Enterprise Vertical SaaS: Lessons from the Titans

by Harlem Capital

By Partner Gabby Cazeau and HCP Fall 2024 Fellow Alivia Jiang

Harlem Capital has had a long-standing conviction in Vertical Software, and we believe it’s an exciting and high-growth area for the future.

Our first piece on Vertical SaaS, The Future of Software is Vertical, shared our view and insights from our portfolio. Our most recent piece, Lessons for Vertical SaaS Startups from the Public Market, narrows in on key lessons for startups from successful public Vertical SaaS companies.

Vertical SaaS companies don’t just serve SMBs! Some verticals are so large that companies are serving enterprise customers and become true titans that dominate their industries. At Harlem Capital we’ve made several investments in startups serving enterprise-scale customers, like AllieHealth and Fintary. We wanted to dive deeper into enterprise scale Vertical SaaS to learn more about the successful companies in this space and hone in on what key drivers led to their success.

Who are the Titans?

We focused on four public and three private companies for our deep dive. On the public company side, we looked into nCino, Veeva, Guidewire Software, and Blend. For private companies were most impressed by Mark43, Clarify Health, and Tekion.

How to Become a Titan?

We found four key factors that help these Enterprise Vertical SaaS companies to scale and become market leaders.

1. Extensively Validate the Problem

2. Partnerships and Integrations are Key to Scale

3. Catalyst Events and Marquee Customers are the Accelerant

4. Leverage Existing Solution to Increase TAM

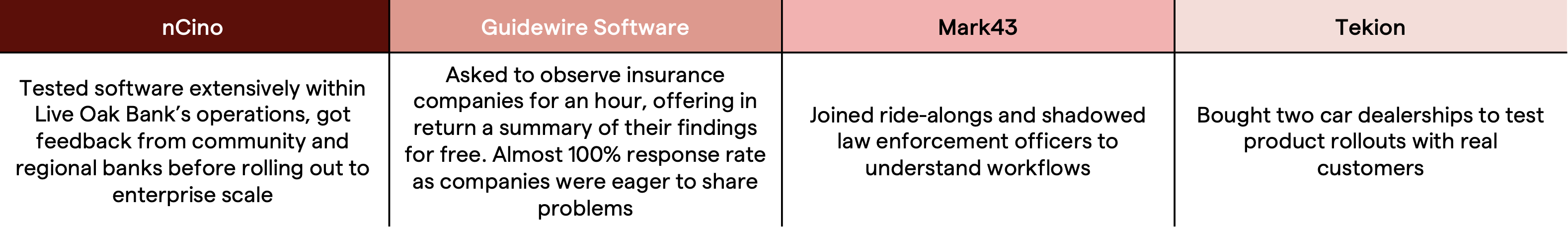

Extensively Validate the Problem

Each founding team spent significant time with customers to understand their pain points. Guidewire Software’s founder, Marcus Ryu, even sat with insurance teams in exchange for free insights. He found that companies were eager to speak with the team, and their takeaways from these simple work sessions built strong relationships that later became their first customers.

Partnerships and Integrations are Key to Scale

A common criticism of enterprise-scale Vertical SaaS companies is that their sales cycles are lengthy, making a sluggish speed of adding new customers that can be discouraging in the early-stages.

A common strategy is partnering with existing distributors or integrating with established workflows for faster adoption. For example, nCino’s partnership with Accenture allowed Accenture’s consultants to sell nCino’s software to their clients, expanding its reach without needing a large salesforce.

Finding points like these to streamline the onboarding process and reduce sales time is invaluable to rapid growth.

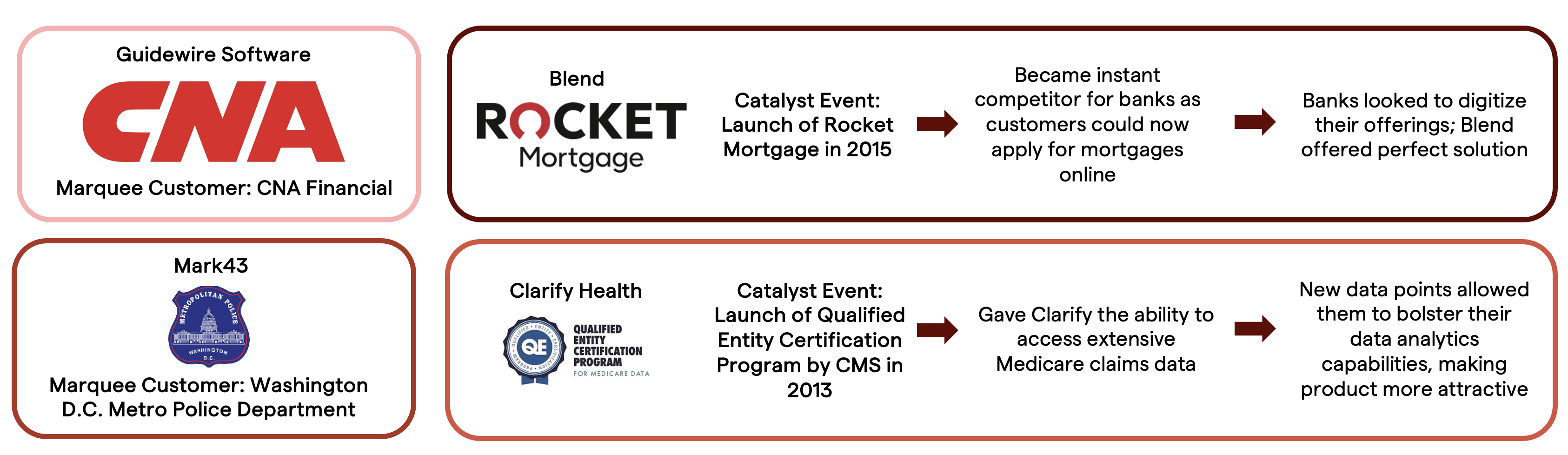

Catalyst Events and Marquee Customers are the Accelerant

In contrast to SMB Vertical SaaS, Enterprise Vertical SaaS brings a higher adoption curve as the stakes are much higher for enterprise companies. The focus in the early-stages needs to be on building credibility. This is commonly seen through the occurrence of a catalyst event or by signing a marquee customer.

Mark43’s marquee customer was the Washington D.C. Metro Police Department. The founders, starting right out of Harvard with no prior experience, needed a large-scale customer like D.C. to validate their product and build credibility for future customers.

Leverage Existing Solution to Increase TAM

Once the initial core offering gains enough traction, we’ve observed that one way to increase TAM is through creating a reduced and more affordable version of this offering for non-core personnel and/or to serve smaller scale customers beyond enterprise.

One example is how Blend took their standard product and removed some non-core features to sell to smaller customers. Increasing their TAM to serve smaller customers is a low-effort way to expand their reach without wasting time on R&D for a new solution.

There are many more lessons to be learned from these companies, and it is our hope that as you look through our full report linked here, you find some key insights that can be applied as you’re looking to scale your company. At Harlem Capital, we’re looking forward to seeing who will be in the new wave of Vertical SaaS Titans.

If you’re a founder thinking about or building in vertical software, we’d love to hear from you! Please reach out to us at info@harlem.capital or gabby@harlem.capital.

About Harlem Capital Partners

Harlem Capital (HCP) is an early-stage, diversity-focused venture capital firm. HCP makes initial investments of $1mm to $2.5mm in U.S. seed rounds for 10-15% ownership.

Stay updated on Harlem Capital news by subscribing to our monthly newsletter, follow us on LinkedIn, X, and Instagram.