The Future of Software is Vertical

by Harlem Capital

By Harlem Capital Partner Brandon Bryant

Twelve years ago, Marc Andreessen penned his groundbreaking essay, ‘Software is Eating the World.’ In it, Marc harped about a seismic economic shift, predicting that software companies would soon dominate vast swaths of our economy and disrupt industries at an unprecedented scale. He was right, with his focus primarily on the ascent of horizontal software—solutions designed for a broad audience of business users, regardless of industry, like QuickBooks (accounting) or Salesforce (CRM).

At Harlem Capital, we believe there’s another kind of software poised for its moment to break out: Vertical Software. This type of software is meticulously tailored to the specific needs and standards of niche industries, exemplified by best-in-class companies like Toast (restaurant software) or Service Titan (home services software). In the coming decade, we foresee Vertical Software as the breakout category for investment.

Vertical Software Boasts Distinct Advantages Over Its Horizontal Counterpart:

1. Customization & Industry Focus

This business model excels in integrations and customization, thanks to its laser focus on industry standards. This enables the creation of an end-to-end solution that has features that are specially designed to streamline particular industry operations.

2. Easier Go-To-Market Motion

Hyper-specialization lends itself as a potent wedge for market entry—deep market understanding acquired through meticulous research and customer engagement results in a faster grasp of the market’s pain points.

3. Lower Customer Acquisition Cost

Having a more potent wedge when selling translates to a lower cost of customer acquisition, as refined customer personas make targeting precise and reduce the need for extensive ad spend.

4. Network Effects ⇒ Sales Expansion ⇒ Retention

In niches, word-of-mouth & network effects lead to organic growth through in-person events and conferences. Moreover, once you’ve secured an initial customer, upselling and expanding product offerings becomes a smoother endeavor, transforming your solution from a ‘nice-to-have’ into a ‘must-have.’ This is when the software becomes an integral part of the daily operations of the business and cannot be replaced.

Harlem Capital’s Vision for Vertical Software

At Harlem Capital, we strongly believe that founders from diverse backgrounds have a unique edge when building Vertical Software companies. Many hail from immigrant backgrounds or have faced adversity, whether due to their upbringing or economic circumstances. This adversity breeds an unmatched sense of urgency and resilience, traits that have historically fueled entrepreneurship in the United States. We anticipate a second wave of diverse founders embarking on ventures, this time in the realm of niche Vertical Software—areas only they understand intimately.

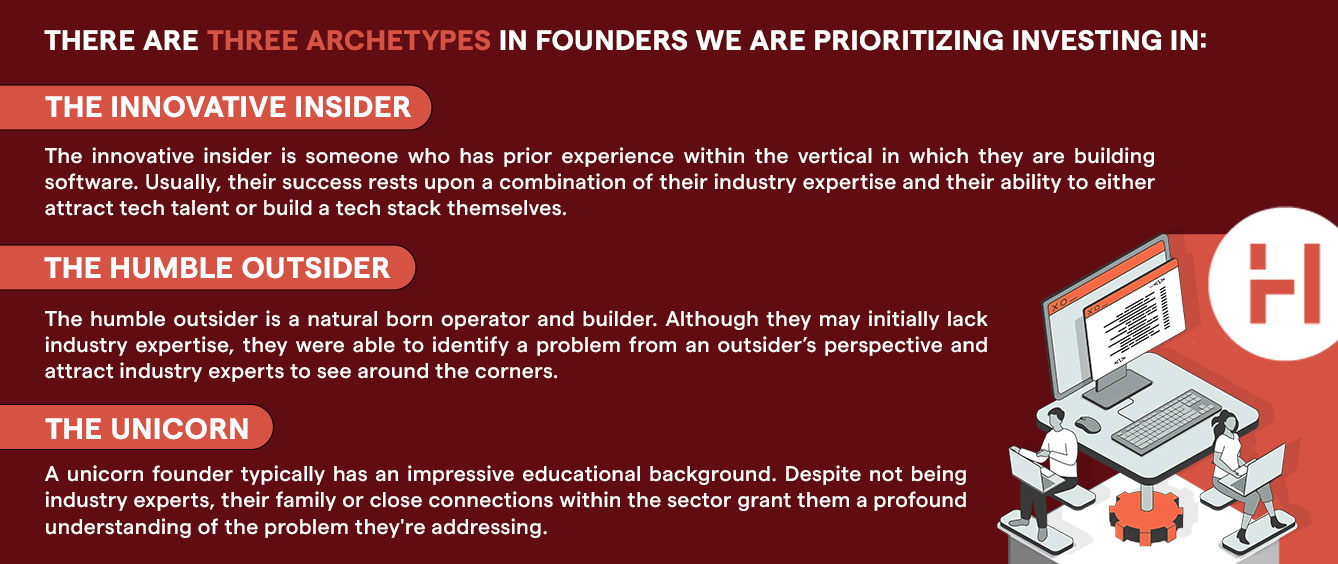

We’re prioritizing investment into three founder archetypes:

1. The Innovative Insider: The innovative insider has firsthand experience within the very vertical they are now transforming through software innovation. They’ve worn multiple hats across various functions, held leadership positions and even managed teams. Their journey in this vertical has given them a unique perspective, enabling them to spot market opportunities born from the intimate understanding of industry pain points. As they pursue their new endeavor, they do so with a trusted network of experts in the vertical who are well equipped to tackle the problem with them.

2. The Humble Outsider: The humble outsider has journeyed through multiple startup environments across multiple different industries and has refined their abilities & built a robust skillset for problem solving. In these diverse roles within high-growth companies, they’ve also amassed invaluable experience and a rich network. Now, as they venture into entrepreneurship, they can easily identify market problems and get up to speed quickly to no matter what the vertical because of their varied skillset for problem solving

3. The Unicorn: The unicorn has been nurtured within the folds of a particular industry, often through family ties or close affiliations. After acquiring a wealth of knowledge and expertise in corporate or tech domains, they circle back to their familiar industry. With their honed skillset, they aim to tackle the industry they’ve always known, reshaping it through software innovation.

Harlem Capital’s Vertical Software Investments

Our portfolio boasts a roster of promising Vertical Software ventures:

- 4Degrees – CRM for deal-driven industries, Founder – Ablorde Ashigbi

- Merri – Operating system for the events industry, Founder – Randi Bushell

- Sauce – Dynamic pricing software for restaurants, Founders – Colin Webb + Nenye Anagbogu

- Toolbox – Financial management software for real estate contractors, Founder – Wil Eyi

- AllieHealth – Assisted living facility software, Founder – Jessie Lucci

- Docdraft – Legal drafting software, Founder – Taher Hassonjee

- Kipsi – R&D tax credit software for accounting firms, Founder – Claire Tsukuda

- Fintary – Financial operating platform for the insurance ecosystem, Founder – Qiyun Cai

Exciting Industry Areas in Vertical Software:

We’re particularly enthusiastic about the potential in sectors such as:

- Real Estate & Construction

- Professional Services Firms (i.e. Consulting, Accounting, Legal, Engineering)

- Healthcare Facilities

- Climate & Sustainability (i.e.Waste Management)

- Business Services (i.e. Debt Collection Services, Call Centers, Security Services)

Harlem Capital’s Support for the Vertical Software Ecosystem:

Our commitment goes beyond investment checks. We’re dedicated to nurturing the Vertical Software ecosystem through:

- Launching cohort-based programs that foster community and provide essential tools for pre-seed & seed founders.

- Conducting in-depth research resulting in market maps and educational articles that share our thesis on the Vertical Software landscape.

- Creating purposeful in-person events as safe havens for discussion, education, and serendipitous connections.

The coming decade holds immense promise for Vertical Software, and we’re eager to connect with founders and investors in this space. Join us in shaping the future!

Stay updated on Harlem Capital news by subscribing to our monthly newsletter.