Power 550: The Black and Latino Venture Capitalists You Should Know

by Harlem Capital

By Ricardo Matias, Marini Bacal, & Jorge Guajardo (Fall ‘24 Intern)

We just dropped Harlem Capital’s 2024 Diverse VC Report and the numbers tell a powerful story.

At Harlem Capital, we believe diverse checkwriters drive real change. For the last seven years, we’ve tracked Black and Latino investors shaping the VC landscape and fueling underrepresented founders. Because winners come from all backgrounds.

What’s new this year?

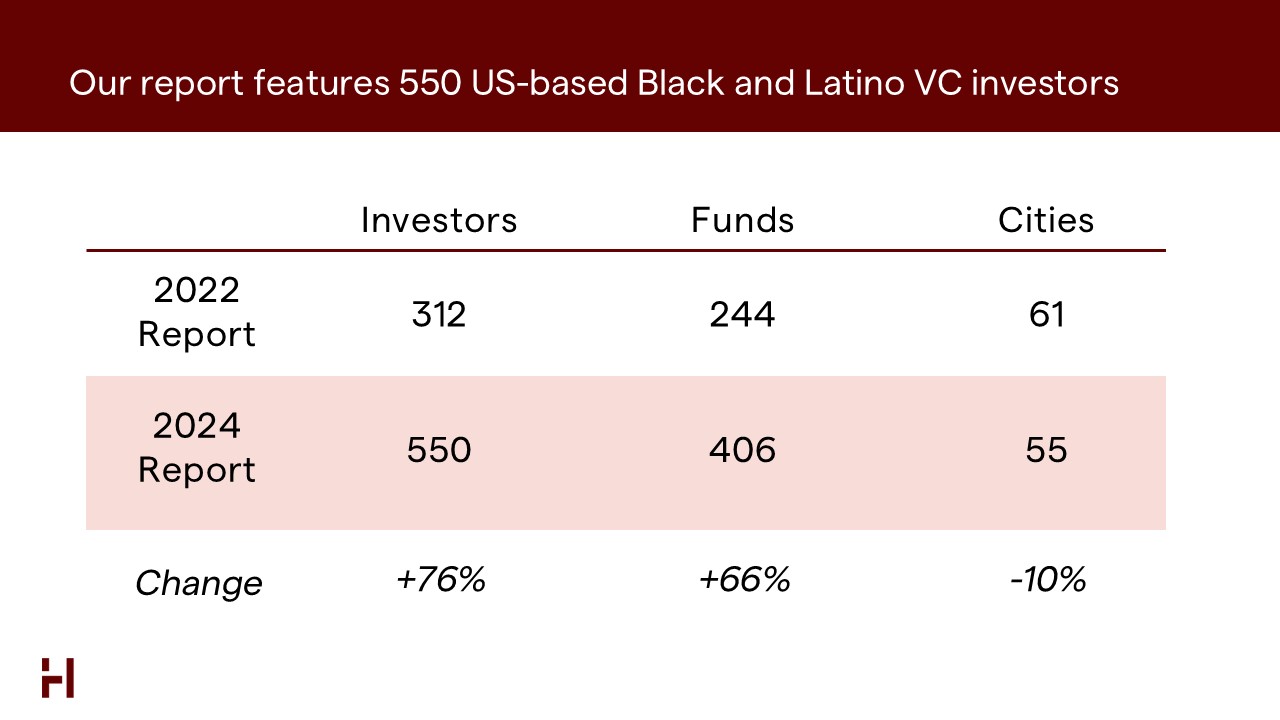

The number of Black and Latino VC investors in the U.S. has surged 76% since our last report, now totaling 550 investors across 406 funds.

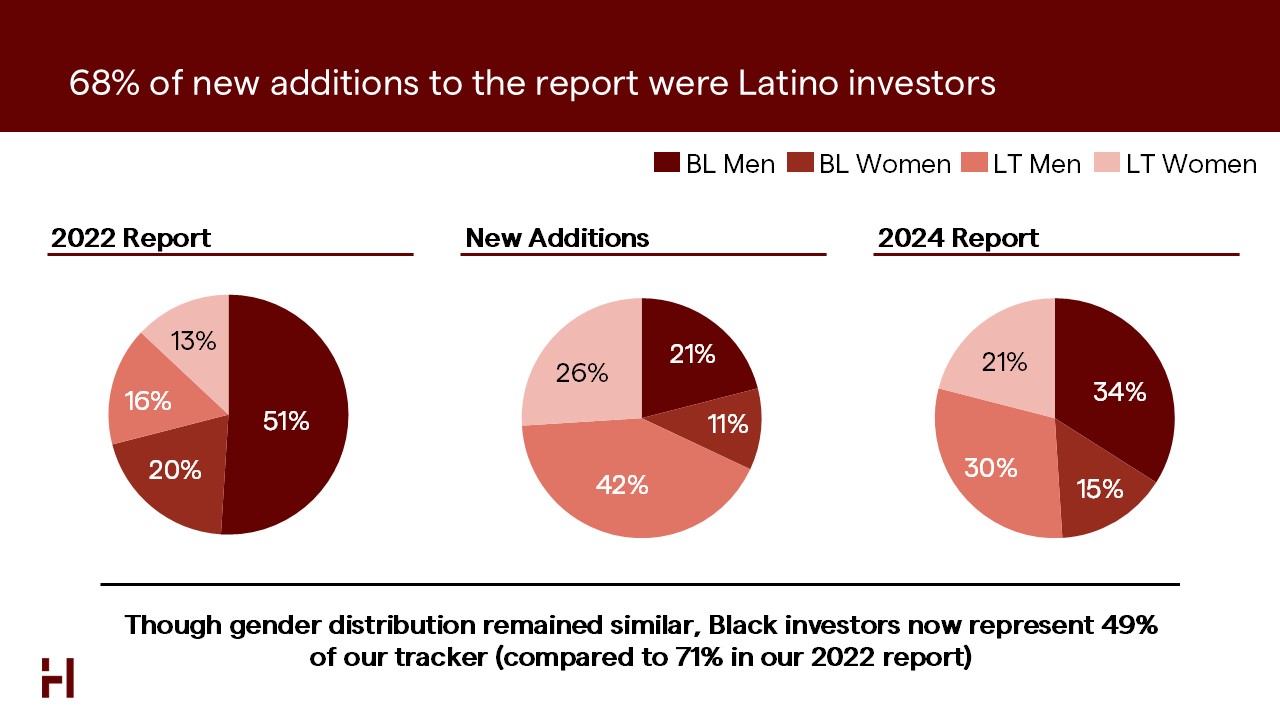

Latino investors led the growth, making up 68% of new additions, shifting overall representation to 51% Latino and 49% Black. Big thanks to VCFamilia for their invaluable self-reported directory of Latinos in VC.

Where are they based?

NYC and the Bay Area remain the dominant hubs, home to 51% of investors (up from 47% in 2022). Miami also made its debut among top cities. Interestingly, despite the investor count rising 76%, the number of unique cities declined by 10%, signaling increased geographic concentration.

What roles do they hold?

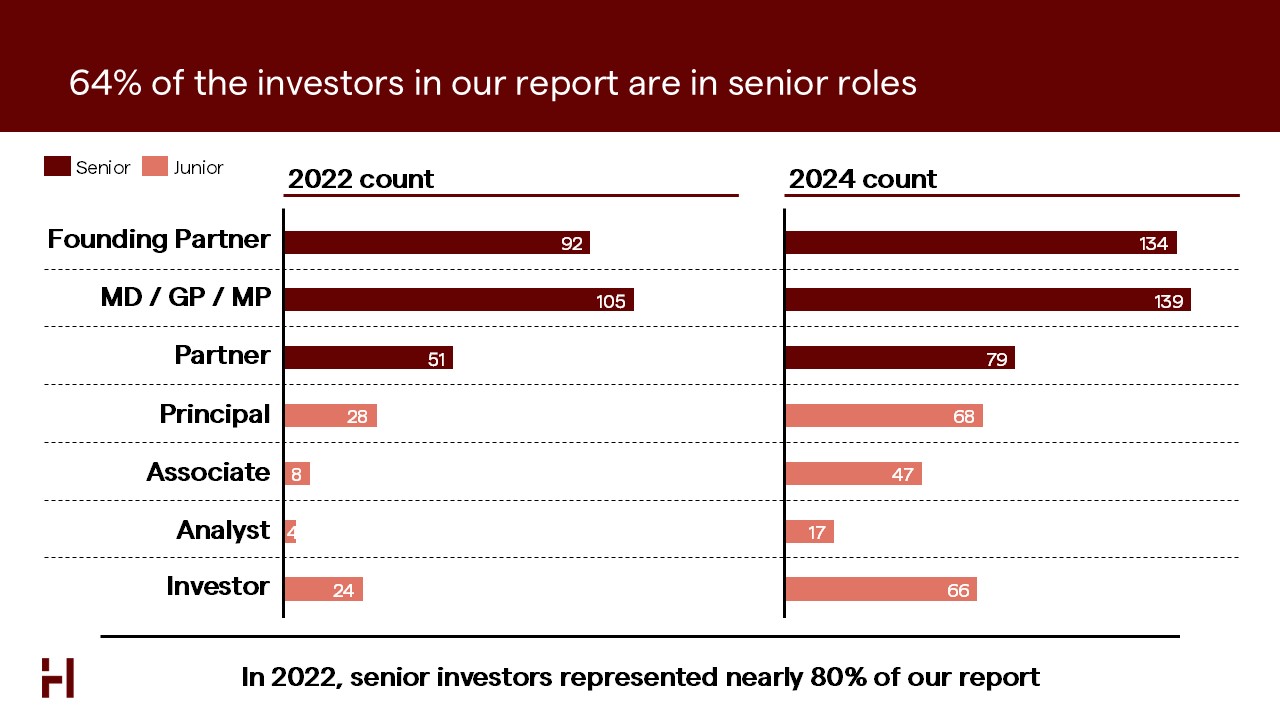

Junior investors (analysts, associates, principals) made up 64% of new additions. While the total number of senior investors has grown, they now represent 64% of our report—down from nearly 80% in 2022.

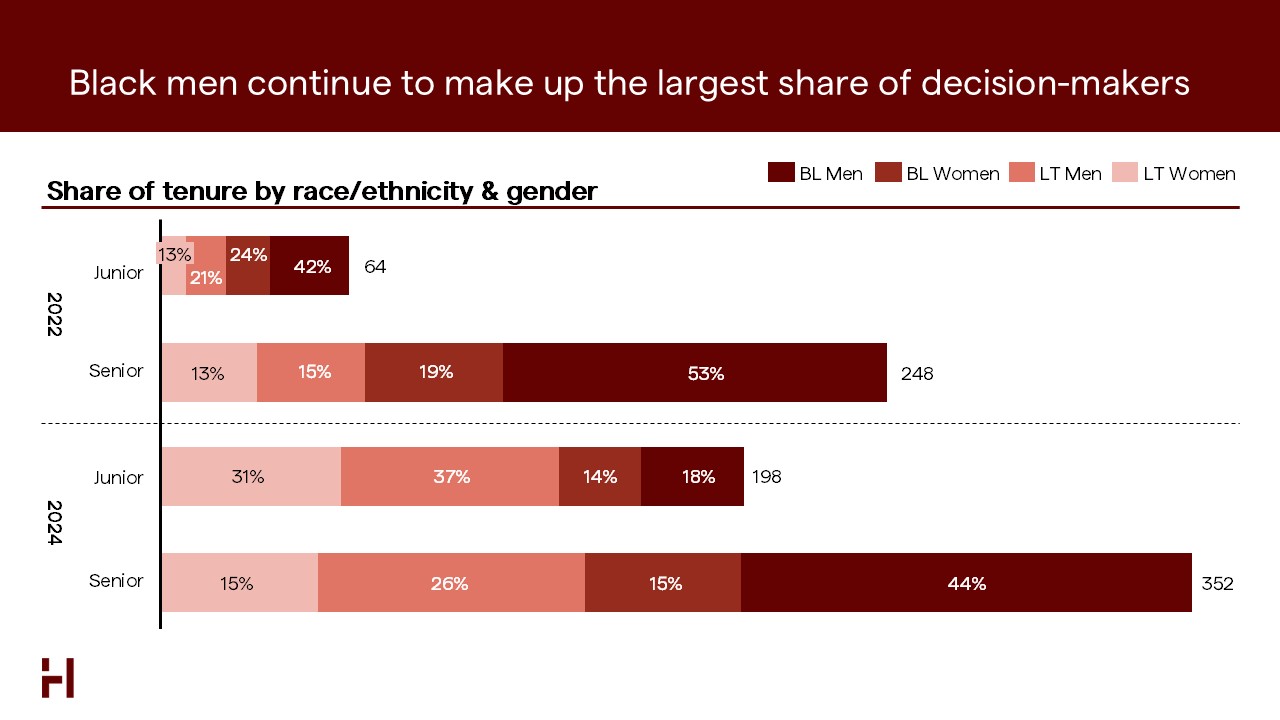

Black men no longer hold the majority of senior roles but remain the largest share of decision-makers. Latino junior investors grew 6x, while the number of Black junior investors grew by 50%.

Which funds are they with?

This year’s report features a 66% increase in funds represented (from 244 to 406).

- 28 funds have 3+ Black or Latino investors

- 95 funds have 2+

- The top 11 funds account for 10% of all diverse investors in the report.

Big wins

Six new funds have been launched by diverse investors since our last report. Twenty HCP intern alumni are now full-time investors, reinforcing our commitment to building a more inclusive industry.

Conclusion

Back in 2018, we identified just 200 diverse investors. Today, that number has nearly tripled, but there’s still work to do. Most funds still have room to improve representation, and we hope this report pushes the industry forward.

Let’s keep changing the face of entrepreneurship. All winners are welcome.

💡 Explore the full investor list here and submit additions here for future reports. Huge thanks to our Fall 2024 intern Jorge Guajardo for his contributions to this report.

About Harlem Capital

Harlem Capital (HCP) is an early-stage, diversity-focused venture capital firm. HCP makes initial investments of $1M to $2.5M in U.S. seed rounds for 10-15% ownership.

Stay connected with Harlem Capital: 📩 Subscribe to our newsletter for exclusive updates

🔗 Follow us on LinkedIn, X, and Instagram