as a fledgling startup.

We believe that understanding the dynamics of disruption is essential for startups aiming to succeed in well-established markets. It allows them to identify opportunities, develop effective strategies, and position themselves at the forefront of innovation and change. Consider these key benefits:

“The Innovator’s Dilemma” by Clayton Christensen catalyzed our deep dive into the world of disruption. We further pored over industry analysis to craft repeatable blueprints for startups.

We’ve discovered that the most successful disruptors aren’t just lucky; they strategically target the weaknesses of established giants, whether it’s outdated technology, operational inefficiencies, or overlooked customer segments. These agile newcomers leverage unique value propositions, disruptive business models, and a relentless focus on the customer to topple industry titans and recreate the playing field.

Unveiling the Disruptor’s Playbook

So, what’s the secret sauce? How do these startups pull it off? These are the two key ingredients we’ve identified:

1. The Disruptor’s Toolkit

Successful disruptors often possess a combination of these key elements:

2. Spotting the Cracks: Identifying Incumbent Vulnerabilities

Disruption doesn’t happen in a vacuum. Here’s where incumbents often leave the door open:

The Investor’s Perspective

For investors, understanding these dynamics is of paramount importance. Spotting the disruptors early on means getting in on the ground floor of the next big thing. After all, the essence of venture capital is about identifying startups that have the potential to reshape entire industries and deliver outsized returns.

Remember, disruption is not just about survival; it’s about thriving in a constantly evolving business landscape. In doing so, both startups and investors can shape the future of industries and drive meaningful progress.

- Ready to dive deeper? Download our full report on Incumbent Disruption for a comprehensive analysis and actionable insights

- Are you a disruptor in the making? Reach out to Harlem Capital – we’re always looking for the next game-changer

About Harlem Capital Partners

Harlem Capital (HCP) is an early-stage, diversity-focused venture capital firm. HCP makes initial investments of $1mm to $2.5mm in U.S. seed rounds for 10-15% ownership.

Stay updated on Harlem Capital news by subscribing to our monthly newsletter, follow us on LinkedIn, X, and Instagram.