What Are VCs Really Looking For Right Now?

by Harlem Capital

By Partner Gabby Cazeau

A lot has changed in the world since we wrote “What are VCs Really Looking for” in May 2020. There’s been a boom and bust in the tech market, mass upheaval, and VC funding has slowed down in the last few years.

At Harlem Capital, we’ve weathered those storms and grown amid the chaos. We launched our second fund, evaluated over 10,000 companies, invested in 60 companies, and scaled how we support our founders as they accelerate to the next stage of growth.

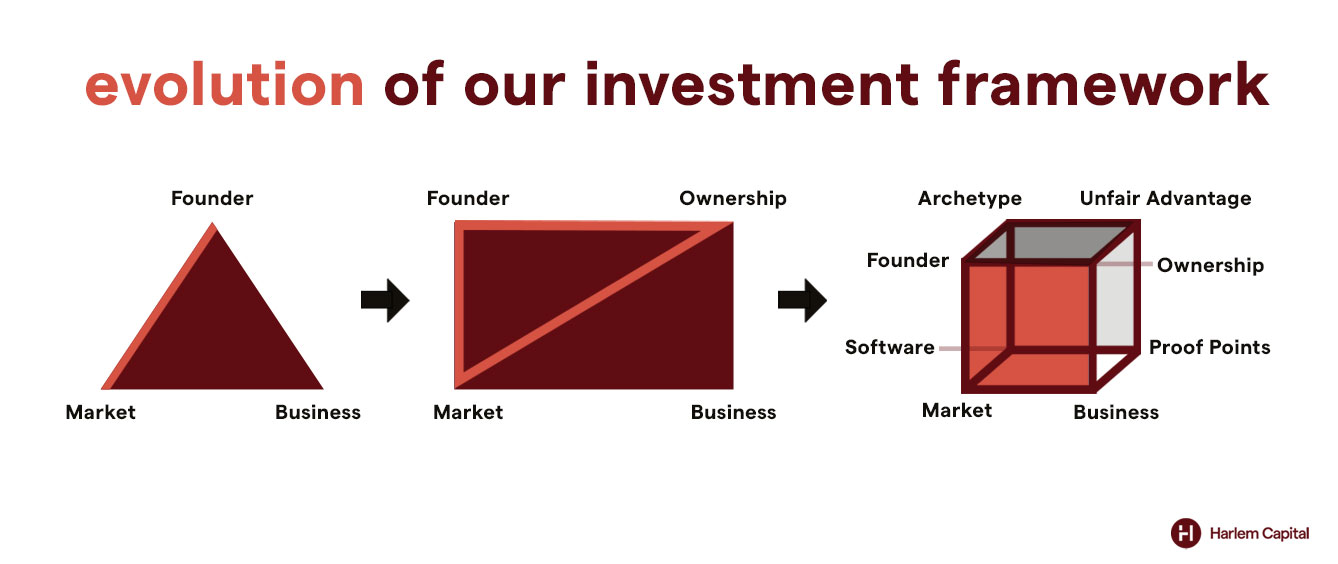

But as the market has shifted, most VC firms have changed how they evaluate companies. Our investment framework has been one of our biggest evolutions too. The HCP box from the May 2020 article is still true to an extent. But we emphasize a few more things that add depth and dimension to our evaluation of potential investments.

Problems Software Can Solve

Every company sets out to solve a problem. But in the fallout of the last few years, it’s become clear that many companies haven’t been focused on the #1 problem, a big enough problem, or the right problem for their customer. We increasingly focus on B2B and B2B2C software solving the #1 burning pain point for customers.

We think about the biggest software businesses today and how they’ve become either 1) a system of record for their customer or 2) a comprehensive suite of tools that provide everything they need. Those are businesses that reach $100-200m+ in revenue and that might be a mix of SaaS, Financial Services, Actual Services, or Hardware. And if it feels like it’s a higher bar to meet than before, it’s because it is. Successful recent IPOs have had at least $200m+ in revenue. Venture capital is a business of scale and power-law outcomes. We have to believe in those large outcomes that come from solving big problems, truly scalable with software’s propulsive power.

Archetypes

VCs are looking for founders whom they want to work with, whom they believe can succeed against all odds. We invest at the early stage – pre-seed and seed – and are betting on the founding team. If anything, that’s one thing that has always been the same. We’re focused on working with exceptional founders solving big problems. How we think about the founder traits and attributes that lead to success has changed.

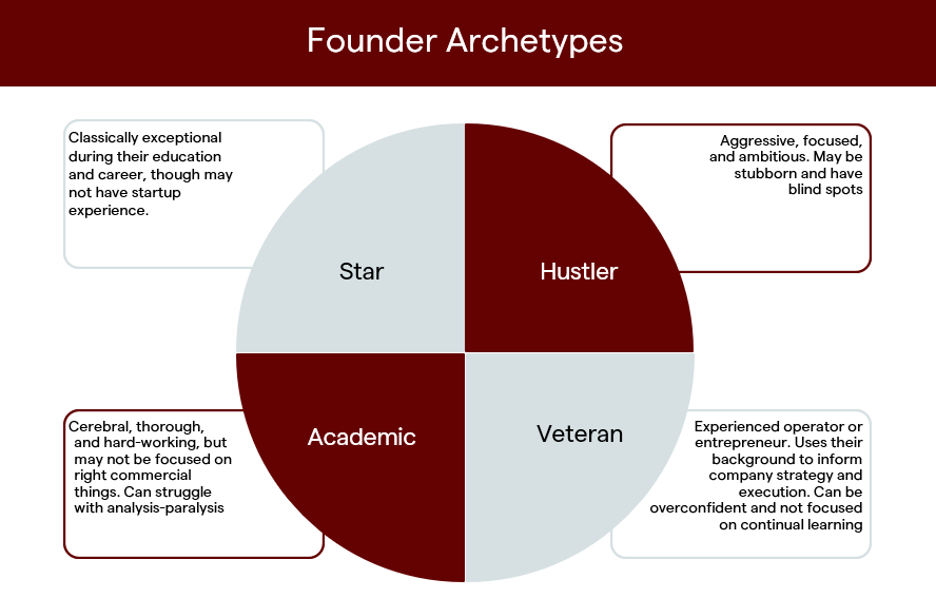

We think about founder traits in “archetypes” – where we’ve bundled traits together to better understand where founders are coming from to meet them where they are.

We believe any founder of any background can succeed. But it’s key that founders (and investors) are self-aware about blindspots and opportunity gaps that could be filled. In our diligence, we focus on a few key traits that shine in the best-performing founder:

- Sense of urgency about the problem you’re solving and how you think you’ll solve it

- Speed of product iteration

- Transparency & communication

Unfair Advantage

We believe that now is one of the best times to start a company. And two key things are happening right now.

1. The cost of creating a new software company drops dramatically with AI and new tools and products today. So you can build faster and cheaper – but so can your competition.

2. Incumbents and scaled businesses have more power and leverage than they did before with scaled distribution, broad customer bases, and trust.

So your unique and unfair advantage in the world matters more. It could be industry specific, distribution-focused, IP, or a specific wedge into a tough market. We know that advantage won’t last forever, but it has to be strong enough to help you break into your market, win over initial customers, and give you time to compete and outlast other startups and incumbents.

Performance Proof Points

At every stage of investing, the traction VCs look for has increased. Previously, $500k – $1mm in ARR was enough for Series A, but now that’s closer to $1.5 – $2mm in ARR. That has a trickle down effect at the pre-seed and seed stage.

Ultimately what VCs are looking for is proof that the problem you’re solving is important enough. It’s about performance and results. Now that proof will look different at each stage. At the pre-seed stage, it could be early prototypes and feedback from users. It could even be your own track record of performance building and launching products. At the seed, it’s early customers. More than ever VCs are talking to customers or potential customers to vet whether founders are solving burning pain points. As customer budgets have gotten tighter, that’s even more important. A customer dollar in 2024 is worth more than it was in 2021.

Looking Ahead

As the market has changed, there is a clear evolution to what VCs are focused on. Early-stage investing is still largely about taking a bet on people who’ve taken a bet on themselves. Since VC is about chasing those unique outliers, there will always be exceptions to the rule. But it’s still key for founders to understand more of this overall evolution and what matters to firms in their decision-making process.

Stay up to date on all things Harlem Capital by following us on X, LinkedIn & Instagram + subscribing to Road to 1,000, our monthly newsletter.