The Pacesetters — 300 Female Founders Who Raised $1mm+ in VC Funding ($47.0bn Total)

by Harlem Capital

Female Founders Report – March 2020

What is this and why are we doing it?

Harlem Capital focuses on investing in and growing the venture ecosystem of minority and women founders. As much as we believe in funding in these incredible founders, we also believe in mapping and learning deeply about the very founders we back. We’re proud to release our first Female Founder Report, analyzing 1,700+ female founders who have raised over $1mm of venture funding and taking a deep dive into how race impacts a woman’s fundraising.

While several databases have been compiled on female founders, little light has been shed on how female founders and their fundraising can differ by race, geography, industry, and education. Below are some of our key findings, and you can head over to our full report for all the details.

Methodology:

Although many databases have started tracking founders by gender, none track founders by race. In total, over 2,300 female founders have raised over $1mm of venture capital funding according to Crunchbase and Pitchbook. We were able to analyze over 1,700 female founders with enough publicly listed funding information.

Then, we took a deep dive into the women who have raised the largest rounds. From our 1,700 founders, we sliced the top 200 raises by female founders, which included 13 Black and Latina founders, and combined that data with the next top 100 raises by Black and Latina founders. These 300 women are our “Pacesetters” — they’re setting the bar for future female founders.

The Big Picture:

We pulled a master list of over 1,700 female founders who have raised over $1mm in venture capital funding. Here’s the big picture:

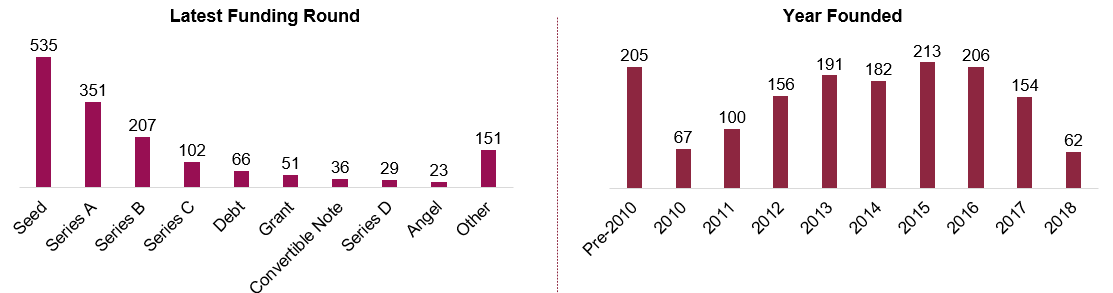

- Since Crunchbase and Pitchbook began tracking data, 1,714 female founders have raised a total of $56.4bn

- The average founding year was 2013 with a median raise of $5.8mm

- The three most popular industries — software, biotech, and healthcare — represent 32% of companies and 33% of capital raised

- Over 50% of all companies were early-stage, at the seed and series A rounds

- While median raise doesn’t vary significantly by city, New York and San Francisco represent over 50% of total capital raised and number of companies founded

The Pacesetters:

Who are these founders?

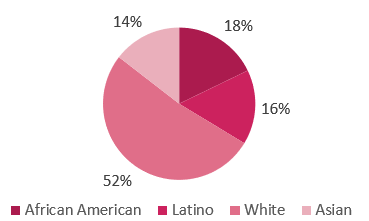

We took a deep dive into the top 200 female founders overall and top 100 Black and Latina founders to identify any key trends by race. Out of the top 300 founders, 52% are white, 16% are Asian, 18% are African American, and 16% are Latina.

What does their fundraising look like?

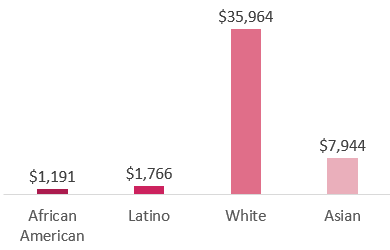

Overall, white women raised $33bn more than African American and Latina women combined. Across all three hundred founders, white female founders raised $36bn, Asian women $8bn, Latina women $1.8bn, and African American women $1.2bn. The largest gap in funding exists between white and African American women, with white women’s funding total 30 times that of black women’s.

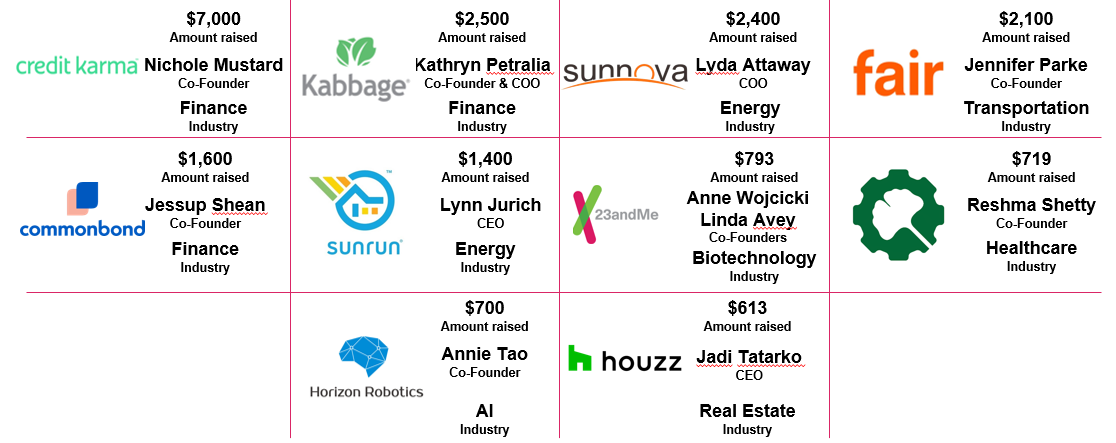

The Pacesetters raised $47.0bn of capital in total, representing 83% of total capital raised by the 1,700 founders. The top 10 largest raises represent 37% of all capital raised. The top three raises (Credit Karma at $7bn, Kabbage at $2.5bn, and Sunnova at $2.4bn), represent 21% of all capital raised. The skew to a few in venture remains true for female founders.

Seed and Series B rounds have the most female founders, with 54 founders having raised seed rounds and 123 raising B and post-B funding. However, 21% have successfully exited so far. This indicates that there is much wealth to be created in the future. To bring this to fruition, the venture capital ecosystem must continue to back female founders, not only in the early stages, but throughout their companies’ lifecycles.

Where did they go to school?

25% of female-founded startups are represented by just 8 undergraduate universities. Further, just 10 graduate programs represent 59% of all capital raised by the top 300 female founders. The top three undergraduate institutions by company count are Harvard University, Stanford University, and Cornell University.

Notably, graduate degrees are most common among women of color. 46% of Asian American women, 40% of African American female founders, and 26% of Latina women have an MBA, as compared to just 23% of white female founders. The top graduate programs by company count are Harvard Business School, Harvard University (various graduate programs outside of the Business School), and The Wharton School at the University of Pennsylvania.

What industries are they in?

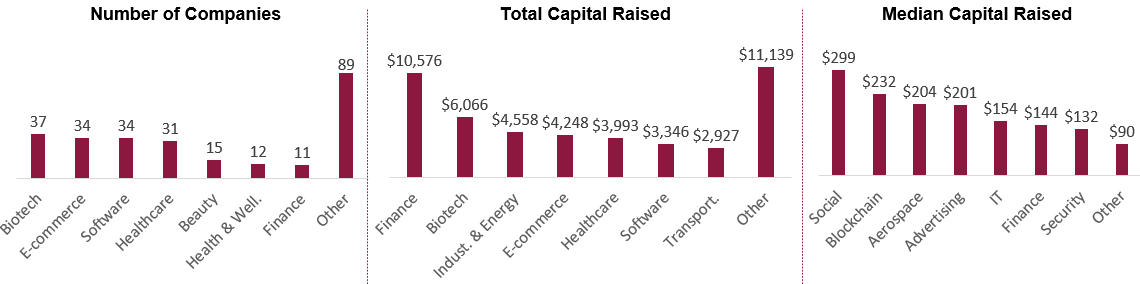

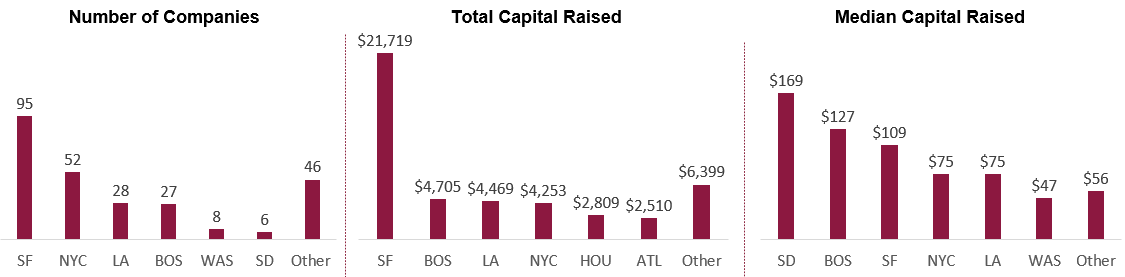

Our 300 founders built companies across 26 different industries. The top three most popular industries were biotech, e-commerce, and software, encompassing 40% of companies. The industries drawing the most venture capital dollars, however, are financial services, biotech, and industrials & energy, with these three industries taking in 45% of all capital raised.

Where are these companies headquartered?

In many ways, top female-founded companies mirror the venture capital landscape at large in terms of geography. 57% of our top 300 founders’ companies are headquartered in New York City and San Francisco. New York, San Francisco, Boston, and Los Angeles represent 75% of all capital raised.

Who are their investors?

Out of 805 investors total, the top 12 made 172 investments in 66% of companies. These investors include two accelerators, one angel syndicate, and one corporate venture capital fund, in addition to eight “traditional” VCs.

Over the last several years, we have seen an increasing number of funds and angel investors come out with the explicit goal of funding women-led companies. However, the highly concentrated nature of funds in investing diverse founders means that it’s still fairly uncommon across the industry to consistently invest in women founders.

Conclusion:

Looking back on the last few years, we’ve seen incredible growth in the presence of female founders in the startup ecosystem. The venture capital ecosystem has never been so female-founder friendly. Though female founders as a whole have been taking up more space in the venture capital ecosystem, it’s important to understand these trailblazing leaders not simply as a monolithic group, but a diverse coalition with varying backgrounds, industries, geographies, and education levels.

Our research corroborates existing evidence that women of color continue to face additional barriers. While the venture capital industry has embraced the mission of funding more female founders, more must be done to support women of color and breaking down the unique barriers they face. Female founders will continue to break glass ceilings and build the disruptive companies of tomorrow.

Special thank you to our interns Danielle Lomax and Angela Liu for their work on this report.

Check out the full report and to stay up to date on Harlem Capital news, subscribe to our monthly newsletter.