First 90 Days After your Seed Round – Part 2

by Harlem Capital

By Harlem Capital Partner Gabby Cazeau

The first 90 days after closing your seed round is a critical time to set the stage for your startups success. In our last blog post, we shared the first 3 things to do with your investors after closing your seed Round. Check it out here.

Now we’ll cover the next 3 things to focus on.

Here’s what to do in your first 90 days with your investors.

1. Define your KPIs

2. Triage Core Needs

3. Secure Early Wins

Let’s dive in!

Define your KPIs

“Data Drives Decisions”. “You can’t manage what you don’t measure”. These sayings about measuring and leveraging data are a dime a dozen. But that’s for a reason! Clearly defining the goals and metrics you want to achieve is the first step to reaching them. Defining your startup’s KPIs helps 3 key stakeholders:

1. Investors – Investors want to help track your progress and benchmark performance. This is done with a focus on how you’re progressing toward the metrics needed for future VC funding

2. Founders – Building KPIs helps you to track how effective you are with the business and identify areas that require immediate attention

3. Employees – Providing employees with clear KPIs helps to craft a culture based on data-driven decision-making and empowers your team with a clear sense of direction.

Every stage of company building requires different goals and KPIs. A pre-Seed might be focused on learning milestones, building the MVP, validating customer discovery insights, and landing the first customers. At seed those KPIs might be specific customer acquisition and retention metrics, optimizing conversion time in your sales motion, and revenue targets.

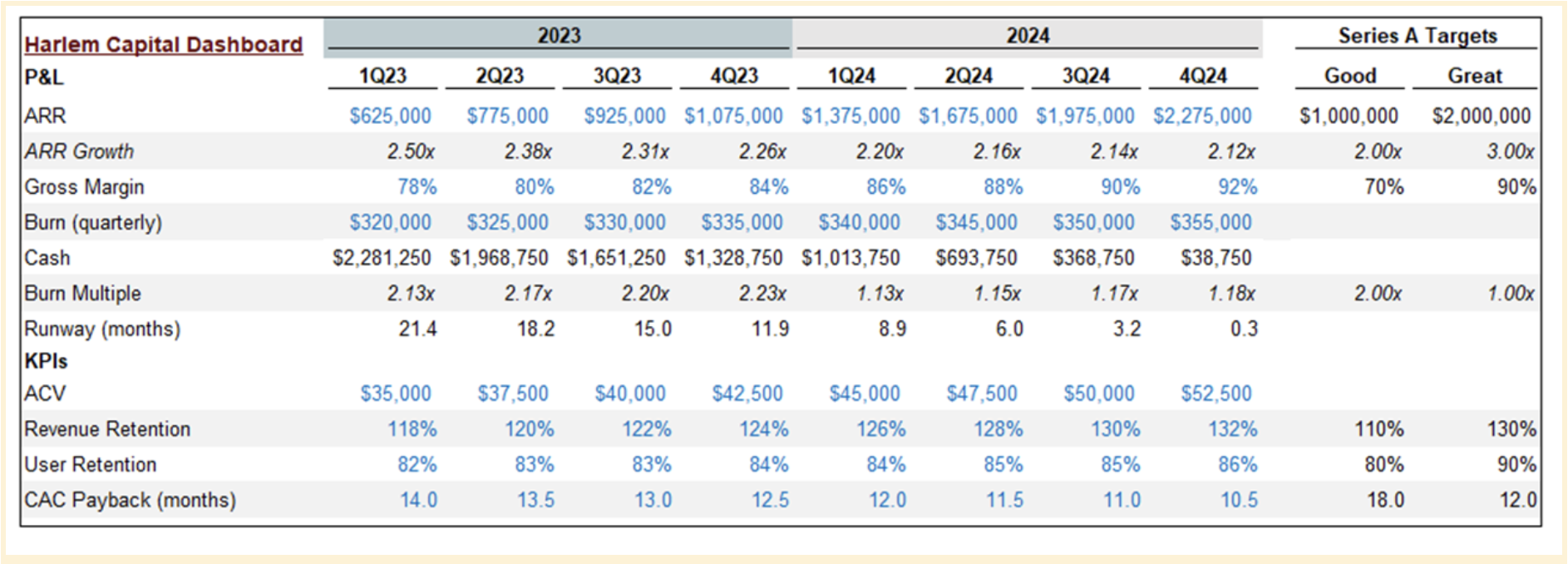

Define with your investor what your goals and KPIs will be for the first 90 days. Map runway and burn to your desired outcomes so that you know what you’ll need to achieve, by what time, AND with what capital. This is also a great time to check in with your investor on what metrics they would want to see before making a follow on investment. Ask your investor for benchmarks they can share for how your performance would compare against other companies in your market or stage, whether in their portfolio or more generally.

Download this example dashboard here

Triage Core Needs

So you’ve aligned on expectations, set your communication cadence and goals. Now is the time to get investors to roll up their sleeves and actually get to work.

Frame up for your investors the most critical things that you need support on. That could be securing PR for the fundraising announcement or getting key introductions to potential customers. The key is to identify where your investors can help the most and make the ask. Your investors might have a few areas they’ve identified as things to focus on post-investment.

Throughout the first 90 days, check in on those core needs, identify what’s been met, and then move on to the next set of focus areas.

Secure early wins

The first 90 days is an important period for investors and founders to build trust with each other. Inevitably, every startup journey will have challenging moments. Having that strong foundation of trust helps to navigate those future challenges more effectively, where both sides feel they can be open and honest. Securing early wins is also about hitting goals and KPIs you’ve set for the business and growing momentum. It’s also about investors delivering on their value add for founders. For founders some of the best ways to build trust is to be open: share the wins, the losses, and how you’re thinking about the business. For investors it’s openly communicating, proactively supporting, and trusting founders’ expertise and vision for their business.

Conclusion

In the first 90 days after closing your seed round, there are 6 key things to do with your investors:

1. Reset and Reflect

2. Align Expectations for North Star Goals

3. Set your Communication Cadence

4. Define your KPIs

5. Triage Core Needs

6. Secure Early Wins

Taking these proactive steps in the first 90 days sets a strong foundation for the collaboration between investors and founders. We hope you found these steps helpful!

To stay up to date on Harlem Capital news, subscribe to our monthly newsletter.