Are You Best in Class?

by Harlem Capital

By Harlem Capital Partner Gabby Cazeau

Is your company best in class? This is the fundamental question investors are asking when they evaluate your company.

One of the biggest reasons for not investing in a company is the opportunity cost. Investors can’t back every great company we meet, so we want to build conviction and confidence that one company – your company – is the one that will grow, scale, and become a category-defining company.

Now it’s hard to vet that for early companies. So investors use different frameworks to understand if you’re on the path to being best in class. One of the clearest ways of vetting that is momentum.

If your company is moving with great ARR momentum it means a few things are likely true:

- Your team is building your product quickly

- Customers are buying your product

- Customers are willing to pay a lot for your product

- And you’re finding PMF

If these are all true, it means your company is well positioned to become a market leader and reach true scale.

What does ‘best in class’ really mean? We put together this framework for companies to understand how they stack up against market benchmarks AND what investors are looking for behind the scenes. You can think of these as a report card around growth and momentum. Of course much more goes into building a business as it’s both an art and a science, but these two metrics are key points to focus on as VC-backed businesses.

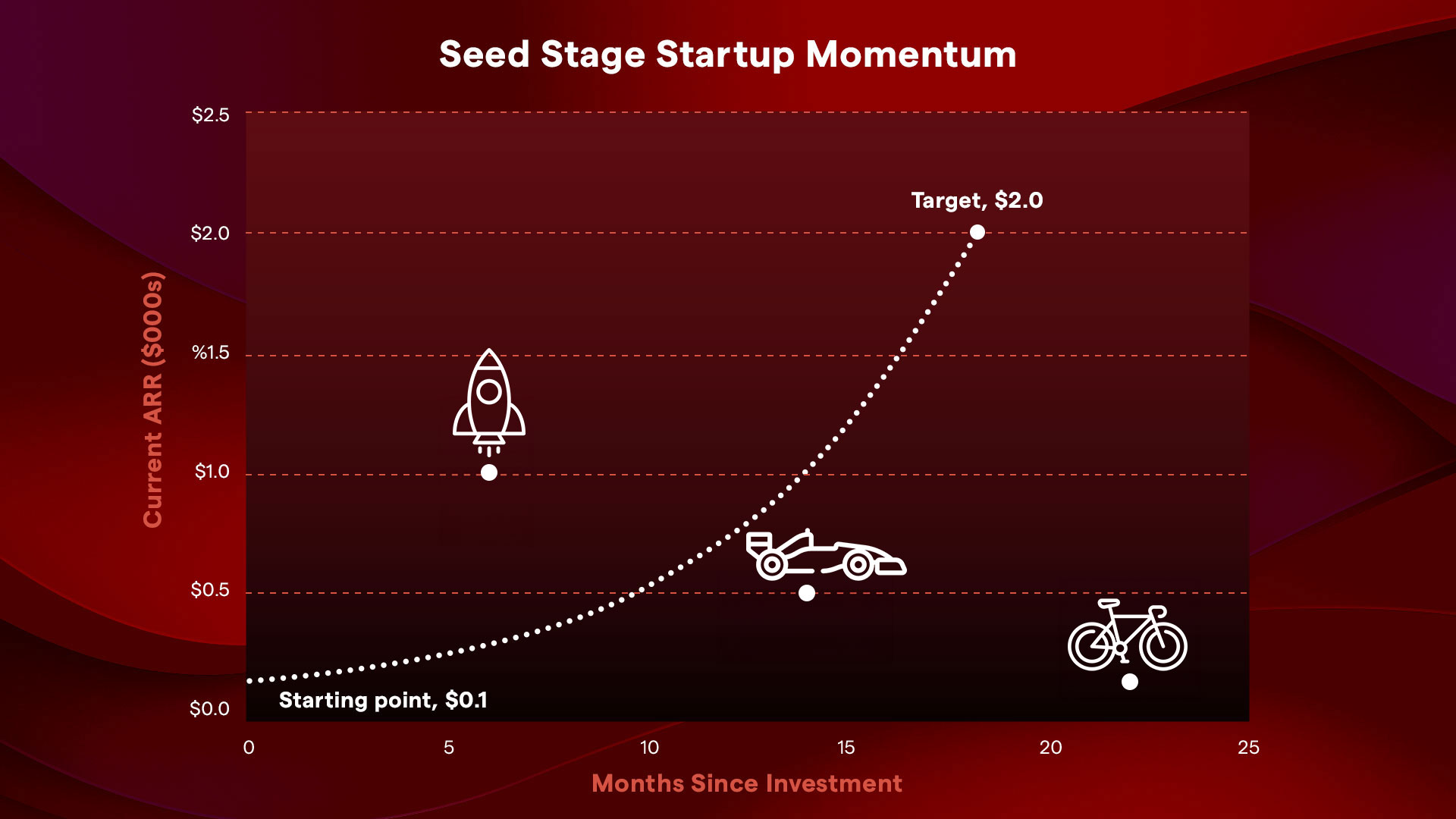

In today’s market, the bar has shifted. For most Seed companies, you’ll need to be at or approaching $2mm in ARR for a successful Series A fundraise.

Are you a rocketship? 🚀

- Raised a small round at $100k in ARR. Very quickly post investment, your company has scaled revenue by rapidly expanding the customer base and increasing ACVs. You’re in the green zone!

- If your company is like the rocketship you’re in a great position – keeping going and doubling down. Make sure you’re building a strong team, have the right frameworks in place, are shipping products quickly and are always focused on building for your customer.

Are you a racecar? 🏎️

- Raised a small round at $100k in ARR. After that initial fast start, you aren’t seeing strong pick up from customers and have had limited growth 14 months post seed round. You’re in the yellow zone.

- If your company is like the racecar, there’s definitely some work to do to make sure you’re still on track. There are likely a few issues to diagnose around your team, product, GTM approach, or sales strategy. The key for companies in this yellow zone is to be decisive, take action thoughtfully and as early as possible to ensure you can get back on track.

Are you a bicycle? 🚲

- Raised a small round at $100k in ARR. You had a great initial product vision and a few customers, but realized that you weren’t finding PMF. After that, there may have been a few business pivots, challenging market dynamics, team changes, and you’re still having trouble finding your footing. Now it’s suddenly 22 months post seed round.

- If your company is like the bicycle, you’re firmly in the red zone, and now might be a good time for some honest reflection. Are you truly understanding your market, customer, product category? Do you know what the right signals will be for PMF? Is this the right direction? Or should you start thinking through other options to find the best outcome for you and your team?

Now what does it mean if you’re somewhere in between? Well it depends on a lot of factors. But use this framework as a guide to understand if you’re truly on pace to become the best-in-class for your stage and in your category.

There are 3 questions you can ask after doing this exercise:

- Are you a Rocketship, Racecar, or Bicycle?

- What changes can be made to ensure you are staying close to the target line or are getting you back to the target line? If you’re above the line, how do you continue to maintain pace and further accelerate?

- As you make changes, how do you hold yourself and your team accountable to hitting your new goals?

Building a startup is hard. We know there are ups and downs along the way and it won’t always be linear (or exponential!) But we hope this framework can encourage you if you’re doing well, help you course correct if you’re facing challenges, and be a foundation for honest communication along the way.

About Harlem Capital Partners

Harlem Capital (HCP) is an early-stage, diversity-focused venture capital firm. HCP makes initial investments of $1mm to $2.5mm in U.S. seed rounds for 10-15% ownership.

For more info on HCP’s impact sign up for our newsletter, follow us on LinkedIn, X, and Instagram, or email info@harlem.capital.