Power 250: Black & Latino Venture Capitalists You Should Know

by Harlem Capital

What Is This?

At Harlem Capital, we believe that a significant change in diverse founders will not happen until there are more diverse investors in decision making roles. As a result, it is imperative that we consistently track the data supporting diversity in the venture capital community. We believe that the increase we saw in diverse founders over the past 2-years is heavily correlated to the diverse VCs now writing checks. Since our 2018 report was published, Crunchbase started tracking diverse investors and funds, and we improved our insights on Latino investors with help from LatinxVC. We hope to continue to see more transparency by race for investors. Below are some of the key findings from our research. Additional details can be found in our full report.

What’s new?

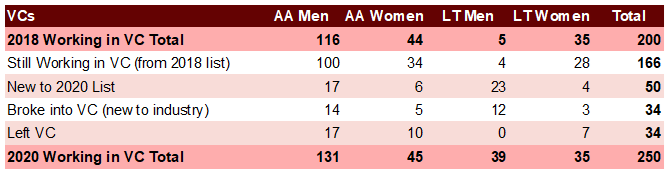

We witnessed an increase from 200 investors to 250 investors, with 84 new investors joining the list and 34 investors leaving the industry. Latino males saw the most significant growth in our list, which is very similar to the increase we witnessed among founders, in which Latino males also saw the largest increase by number and capital raised. This increase in Latino males was due to the lack of churn, with 12 Latino men breaking into VC and none left. In comparison, 14 Black men broke into VC, while 17 left. It should be noted that African American and Latino women saw no increase due to 17 leaving VC. The number of VCs in decision making roles grew by 70% to 170. The number of junior investors declined by 22%, due to both a number of promotions among current VCs and individuals who left the industry. 17% of the 166 VCs that still worked in the industry since our 2018 report were promoted. Among the 34 individuals that left, 38% left to work at a startup. Finally, of the 34 individuals that broke into VC, 32% arrived from positions in financial services.

Who Are the Investors?

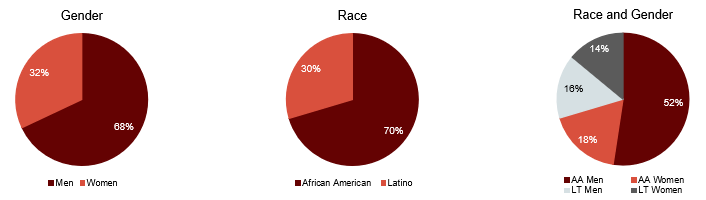

Among the 84 new investors who were added to the 2020 report, 50% were Black and 50% were Latino; 79% were men and 21% were women. We saw a small increase in men to our overall 2020 list, largely due to the relative increase in Latino men. It is important to note that 34% of the Latinos added to the list were new to VC.

What Roles Do They Have?

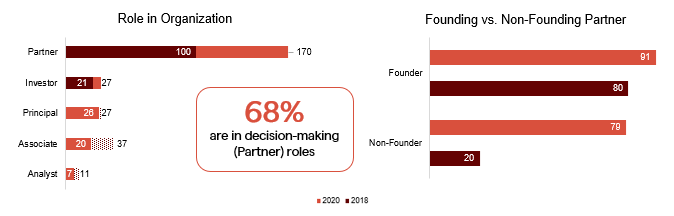

The percentage of decision makers, defined in our report as VCs who hold Founder, General Partner, Managing Director, or Managing Partner roles, suggests that there is a continued trend of Black and Latino VCs starting their own funds to gain entrance into the industry instead of working their way up at larger majority-owned firms. Compared to 2018, in which 50% of VCs were in decision-making roles, 68% of VCs were in those roles in 2020. Additionally, the number of VCs that founded their own funds increased by 11 to 91; 4 of those 11 were founded after our 2018 report. In our report, Black VCs accounted for 71% of decision-maker roles. Our report also noticed a decline in junior roles, including analyst, associates and investors specifically, by 22%. This is largely due to the increase in VC promotions and the number of VCs breaking into the industry cancelling out the number that left.

Among the 166 VCs that are still working in VC from our 2018 list, 29 were promoted. 10 of those 29 were promoted internally, while the remaining 19 were promoted through joining a new firm. Latinos noticed the most transitions, with 32% leaving their prior firm. Among those that broke into venture capital, 61% worked previously at a startup or in financial services. Of those that left VC, 38% left for a startup. Black men represented 50% of all departures.

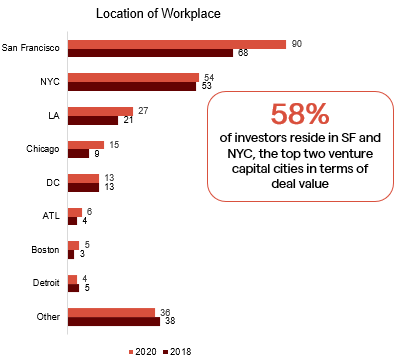

Where Are They Located?

We did not witness a significant shift in location of the workplace, in which 58% of investors resided in San Francisco or New York, compared to the 56% that resided in those 2 cities in 2018.

What Funds Are They With?

Our report included 201 funds with one or more Black or Latino VC. 9 funds had 3 or more Black or Latino investors, seen in the table below. Of those 9, 6 were founded by a Black or Latino VCs. Among the 201 funds, only 35 had 2 or more Black or Latino investors, which can be seen on page 11 of the report.

We believe the diversity of our own fellowship and internship classes sends a strong message to larger firms looking for diverse talent. Among the 34 investors that broke into VC since 2018, 5 were prior Harlem Capital interns or fellows. We expect to see the number of junior investors breaking into the industry increase with the launch of Harlem Capital’s talent platform to provide VC opportunities to anyone we interview.

Conclusion?

This year’s report showed incredible growth in not only the number of investors making decisions, but also the number of investors gaining visibility. We are proud to be represented among a powerful group of diverse VCs who not only are continuing to increase the access of capital to diverse founders, but also lowering the barrier of entry for underrepresented minorities breaking into the venture industry.

Check out the full report to see the list of 250 investors.

Thank you to our intern Adetayo Zenger, Winter 2021, for his work on this report.

To stay up to date on Harlem Capital news, subscribe to our monthly newsletter.