Why should we care about Web3?

by Harlem Capital

In case you missed it, Harlem Capital believes Web3 will generate outsized value that could be larger than what Web1 or Web2 have achieved. You may still be skeptical of Web3 or perhaps you want to take a deeper dive into the rabbit hole.

To help make sense of the varying Web3 dimensions and exciting use cases that can emerge, Harlem Capital has developed a Web3 Primer. We double click into the infrastructure, tokens, NFTs, gaming, defi, and the importance of community. This report is especially helpful if you are interested in investing in digital assets.

You can find the full report here:

Why Web3 Matters

Web3 creates new opportunities for ownership, collaboration, wealth generation, and proof of scarcity:

- Ownership – creators and consumers will own their own data and avoid large fees from platforms.

- Collaboration – the blockchain now allows parties to securely work together across the globe in a decentralized manner.

- Wealth Creation – One example: In Web2, creators get 100% of the first sale of their work and no additional revenue in any secondary sales. In Web3, they can get 100% of the initial sale, and X% of every additional sale creating passive perpetual revenue — Think NFTs.

- Proof of Scarcity – The blockchain acts as a ledger that shows proof of ownership and transaction history. And it’s immutable, meaning it can’t be changed, which makes it more secure and trusted. As a result, digital content and goods can be unique and scarce.

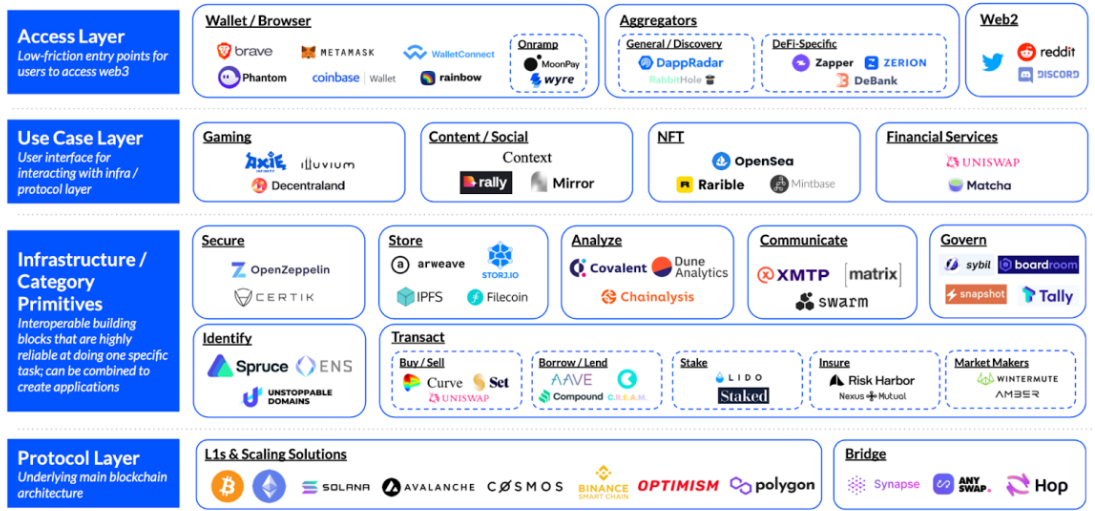

How It Works

Most of the popular and mainstream discussion around Web3 startups happens at the access and use case layers. This is where users interact with blockchain technology across multiple industries. This would not be possible without enhancement and expansion of the infrastructure and protocol layers. Critical aspects of underlying blockchain infrastructure include key management, networking firewalls, and other security considerations.

In order for Web3 to support mass adoption (high volume and transaction speeds), investments in the infrastructure and protocols are critical. Harlem Capital has seen more deals in these layers (Alchemy, NEAR Protocol) over the past year and we predict continued growth.

In order to use Web3 products, you need Web3 digital assets. These can be fungible or non-fungible. Fungible assets are interchangeable like cryptocurrency (e.g. Bitcoin or Ethereum).

- Single-use case: Its only use case is to serve as digital money i.e. BTC.

- Multi-use case: It can be used as digital money but also to create decentralized applications (dapps) i.e. ETH.

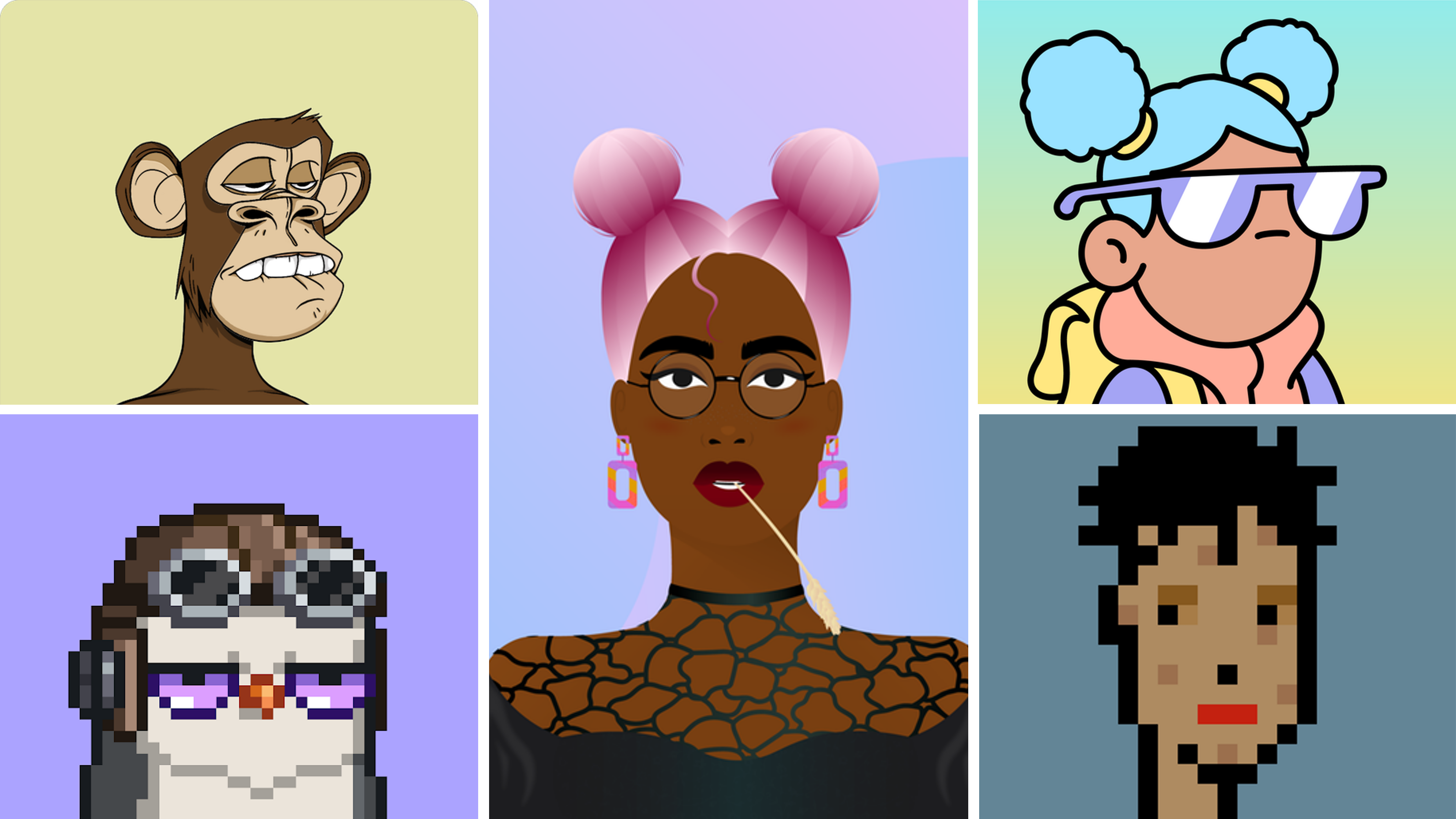

Non-fungible means that an asset is distinct and unique; non-fungible assets cannot be substituted for one another. NFTs are the most popular example here. NFTs function as proof of ownership over a unique asset. It can give owners more social capital as possessing a certain NFT can signal status within the crypto community. Some of the most popular collections include Bored Ape Yacht Club, Doodles, Cryptopunks, World of Women, and Moonbirds.

In order to access, send, or receive Web3 assets, you need a wallet. Wallets store keys, which provide access to your funds. You can then use wallets to make transactions. Popular wallets include Metamask, Rainbow, Phantom, and Ledger.

The Market Size

- Defi has grown to an $80 billion industry in 2021, with expectations to grow 10-fold based on current trends.

- NFT trading volume reached $10.7B in Q3 2021.

- Defi and NFTs are only a subset of what Web3 can offer, with no signs of slowing down. Other pertinent areas of growth include infrastructure and gaming. Web3 will likely be a multi-trillion dollar opportunity over the next few years.

The Opportunity

Creators: Web3 enables users to take ownership of their content like NFTs or social tokens. Social tokens allow individuals and communities to monetize themselves as these tokens provide opportunities for a new rewards system. Creators can give their fans tokens to access exclusive content. Creators would not need to interface with a third party to make this happen. This drives creators to Web3 since they have a greater upside than relying on Web2 incumbents like YouTube or Instagram to pay them. Creators need more Web3 tools to build and expand their communities. Moreover, Web3 helps to align economic and cultural incentives between creators and their communities since there is no web2 incumbent to intervene with transactions.

Communities: DAOs (Decentralized Autonomous Organizations) are internet-native businesses that are collectively owned and managed by their members. DAOs enable community members to take ownership and control how they want their organization to develop and thrive. This helps align economic and community incentives.

Gaming: Users can play-to-earn and accrue digital assets that can be converted to fiat currency. Blockchain enables gaming studios to create their own economies on platform, promoting incentive alignment between studios and users. Marketplaces will naturally arise due to the fluidity of gaming and carrying over assets.

Finance: Web3 can revitalize and revolutionize financial services. For example, cross-border payments that utilize stablecoins make it frictionless for P2P transactions and companies to pay workers abroad. This results in faster payments and lower transaction fees. Another area is insurance as traditional insurance has high processing time and costs to validate the source of truth for transactions between parties. Blockchain can dramatically increase operational efficiency as it would be the singular source of truth due to its immutability.

Critical Drivers for Web3

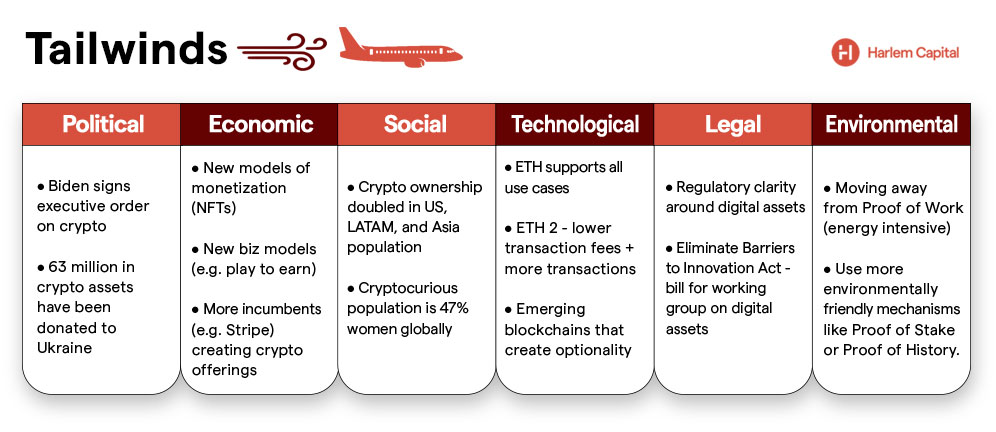

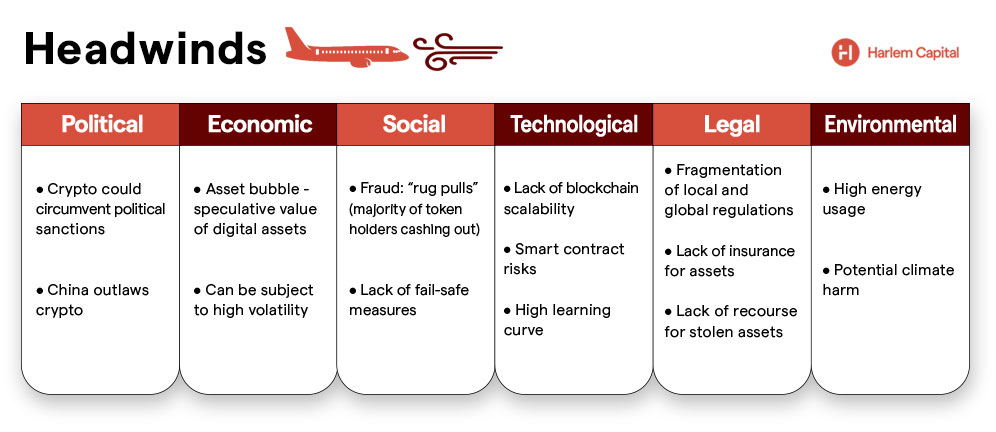

There are many headwinds and tailwinds that will determine the outcome for Web3. Harlem Capital has highlighted the most pertinent factors from a variety of perspectives. Overall, Harlem Capital views more tailwinds that enhance opportunities and the global growth of Web3.

- Regulation: Web3 players want to see more regulation. President Biden signed an executive order to discern how digital assets will be treated demonstrating the US government’s interest in potentially working with the industry players to provide clarity.

- Climate Change: More tokens are emerging that are moving away from energy-intensive Proof of Work to address climate concerns.

- Scalability: Blockchain cannot process transactions at the pace Web 2.0 can. Strong infrastructure is imperative for Web3 to scale. More funds are investing including Tiger Global leading NEAR protocol’s $350M raise.

- Ease of Onboarding: Web3 still remains quite technical for the average user and onboarding is not seamless. However, this has not stopped crypto adoption from doubling in US, LATAM, and Asia. Tools to help with education and adoption are necessary. Web2.5 will be the bridge from Web 2.0 to Web3.

Key Areas of Interest for Harlem Capital in Web3:

- Tools and Infrastructure for NFTs and social tokens

- Creator Economy

- Consumer Social

- B2B Infrastructure

- On and off-ramps between Web2 and Web3

- DAOs

We have only started to uncover the use cases for Web3. All industries may be impacted by this frontier technology. Harlem Capital is excited to see what others will emerge, especially those that can help bridge Web2 and Web3.

We would love to connect with founders and investors pioneering Web3! Feel free to check out more of our articles regarding our Vision for Web3 and Web3 Diverse Founders Report.

Thanks to our Fellow, Sharlene Guiriba, for writing this Web3 primer.