Generative AI: The VC Landscape

by Harlem Capital

Although the pace of VC funding has slowed in 2023, the race to innovate in artificial intelligence is only starting to heat up.

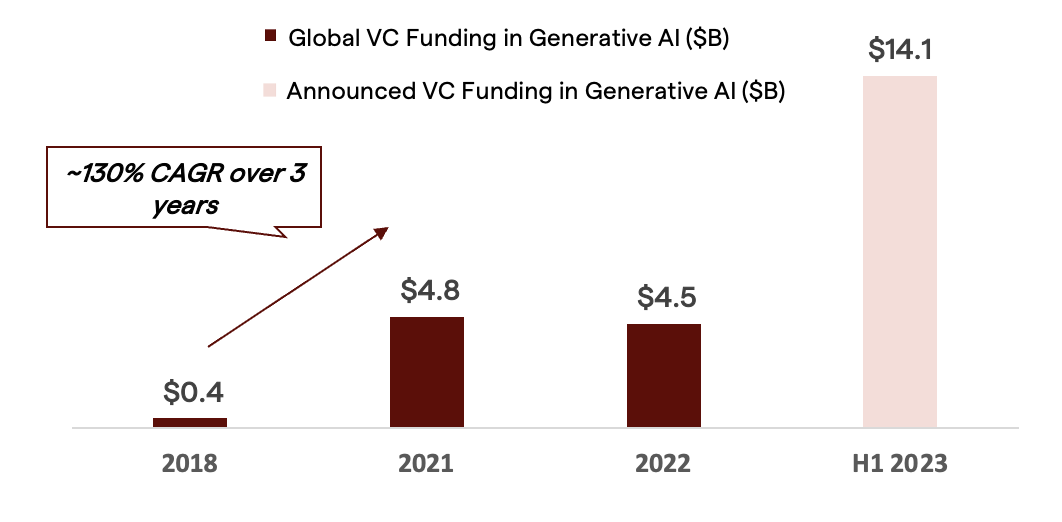

Venture activity in the AI space has witnessed remarkable growth, particularly in Generative AI, which has attracted significant attention from investors. Startups in the field have received a substantial amount of funding, surpassing $9 billion globally in the last two full years, with H1 2023 already blowing that out of the water (~$15 billion globally).

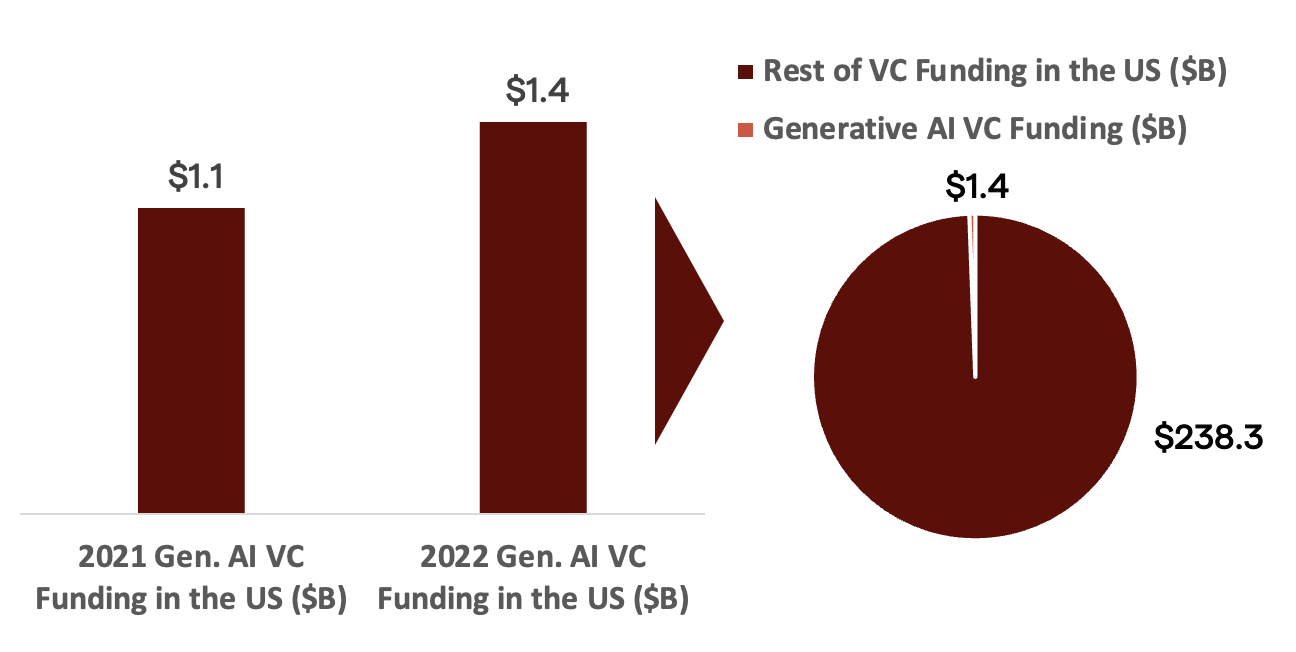

In the last two years, we’ve seen ~$2.5B in VC funding and over 150 deals in the US alone. And with that accounting for less than 1% of total US VC funding, there’s still a ton of room to grow. Harlem Capital has dug into the current Gen AI VC landscape in a comprehensive report.

Why the hype?

Generative AI has been widely regarded as a transformative force across multiple sectors, leveraging Large Language Models (known as LLMs) which imitate human thought processes through the utilization of algorithms that progressively learn during their use.

Essentially, these models recognize recurring patterns that allow them to generate content autonomously.

These incredible capabilities have already turned the heads of big tech executives. According to a survey conducted by CNBC, 47% of top technology officers say that AI is their number one budget item over the next year — more than double their second biggest spending area, cloud computing.

VCs are hungry for a piece of the pie

Global AI revenue is projected to reach ~$120B in revenue by 2032. Tech giants are driving that growth, having already invested a significant amount of capital into Generative AI. Most notably, Microsoft invested $10 billion in ChatGPT creator OpenAI. We’ve also seen giants like Google and Meta develop models and tools of their own.

No wonder VCs want in on the action.

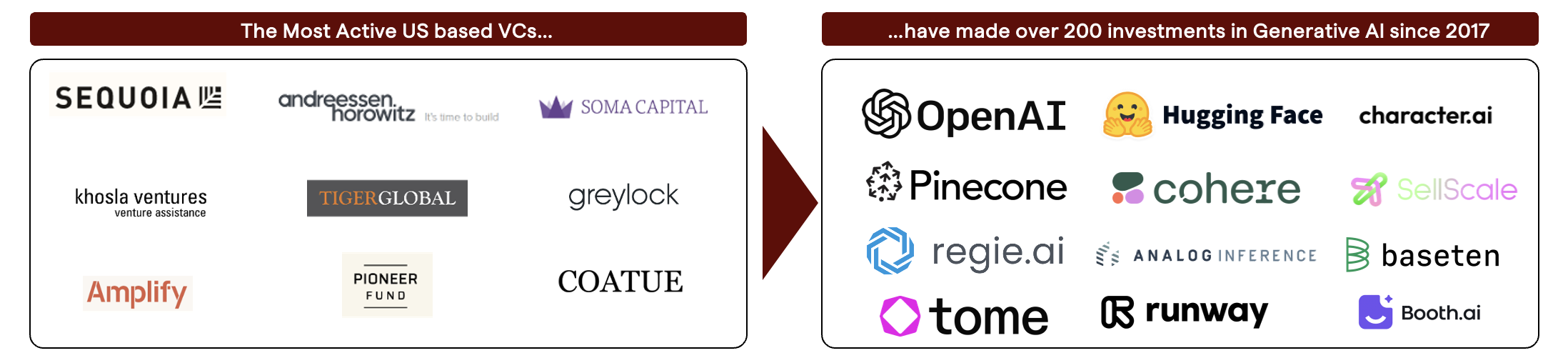

In fact, large VC funds like Sequoia Capital & Andreessen Horowitz have both invested in OpenAI as well. And while OpenAI is renowned as a leading generative AI organization, it’s certainly not the sole player in this field.

According to Pitchbook, the ten most active US based VCs have made more than 200 investments in the Generative AI space since 2017, with both Sequoia and a16z topping that list.

Sequoia Capital has been a clear leader in funding the space, including in AI training software specialist Hugging Face. Andreessen Horowitz’s portfolio includes Character.ai, a chatbot service that can generate human-like responses, and Pinecone, a vector database that makes it easy to connect company data with generative AI models.

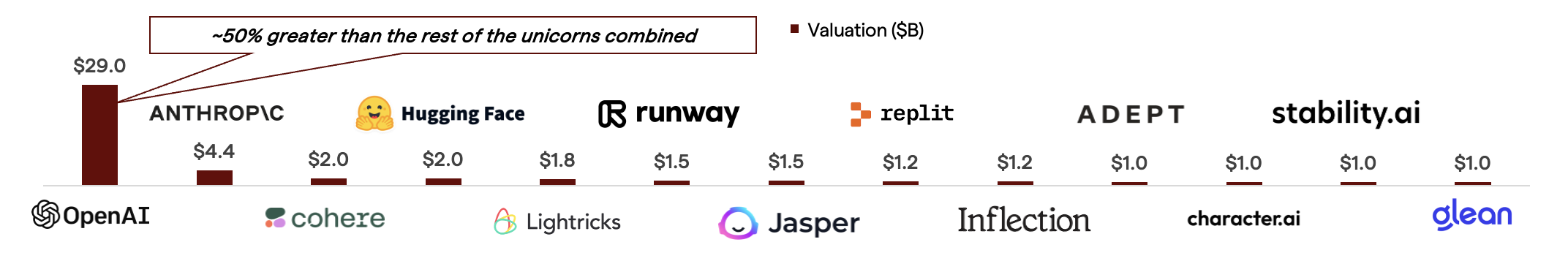

Young companies with huge valuations

Although more than two-thirds of generative AI companies have not yet raised a Series A round, we have already seen 13 of them reach unicorn status.

Even more impressive, the average time for these companies to reach unicorn status is ~3.5 years. The average amongst all other unicorns is ~7 years.

Unsurprisingly, OpenAI leads the pack with a valuation that is almost ~50% greater than the rest of the unicorns, combined.

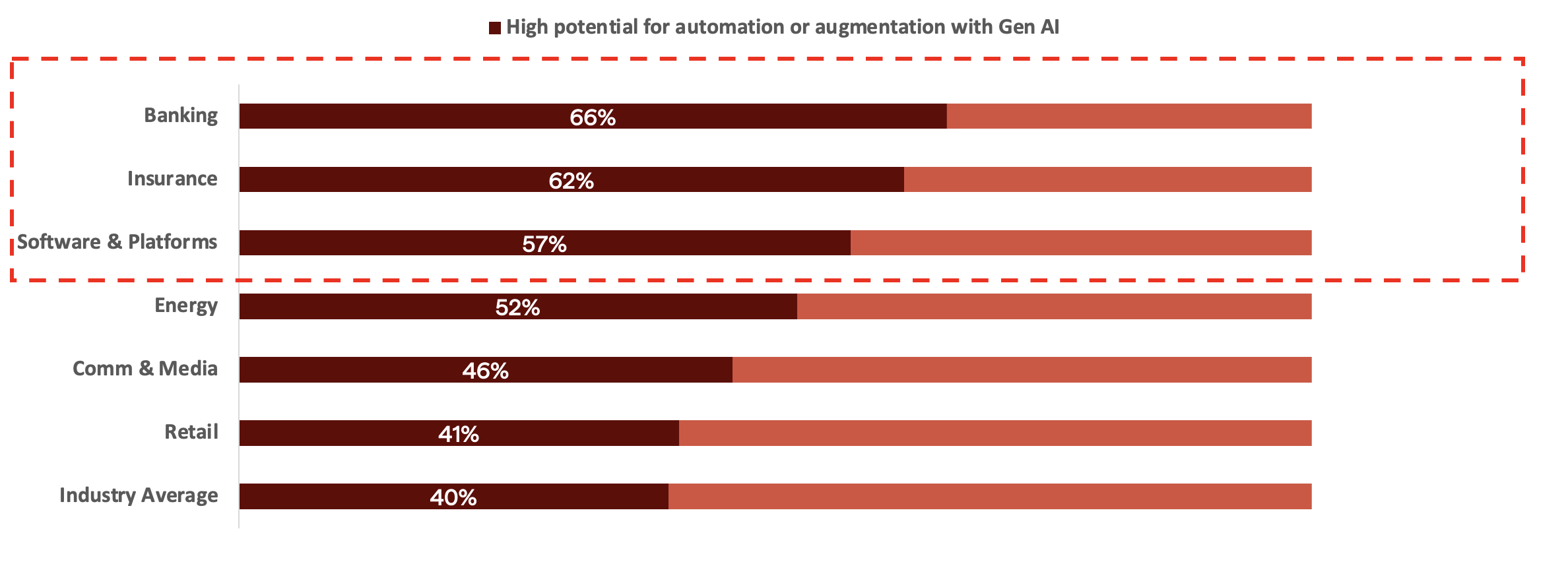

What industries are ripe for change with the incoming use of Generative AI?

A study done by Accenture manually identified tasks that could be transformed by LLMs, tracing them back to industries with the most potential to be automated or augmented with Generative AI.

Banking, insurance, and software led the way as the industries with the highest potential of automation and augmentation. When evaluating Generative AI opportunities, VCs should give special consideration to these industries.

Through 2022, over 50% of VC investments in Generative AI have been in the text and visual media segments. Thus far, much of the investment has been in segments not related to the above, including areas such as social media, text summarization, and AI avatars.

It is worth noting that in recent quarters there has already been a shift in investments towards generative interfaces. Nevertheless, there is still a significant amount of opportunity in these target industries.

For example:

- Banking: loan applications, financial advice, authentication & biometrics, fraud

- Insurance: customer support, policy acquisition, risk assessment, claims

- Software: user behavior insights, sales optimization, no code development

Considering the risks in Generative AI

The opportunity in Generative AI speaks for itself, but with it comes a necessary amount of due diligence when investing in any related startup in the field.

Risks can be broken down into three categories:

- Ethical: AI is susceptible to inaccuracies, discriminatory outcomes, and biases. This requires internal policies for data collection, storage and usage

- Cyber: Security measures such as audits & encryption are needed to protect against cyber attacks

- Regulatory: The AI regulatory landscape is still in its infancy and could change drastically. For example, the EU has already approved a draft legislation that created limitations

How an AI startup handles these risks could significantly impact whether they should be viewed as a viable investment opportunity.

Conclusion

Generative AI is still in its early innings, and while many tech giants & VCs have gotten a head start, it’s merely the beginning of the innovative journey. If you’re looking to invest in the space, keep these 3 considerations in mind:

Thanks to Harlem Capital Partner Jarrid Tingle and Summer 2023 Intern Frankie Lopez