Can Your Start-up ‘Return The Fund?’

by Harlem Capital

At Harlem Capital, one of our slogans is “Data Drives Decisions.” We are more data driven than most would expect for an early stage investor, which certainly stems from our finance backgrounds. We are also trying to remove biases that have historically led to a lack of diversity in venture. As a result, we want to provide insight to how the venture fund model works as we often feel there is a disconnect between founders and investors.

We will take a deep dive into venture math, particularly Harlem Capital’s, for founders to better understand what VCs are looking for. It will also be helpful for potential investors looking to better understand the economics. Either way, if you don’t like math, you should definitely read this post 😉

5 Step Return Analysis

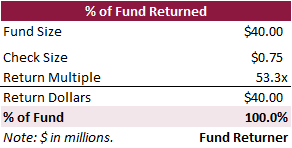

The below analysis provides some context to how we think about returns. You often will hear VCs say, “Can this return the fund?” This question is VERY IMPORTANT, so first lets define “Fund Returner”.

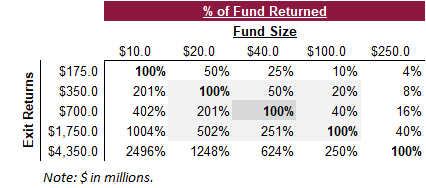

Fund Returner means to invest an amount of money and receive back 100% of my TOTAL fund from that investment. The above example shows a $40mm fund investing a $750k check and getting a 53.3x return to generate $40mm in return dollars, aka a Fund Returner. Not easy to get a 53.3x by the way, why Fund Returners are RARE. Although rare, they are critical in venture due to the very high startup failure rate (75%-90% depending who you ask and how they define it). Now lets walk through the complete venture math in 5 steps using the below example. There are other terms used that will not be defined so please reference these 100 VC terms if any term is unclear.

Step 1 — Check size

Every fund has a “typical” check size range based on the size of the fund and fund strategy (diversified vs concentrated). Find this out early in conversations if possible.

As a $40mm fund that is investing in 30 companies, Harlem Capital’s check size range is $500k to $1mm, with our average check being $750k (used in example above).

Step 2 — Valuation

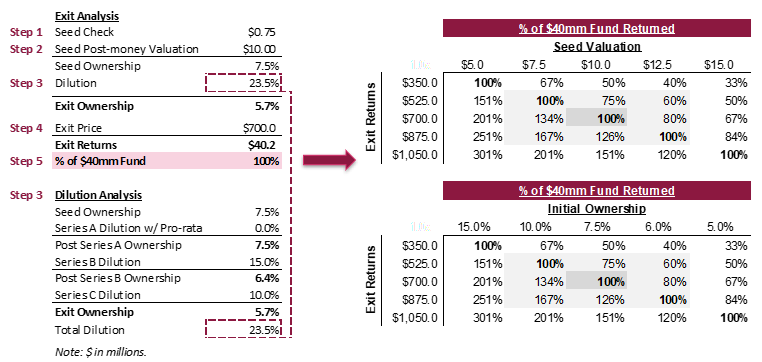

Seed valuations are NOT determined by revenue multiples, but instead by ownership targets. Please remember this. A founder should expect to give up 20%–30% ownership in the Seed round. Generally, larger funds ($100mm+) have 10%–20% ownership targets and microfunds ($25mm–$100mm) have 5%–10% ownership targets.

As a microfund, we target 5%–10% ownership. That varies depending if we co-invest where we target 5%–7.5% versus if we lead where we target 7.5% –10%. Assuming we invest $750k, this implies we only invest in companies with a post-money valuation range of $7.5mm to $15mm in order to get our ownership targets. In the above example, a $10mm valuation implies a $2mm-$3mm Seed round if we take the 20%–30% ownership assumption.

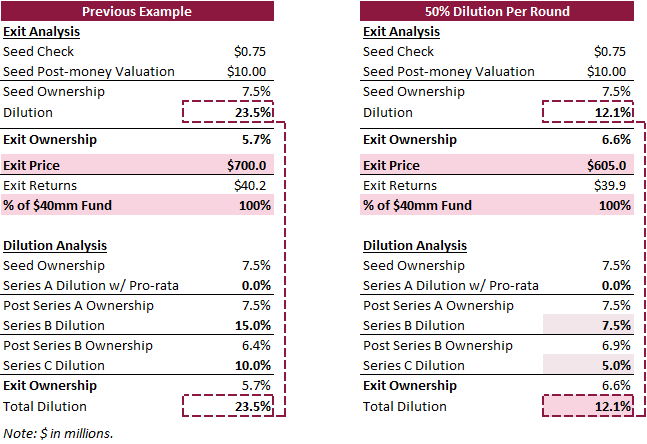

Step 3 — Dilution

The dilution assumption is the first BIG guess in the return model. The previous example shows 23.5% total dilution by exit, which leads to 5.7% ownership at exit. Let’s look at the example of cutting the Series B and Series C round’s dilution by 50.0%, table on the right below. That leads to 12.1% dilution and 6.6% ownership at exit. That 0.9% ownership increase leads to an investor only needing a $605mm exit instead of a $700mm exit to return the fund, that’s $95mm (AKA a lot of money).

So how does Harlem Capital think about dilution? It varies by industry and company (every VC answer), but we typically assume the Seed round is 25% (midpoint of 20–30%) and steps down 5% each round. Meaning, 20% for the Series A, 15% for the Series B, 10% for the Series C and 5% is the floor for Series D+ rounds. However, we reserve 30–40% of our fund for follow-ons to take our pro-rata in our winners in the Series A to prevent dilution. This is why there is 0% dilution in the Series A round above. Every fund has different follow-on reserves so ask them upfront. Overall, we usually assume 25–30% dilution by exit with our Series A pro-rata check. Note this total dilution is 40%+ without the Series A pro-rata so funds that don’t follow-on will require larger exits from founders. It is important to manage your dilution.

Step 4 — Exit Price

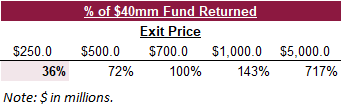

Exit price is the biggest and most important guess. NO ONE obviously knows, but investors will try to make an educated guess of a range of potential outcomes. For many founders hearing a $250mm exit is not big enough doesn’t make ANY sense, but it’s unfortunately the reality for many funds. A $250mm exit only leads to 36% of a $40mm fund being returned in the previous example.

Some funds don’t focus on the exit value because it truly is a guess. Some funds only invest in companies that they envision going public. It is important for founders to be aligned on exit as that can impact their relationship with investors in the long term.

Harlem Capital does not model for IPOs or Unicorns as the vast majority of exits are M&A and under $1bn of enterprise value. This does not mean we do not believe our startups can become unicorns or IPO, but we want to believe we can return the fund even if they don’t. For this reason, we do acquisition and comparable analysis to understand who is likely to buy them and in what price range. An exit is usually far away from the Seed round, but have an idea of who can acquire you or how big the business can get as a standalone.

Step 5 — Exit Returns as Percentage of Fund

The fund size is a large driver to what is required for an investment to return the fund. The above example needed $700mm exit to return a $40mm fund. This implies a $350mm exit to return a $20mm fund, a 50% haircut. The same investment of $750k would require a $4.3bn exit for a $250mm fund, aka VERY UNLIKELY. Hence, why a $250mm Seed fund is likely going to have a check size range of $2mm+. A fund is generally not going to invest less than 1% of the fund in any company.

Most Seed funds are targeting a 3x–5x gross return, which implies $120mm-$200mm for Harlem Capital’s $40mm fund. If we assume for simplicity, HCP on average has 5% ownership at exit, this implies $2.4bn-$4.0bn of total exit value. Now it begins to be clear why Unicorns are such a focus for VC. A fund may not need unicorns to return the fund, but it will need billions in value creation to meet the 3x-5x return goals.

Conclusion For Founders

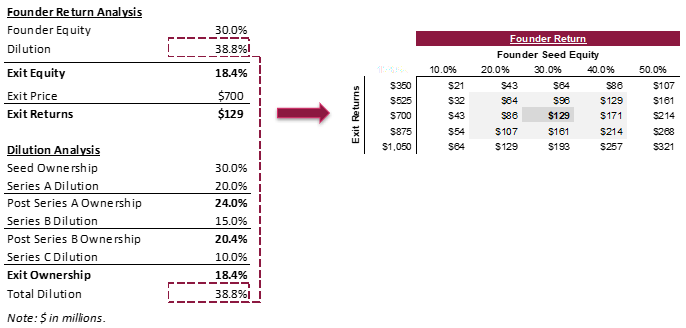

So…if you know an investors initial ownership and you make some dilution assumptions, you can back into what exit they are assuming for you to return the fund. We encourage founders to think through some of this math because investors are taking a piece of your baby and you want to be aligned. We also encourage founders to run this math for THEMSELVES. You can replace the above analysis with founder equity. We generally see co-founders after Seed rounds owning ~30% each. Note the Series A dilution below as founders do not have pro-rata to prevent dilution, this leads to 38.8% total dilution instead of 23.5% for the investor. Still not bad for a founder to take home $129mm though 😉

Venture is as much MATH as it is GUT. Run the numbers for yourself and for your business to set yourself up best for the long haul that venture is. Too often we see founders (especially first time) with too little equity at the Seed stage and that can signal investors to your lack of understanding of venture. It certainly isn’t your job to be mathematicians, but some insight can really help protect the thing you are working so hard on.

Conclusion For Investors

Try to learn as much of the above as you can. Robert Smith says, “You should be a MASTER of your craft.” Math is a part of venture, there is no way around it as this is still investing. You may have a network, empathy, “proprietary” deal flow, but have the math as well.

Check out our previous post on our Investment Box and to stay up to date on Harlem Capital news, subscribe to our monthly newsletter.

Thanks to our Managing Partner, Henri Pierre-Jacques, for writing this piece.

Regards,

Harlem Capital Team