Power 300+: Black & Latino Venture Capitalists That You Should Know

by Harlem Capital

What Is This?

At Harlem Capital, we believe that a significant change in diverse founders will not happen until there are more diverse investors in decision-making roles. As a result, it is imperative that we consistently track the data supporting diversity in the venture capital community. We believe that the increase we saw in diverse founders over the past 2-years is heavily correlated to the diverse VCs now writing checks. Since our 2020 report was published we improved our insights on Latino investors with help from LatinxVC, VC Familia, and with help from our Twitter followers who replied to our posts with names they thought needed to be on the list. We hope to continue to see more transparency by race for investors. Below are some of the key findings from our research. Additional details can be found in our full report.

What’s new?

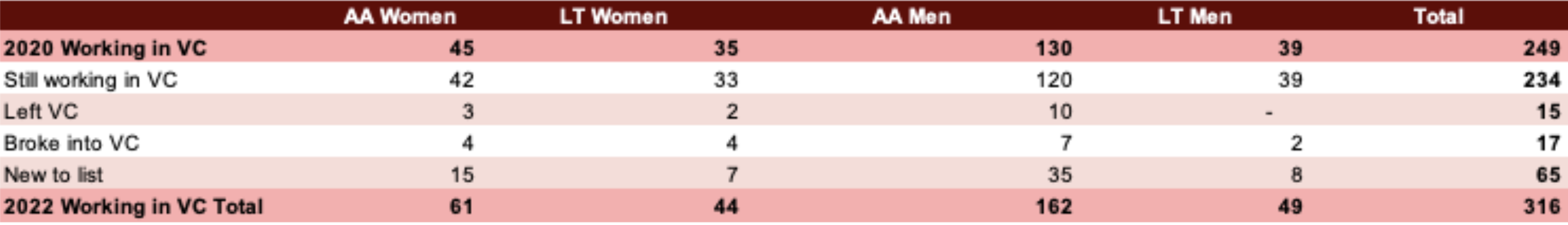

We witnessed an increase from 250 investors to 316 investors, with 82 new investors joining the list and 15 investors leaving the industry. African American women saw the most significant growth in our list, with a 35% increase. This increase was due to a) 15 new additions to the list and b) despite 4 African American women leaving the industry, 4 broke into it. In comparison, 7 Black men broke into VC, while 10 left. Latino Men and Women both increased by 25%, with 4 women breaking into the industry and 2 leaving and 2 men breaking and none leaving.

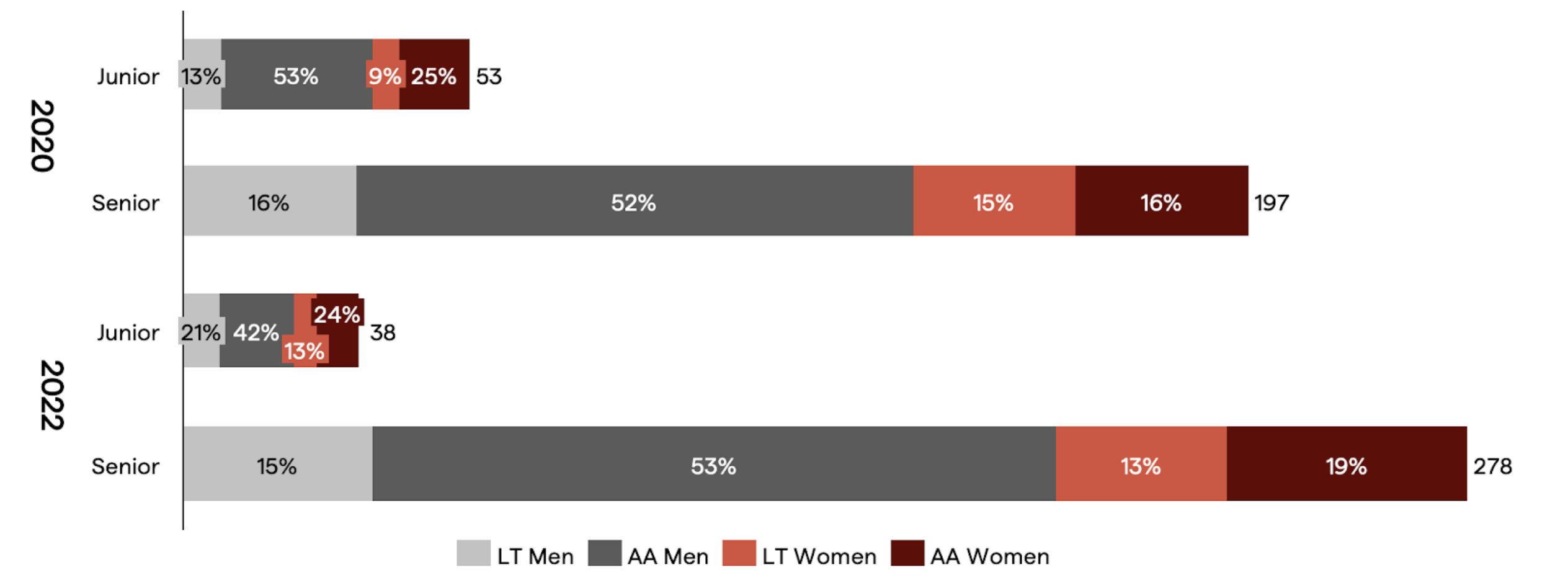

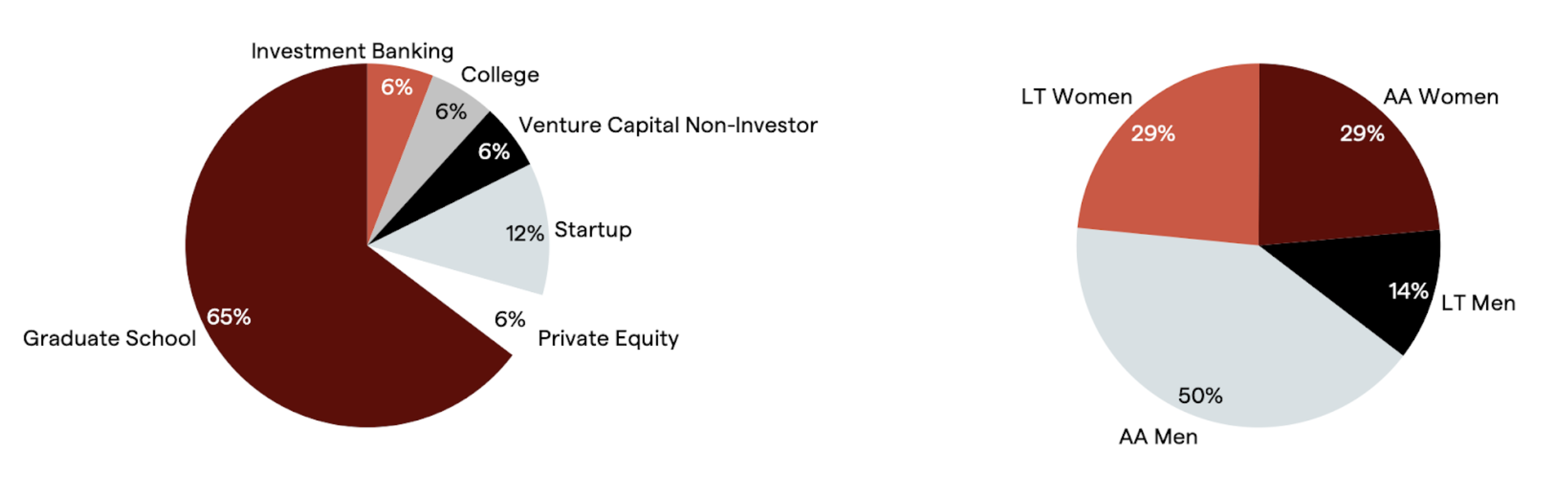

The number of VCs in senior roles grew by 41% to 278. The number of junior investors declined by 28%, due to both several promotions among current VCs and individuals who left the industry. 9% of the 234 VCs that still worked in the industry since our 2020 report were promoted. Among the 15 individuals that left the industry, 47% left to find or work at a startup. Finally, of the 17 individuals that broke into VC, 65% arrived after graduating from graduate school.

Who Are the Investors?

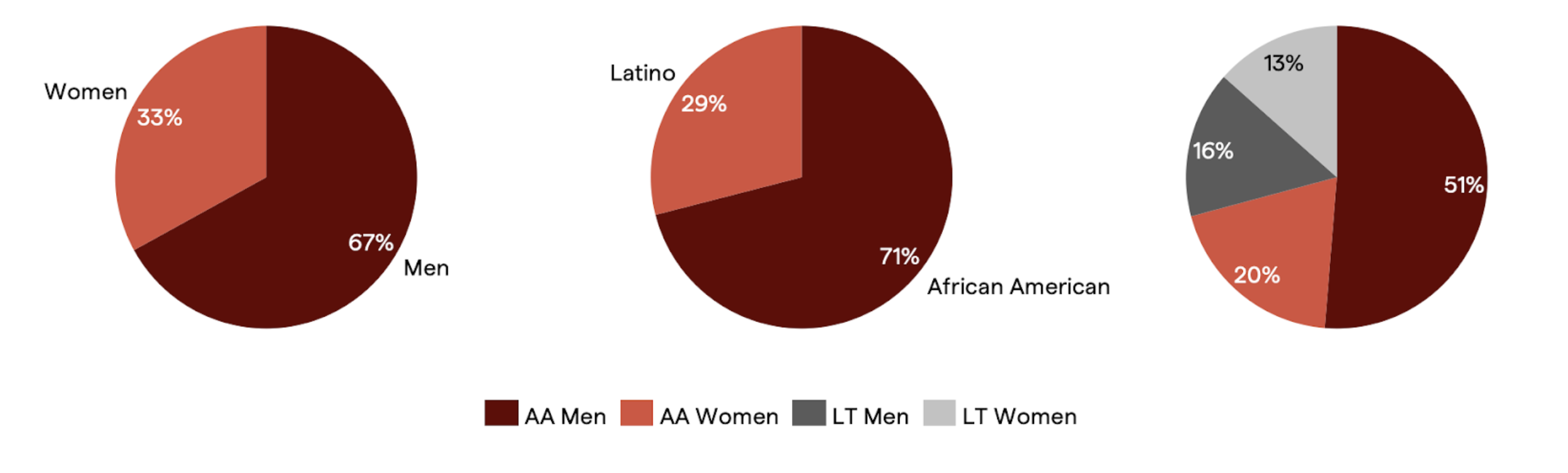

Among the 82 new investors who were added to the 2022 report, 60% were Black and 40% were Latino; 63% were men and 27% were women. We saw an increase of 31% in the number of women and 25% in the number of men.

Roles and career changes

Out of the 235 from the previous list that remained in the industry, 19% changed firms, 9% were promoted and 2% started their own fund. Of the 15 that left, 53% were in junior roles, 47% left to found or join a startup, 20% left for a corporate role, and 13% to attend graduate school. The founded funds were Sunset Ventures and Collide Capital.

Among the 21 from the previous list that were promoted, 12 were black men, followed by 5 Latina women, 3 black women, and 1 Latino man.

On the overall list, we saw a decrease of 28% in the number of junior investors but an increase of 41% in the number of senior investors, with 53% of the 278 senior investors being black men. As Junior Investors we are considering roles such as analysts, associates and senior associates, interns, and investors.

Of the 17 that broke into VC, 7 are senior investors, and 10 are junior investors and were hired by 12 funds. The majority are Black men with 50%, followed by 29% Black women and 29% Latina women, and lastly 14% Latino men. The majority broke into VC after graduating from graduate school (65%).

Where are they located?

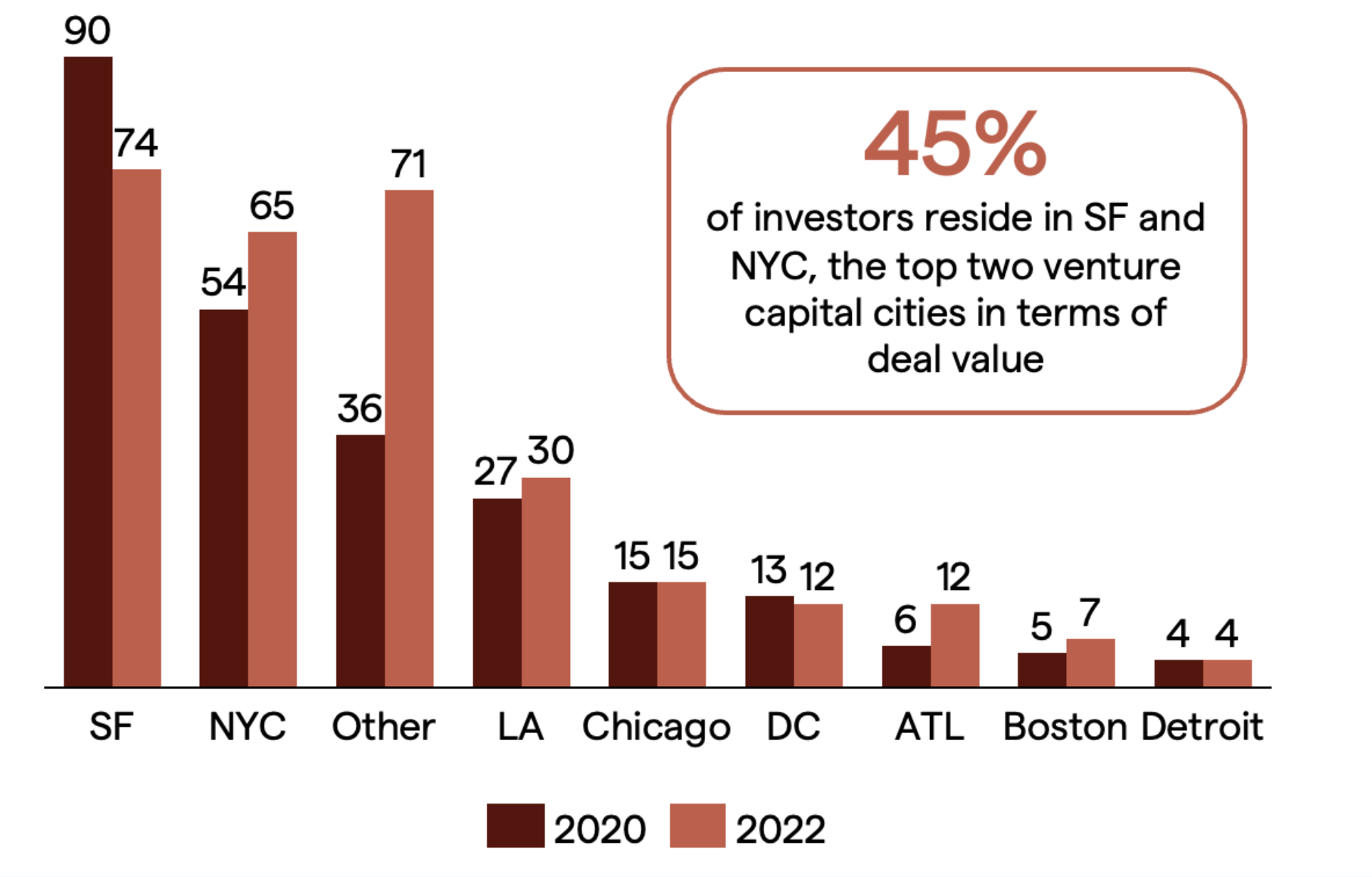

When we started to update the data, we were curious to understand the impact covid had on the investors’ locations and if the working-from-home trend would make the major cities less relevant. It turns out that of those on the 2020 list who are still in VC, 30% moved to a new city, and of those 49% moved to NY, LA, SF, or Miami.

Out of the full list, although NY and SF still have the largest share of investors, it decreased to 45% from 54%. SF saw the biggest decrease, with 16 investors leaving the city (18%); in percentage points, Atlanta saw the biggest increase with 100% – from 6 to 12.

What Funds Are They With?

This year’s report saw an increase of 21% in the number of funds, with 245 funds having one or more Black or Latino VC. 14 funds had 3 or more Black or Latino investors, as seen in the table below. Among the 245 funds, only 44 had 2 or more Black or Latino investors, which can be seen on page 11 of the report. The top 13 funds represent 16% of the total number of diverse investors.

Conclusion?

Our 2022 report saw continued growth in the number of diverse investors, particularly in the number of decision makers, but that number unfortunately came with a shrink in the number of junior investors, which provides some concern as they are the future Partners – this points out to the fact that there needs to be a focus on retaining junior investors of color. Moreover, it is interesting to see that even with the “work-from-anywhere” shift with the Covid-19 pandemic, SF and NY are still the VC hubs, what can be further seen in the latest PitchBook report that shows that funding from those two cities accounted for 72% of capital raised and 45% of deal value in 2022.

We are proud to be one of the top 3 funds with diverse investors and excited to see an increase in the number of funds represented. Progress is being made, but there are still a majority of funds without Black or Latino representation, and it’s our hope for this report to inspire more funds to join this list.

Check out the airtable to see the full list of investors. If we missed anyone, please submit here for our future report. Thank you to our intern Patrick Kerr, Winter 2023, for his work on this report.

To stay up to date on Harlem Capital news, subscribe to our monthly newsletter.