What Are VCs Really Looking For in an Investment???

by Harlem Capital

One of the top questions that founders ask us is “What are you looking for in an investment?” This question should be simple, but is often complex and open-ended for venture capitalists. Most VC firms have general investment criteria, some publicly like ours and others internally. However, meeting that criteria likely doesn’t mean the VC firm will invest. Instead, it means that the startup will make it to the next stage of the diligence funnel.

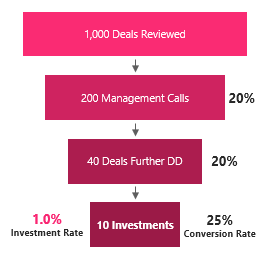

At Harlem Capital, we have four stages of diligence as shown above. Each stage typically has a conversion of 20%–25%, which leads to an investment rate of ~1%. It is worth noting this is very typical for VC firms — investing in 1 out of 100 startups they see. For context, the lowest college acceptance rate is Stanford at 4.7%. What does this low of an investment rate mean for Harlem Capital?

- Our biggest reason for not investing is often OPPORTUNITY COST. That means, “Is this deal better than the next 99 that we will see?” The answer to that question doesn’t mean the startup is bad, which is often the assumption. People often refer to FOMO (Fear of Missing Out) for VCs investing in deals, but it also applies to why VCs don’t invest as they don’t want to miss the chance of another deal. There are two constraints: 1) VCs only have so much capital or so many deals they can invest in and 2) VCs can’t invest in direct competitors as that is a portfolio conflict.

- When we meet you DOES matter. We are targeting 10 deals a year and 30 deals for the fund. As a firm with 2 Partners, we are usually focused on 3–4 deals any month that will end up as the 1 deal we invest in. There is only so much bandwidth investors can have for looking at several deals. There are many reasons that can make a deal high priority (Partner industry interest, the introduction, etc.)

- We say ‘NO’ A LOT (99% of the time), so PLEASE don’t take it personally. It is never easy for us to say no, especially as we speak with the founder numerous times or do more diligence. We try to be efficient with founders’ and our time as nothing is more precious for either side. As a result, our goal is to say no as fast as possible, but we aren’t perfect. We understand venture is a PEOPLE’s business as it’s all about RELATIONSHIPS so we value that and focus on the long-term relationship. We’ve invested in businesses that we have passed on because we remained in touch with the founder. It’s important to remember that every e-mail or conversation will be a part of future decisions, on both sides.

Why We Invest

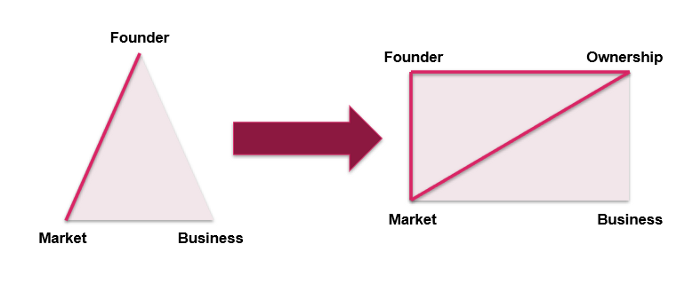

So we provided a lot of context on why we don’t invest, but let’s dive into why we do invest in those 1%. After taking calls with ~20% of founders we do deep diligence on ~20% of those, or 4% of the total. The key 4 areas we are focused on in further due diligence are what we call our HCP Investment Box

Founder

We are looking for great founders as we believe this is the most important piece of the box. Understanding why the founder is the right founder for this business at this time is important. That is essentially answering, “Why You and Now?”

Getting to know the founder typically includes several calls with management, talking to existing investors and personal reference checks. We had a rule to meet the founder once before investment, but COVID-19 has adjusted us to doing more zoom calls than before, which has actually led to us getting to know the founders better.

Market

We are looking for $1bn+ markets that are growing. We generally believe most businesses are being built in existing markets. There are the few like Uber, Airbnb, etc. that create new markets, but that is not generally the case. We usually have a clear sense of the market size.

Our market diligence includes a top down and bottoms up market analysis, analyzing private and public comparables for differentiation and looking at potential acquirors for exit ranges. Our current portfolio is ⅔ enterprise and ⅓ consumer, which is likely to persist during COVID-19 given the uncertainty for consumers.

Business

The business will likely pivot or adjust in some capacity so it is the least important part of the box for us. The other components cannot generally be changed so we focus on those the most, why there is a triangle inside the box. We do want to believe the unit economics work at scale (LTV/CAC, margins, etc.). We also assess based on pricing how many customers you will need to be a $50mm+ revenue business and what that implies for customer penetration based on the number of customers in the market (much easier to determine for enterprise).

We rarely invest pre-revenue (2 of 15 to date) so for startups that have some traction ($6k+ MRR) we like to look at monthly revenue, margins, customer retention and other key performance indicators (KPIs). The revenue threshold will likely be more stringent during COVID-19 as the bar is raising for most investors. You have already seen pre-revenue Seed rounds decrease from 91% in 2010 to 33% in 2019.

Ownership

We adjusted our investment triangle to an investment box once we hit our $40mm cap. There is a threshold for funds that ownership becomes important, we believe that is around $30mm. Based on our model, which is explained in our fund return post, we target 5–10% ownership.

Given our typical check size of $750k, we are looking for Seed rounds between $7.5mm and $15mm valuations. We expect to be on the higher end of our ownership target, if not above 10% given Seed valuations are expected to drop 20%–30% post-COVID-19.

Conclusion

Every fund has different criteria and diligence processes so it is helpful for investors to be as transparent as possible and for founders to ask. However, most investors will have some form of the above investment box (founder, market, business, ownership) and they should be answered in your pitch deck. The variation will often come from the prioritization of these four items and the diligence done to assess each area. Any fund’s investment box can be broken and that’s the frustrating thing about venture — there are always exceptions. We wanted to provide some insight for our general investment thoughts, but at the end of the day we are looking for amazing founders that are trying to change the world.

To stay up to date on Harlem Capital news, subscribe to our monthly newsletter.

Thanks to our Managing Partner, Henri Pierre-Jacques, for writing this piece.

Regards,

Harlem Capital Team