Lessons for Vertical SaaS Startups from the Public Market

by Harlem Capital

By Gabby Cazeau (Partner) & Jon Diakanwa (Intern)

Last year, we published our report, The Future of Software is Vertical, highlighting the rise of vertical software and how it’s become core to our investment focus at Harlem Capital. Vertical software is software tailored to specific niche industries. As we work with and invest in vertical software companies, we wanted to dive deeper into the big lessons that startups can learn from the success of public market vertical software companies. We focused on uncovering the metrics and trends that matter most and the path companies take to reach success.

Who are the key players?

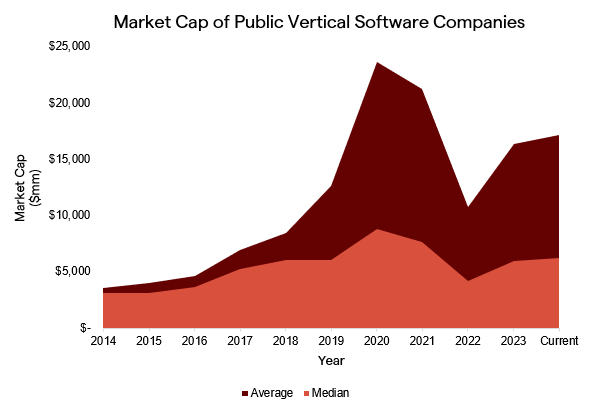

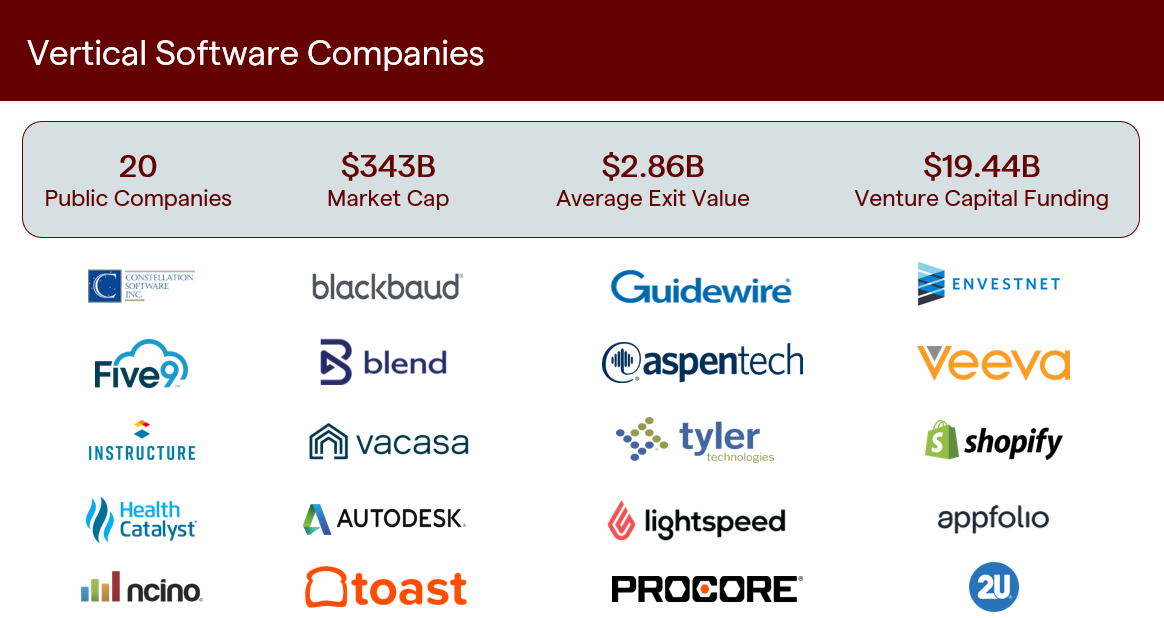

While 2021 saw historically high valuations and blockbuster IPOs for startups, 2024 has been more of a regression to the mean in terms of the value of public companies. We’ve identified 20 notable publicly listed vertical software companies from which we analyzed annual filing and investor databases to derive insights for vertical software startups.

What’s the fundraising path to scale?

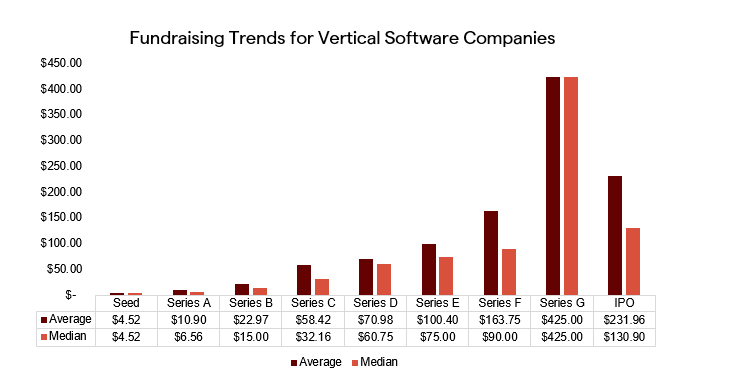

On average, the 20 public vertical software companies raised 3-4 rounds of capital over 10 years before going public. The median raise for a Series A, B, and C vertical software company on the path to going public is $6.6M, $15M, and $32.2M.

Some notable exceptions to that trend include Procore, Blend, and Health Catalysts which have all raised a Series F round and beyond.

What does it take to IPO?

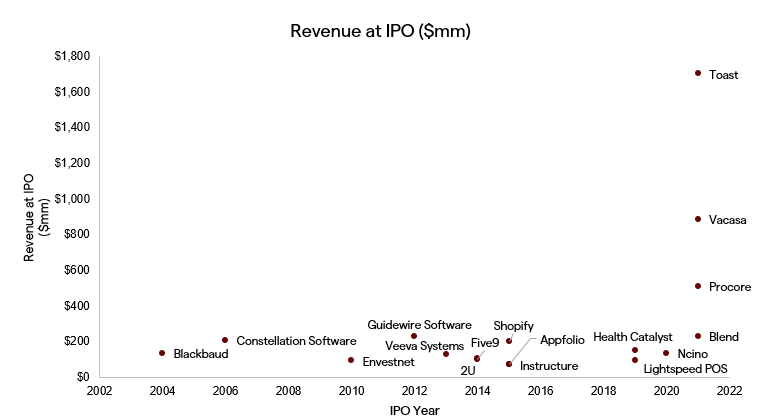

REVENUE AT IPO

For early-stage companies contemplating their path to exit, it’s crucial to understand the scale needed for an IPO. The median revenue for vertical software companies at IPO is $139M. Historically for vertical software companies, it’s taken on average 10 years to reach an IPO, with the median value at IPO being $789M.

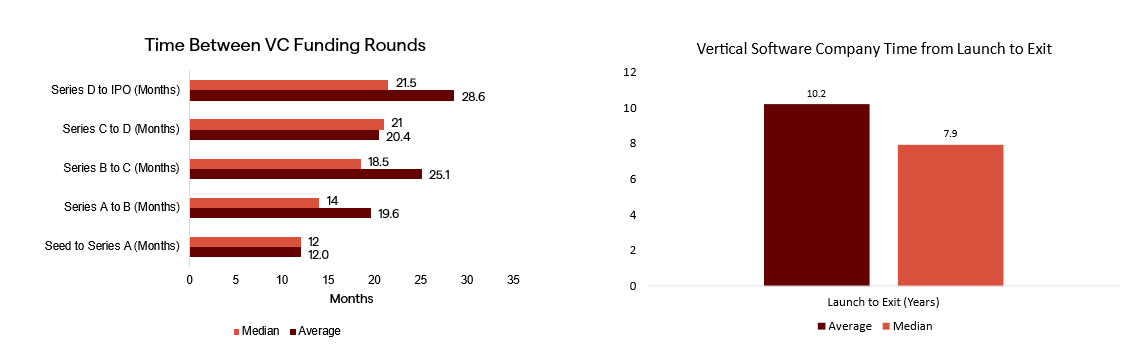

Those companies scaled and raised capital at a pretty fast rate. The median time from Seed to Series A took approximately 12 months, Series A to Series B in 14 months, and Series B to Series C in 18 months. The fastest series A to IPO in our list of 20 companies was Veeva Systems in 6 years and Envestnet in 4 years. For founders, it’s important to know how your growth and path to scale tracks against these benchmarks.

What Drives Enterprise Value?

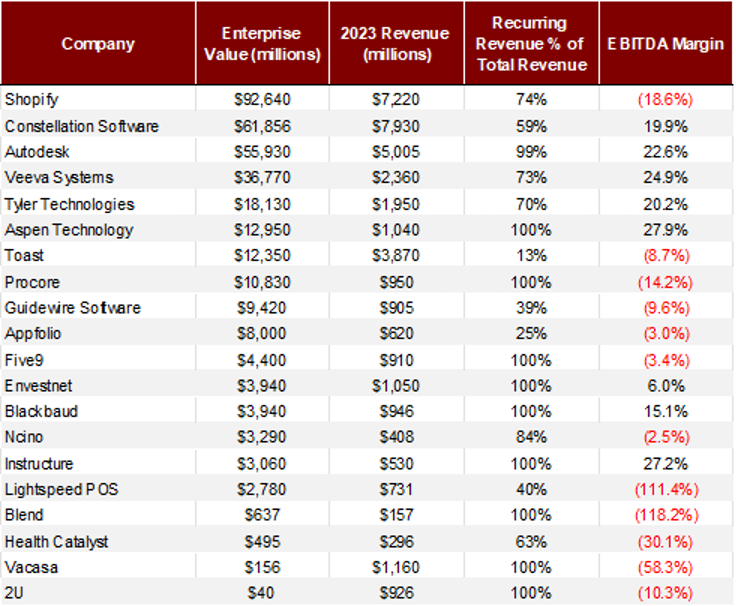

Once companies have IPO’d, the focus shifts to increasing enterprise value. Among the many factors influencing enterprise value, we’ve identified two enduring trends that consistently drive the value of vertical software companies: profitability and diversified revenue streams.

Profitability

It’s no surprise that with the macro market correction companies have focused more on profitability than growth. The public market has rewarded companies that have successfully made this transition. Companies with higher enterprise value tended to be more profitability-focused than growth-focused with 8 of the 20 vertical software companies with a positive EBITDA margin in 2023 comprising almost 60% of the total enterprise value.

Diversified Revenue Streams

A core way that vertical software companies scale is by adding layers of various products and services to become an all-encompassing platform for end customers. This model brings numerous benefits like higher customer retention, larger ACVs, and a moat that leads to market leadership.

It is illuminating to see the range of services vertical software companies offer and the ratio of recurring vs. non-recurring revenue models. Half of the 20 vertical software companies have both subscription revenue and non-recurring revenue models, through sources like professional services, fintech, and hardware. Toast led the charge with only 13% of 2023 revenue coming from subscription services! Companies with mixed revenue streams had a median enterprise value of $12.4B compared to $3.9B for companies with one source of revenue.

Efficiency Metrics

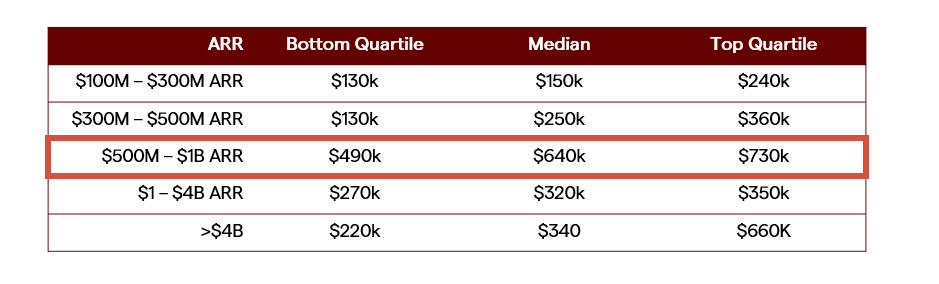

As the market has begun to correct, companies have shifted focus to running more efficiently as opposed to prioritizing growth at all costs. Metrics like ARR per FTE can help vertical software companies determine how efficiently they are running although some metrics may be more useful than others depending on the stage of the company.

Annual Recurring Revenue per Full Time Employee (ARR per FTE) is a popular metric for SaaS companies that has a strong correlation to market capitalization and total enterprise value. Companies like Shopify and Five9 boasted values of close to $1M in ARR per FTE compared to a median value of $330K for all 20 companies. Interestingly, we found that mid-sized public companies between $500M and $1B in ARR had a higher median and top quartile ARR per FTE than both companies with less than $500M and companies with over $1B ARR per FTE. This speaks to the difficulty larger vertical software companies face in scaling efficiently.

Key Takeaways for Vertical Software Startups

There is much to learn from the 20 publicly listed vertical software companies but these are a few takeaways for early-stage start-up building vertical software:

1. Fundraising Trends: Aim for 3-4 rounds of capital before IPO. Be aware of outliers.

2. Revenue at IPO: Median revenue at IPO is $138M and takes about 10 years to reach. Keep that in mind as you think about the path to scale

3. IPO Valuation Realism: Median IPO value is $789M. Target the median fundraising per round over the average.

4. Enterprise Value Drivers: Profitability and mixed revenue streams proved to be great determinants in driving enterprise value for public companies

5. ARR per FTE Correlation: ARR per FTE links strongly with market cap and total enterprise value. Prioritize optimization.

There are so many great lessons and you can see the full report here! We hope these insights are helpful for founders as you build and scale. We’re excited to see how vertical software companies navigate the shifting ecosystem and are eager to support founders and investors in this space.

If you’re a founder thinking about or building in vertical software, we’d love to hear from you! Please reach out to us at info@harlem.capital or gabby@harlem.capital

Stay updated on Harlem Capital news by subscribing to our monthly newsletter.