Meet 105 Black & Latino Founders Who Raised $1mm+ in VC Funding ($2.7bn Total)

by Harlem Capital

What Is This?

At Harlem Capital, we are focused on investing in minority and women founders. One of the most underserved groups is Black and Latino founders and we wanted to map this ecosystem, but unfortunately most databases like Pitchbook and Crunchbase do not track by race. Therefore, we spent the past few months scraping articles, websites and LinkedIn to find Black and Latino founders who have raised $1mm+ of venture funding. Below are some of the key findings from our research, and more details are in our full report.

How Much Have They Raised?

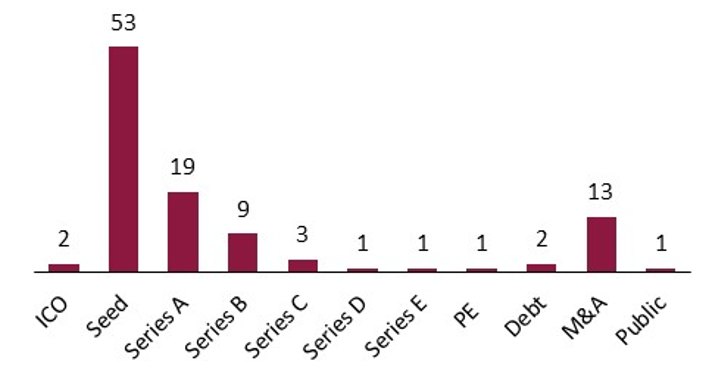

We found 105 companies that have raised $2.7bn in venture capital, but the median raise is $3mm as the top 3 raises (Compass at $808mm, Honest Co. at $503mm and FS Card at $190mm) represent $1.5bn or 55% of capital raised. 70% of the latest funding rounds are Seed or Series A, but 13% have been acquired. The average founding year of the 13 companies acquired is 2013.

Who Are The Founders By Gender and Race?

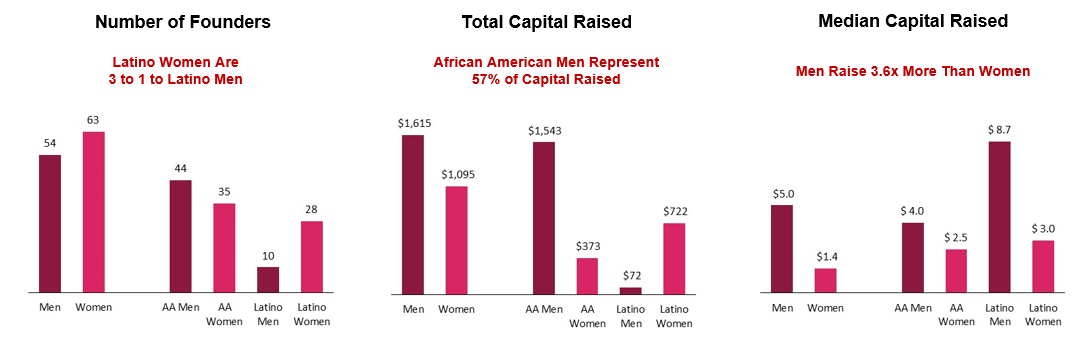

There are 117 founders, of which 63 are women and 54 men. We were surprised to see more women given only 20% of VC funded start-ups in 2017 had at least one female founder, according to Pitchbook. A large reason for the boost was Latino women are 3 to 1 to Latino men. However, men still represented 68% of capital raised and raise 3.6x more than women per median. Latino men have the highest median at $8.7mm, but given their small sample of 10 it is not as meaningful.

What Industries Are They In?

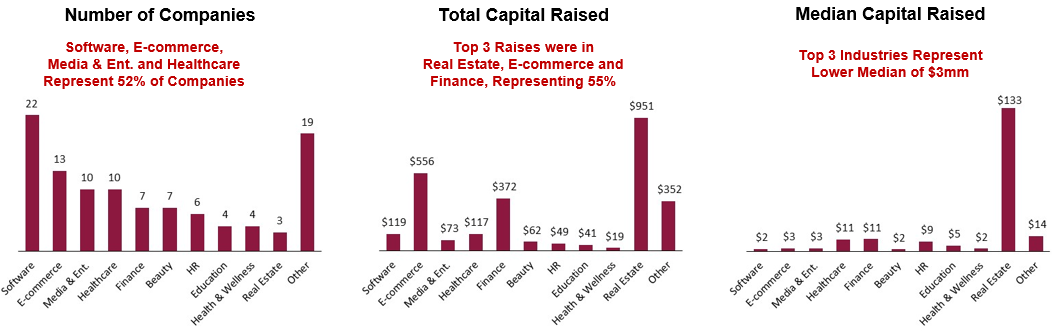

The top industries by company are software, e-commerce, media & entertainment and healthcare, representing 52% of the companies and 32% of capital raised. Real Estate has the highest median raise due to having two of the top five largest raises (Compass at $808mm and Cadre at $133mm), but healthcare, finance and human resources have the next highest median raises. These are all industries we see substantial deal flow from.

Where Are These Companies Headquartered?

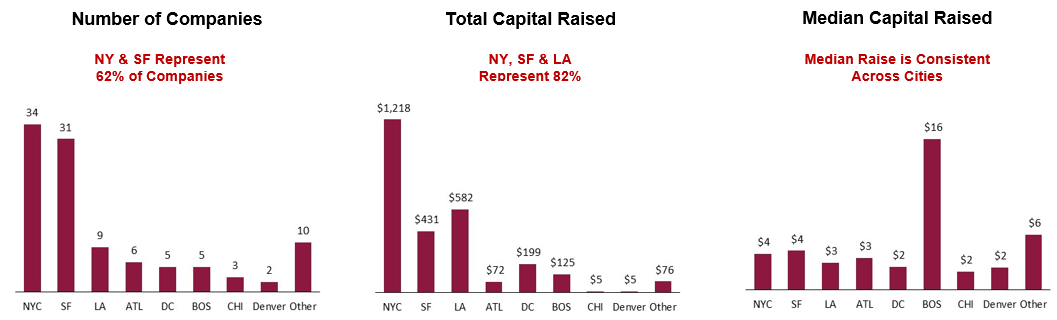

Similar to the overall venture landscape, 65% of the companies’ headquarters are in New York and San Francisco. However, New York represents 45%, Los Angeles 22% and San Francisco 16% of funding. As we hypothesized, top founders of color are under indexed in the Valley and traditional pipeline programs are not the main source. Even though there is concentration in 3 cities, the median raise is mostly between $2mm and $4mm across cities.

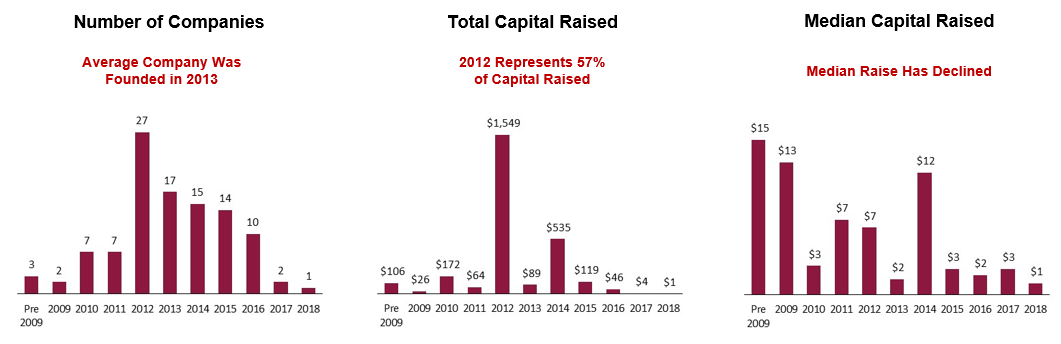

When Were These Companies Founded?

The average company was founded in 2013, but 2012 founded companies represent $1.5bn or 57% of the capital raised. The median raise for companies less than 4 years old is $2mm compared to $6mm for companies older than 4 years. There should be a pop in the median for 2015 companies coming up on their 4 year marks.

Who Are Their Investors?

There were 140 investors across the 105 companies, but only 18 investors had more than 2 investments. The top 10 investors invested in 34 of the 105 companies (32%) and made 67 of the 234 investments (29%). They include 2 accelerators, 6 diverse led VC firms, 1 corporate VC and 1 angel fund.

There is something to be said that 6 of the top 10 firms have diverse GPs, but only 3 of those 6 have diversity-focused thesis. There is no reason that larger more established funds should not be on this list. We continue to believe that minority and women led venture firms are the fastest solution to shifting the flow of capital, but want to partner with other funds to help improve their pipeline as we know this requires everyone’s focus.

Conclusion

We hope this report provided more insight to the landscape of Black and Latino founders. There are a number of other founders, not in this report, that are building disrupting companies that we hope to fund. We believe the number of companies and amount of funding will continue to grow over the next decade as more investors focus on this ecosystem.

To see the full report with the list of 105 companies please visit the Harlem Capital website.