1,338 Black and Latino Startups That Have Raised $1M+ in VC Funding ($52.3B Total)

by Harlem Capital

By Nicole DeTommaso and Arjun Dundoo (Winter ‘25 Intern)

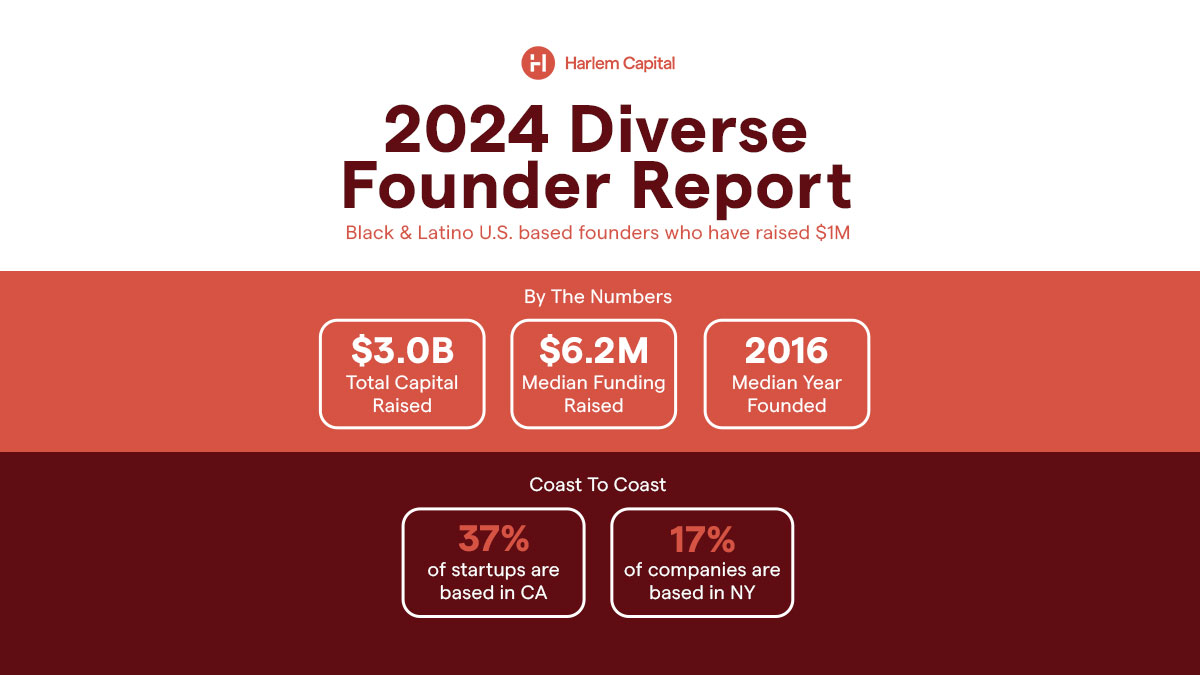

We just released Harlem Capital’s 2024 Diverse Founder Report.

At Harlem Capital, we believe in the power of bold ideas, relentless ambition, and the courage to build against all odds. We are deeply committed to being a fund for exceptional, diverse founders reshaping industries and rewriting the future. All winners are welcome.

Harlem Capital is confident that we will continue to see growth in the Black & Latino VC funding market as more companies scale and more diverse investors enter the space.

What’s new this year?

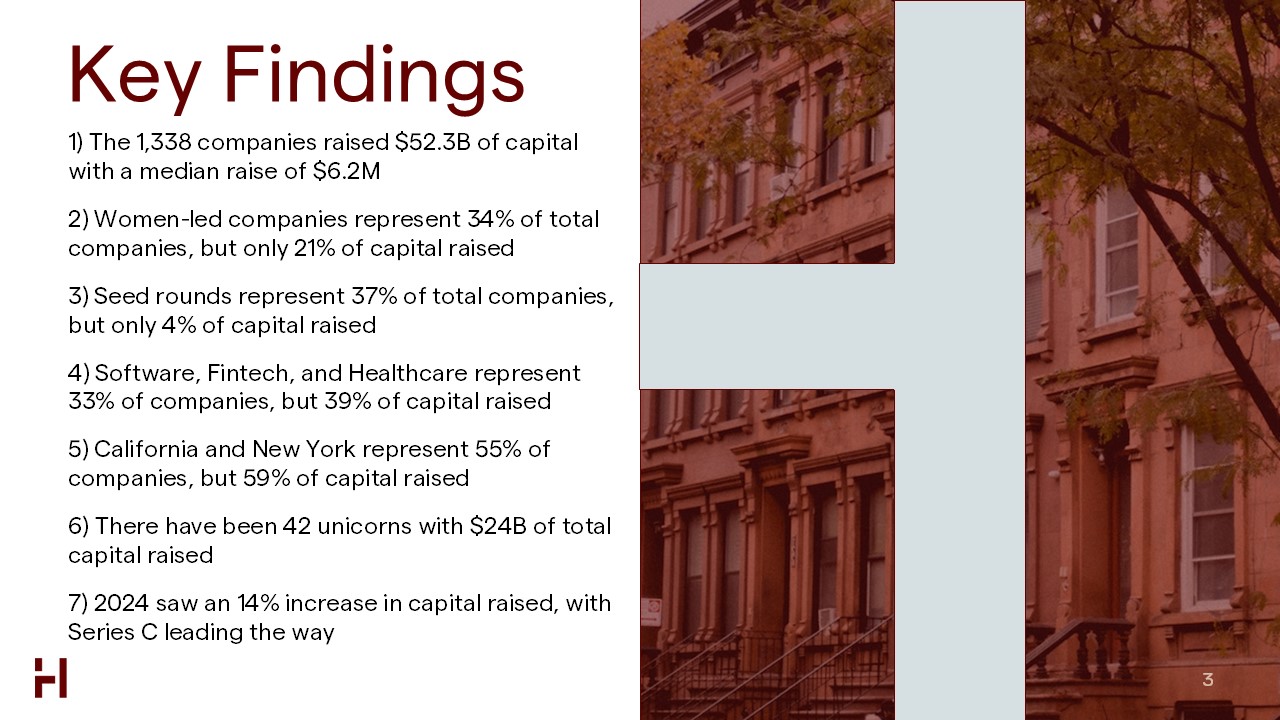

This year’s report has expanded to 1,338 companies, all of which have raised at least $1 million in venture funding – an increase from last year’s 1,257 companies. We’ve also introduced new insights into how diverse unicorns are linked to their university backgrounds and previous employers.

Key Updates for 2024

- 81 new Black & Latino-founded companies added to the $1M+ VC-funded list

- $3.0 billion in additional capital raised

- 2 new diverse unicorns (Helion Energy & Twelve)

- 1 new investor joins the list of those with 25+ investments in Black & Latino founders

- 6 raises exceeded $100 million, up from 5 last year, with a notable increase in late-stage (Series C) activity

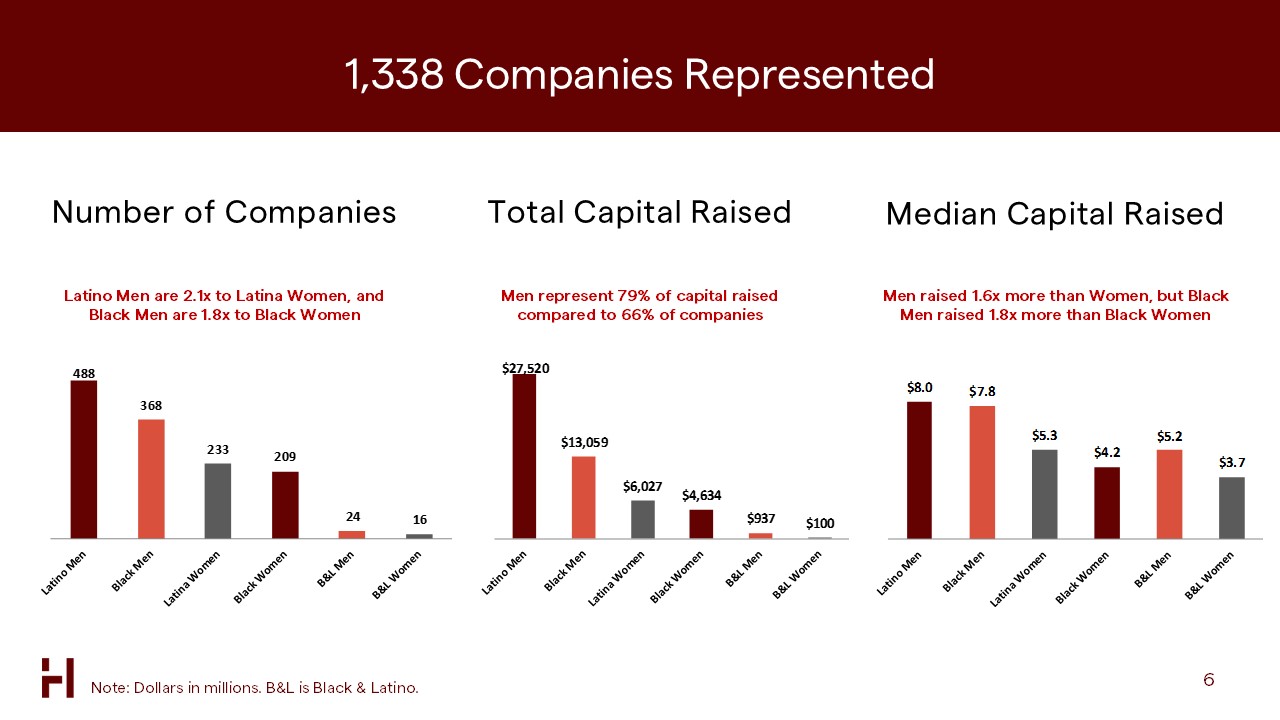

Who are the founders by gender and race?

34% of founders are women, but they received only 21% of total capital raised.

Median capital raised:

- Men raised 1.6 times more than women.

- Black men raised 1.8 times more than Black women.

- Latino men raised 1.5 times more than Latina women.

- Latino men hold the highest median raise at $8.0 million.

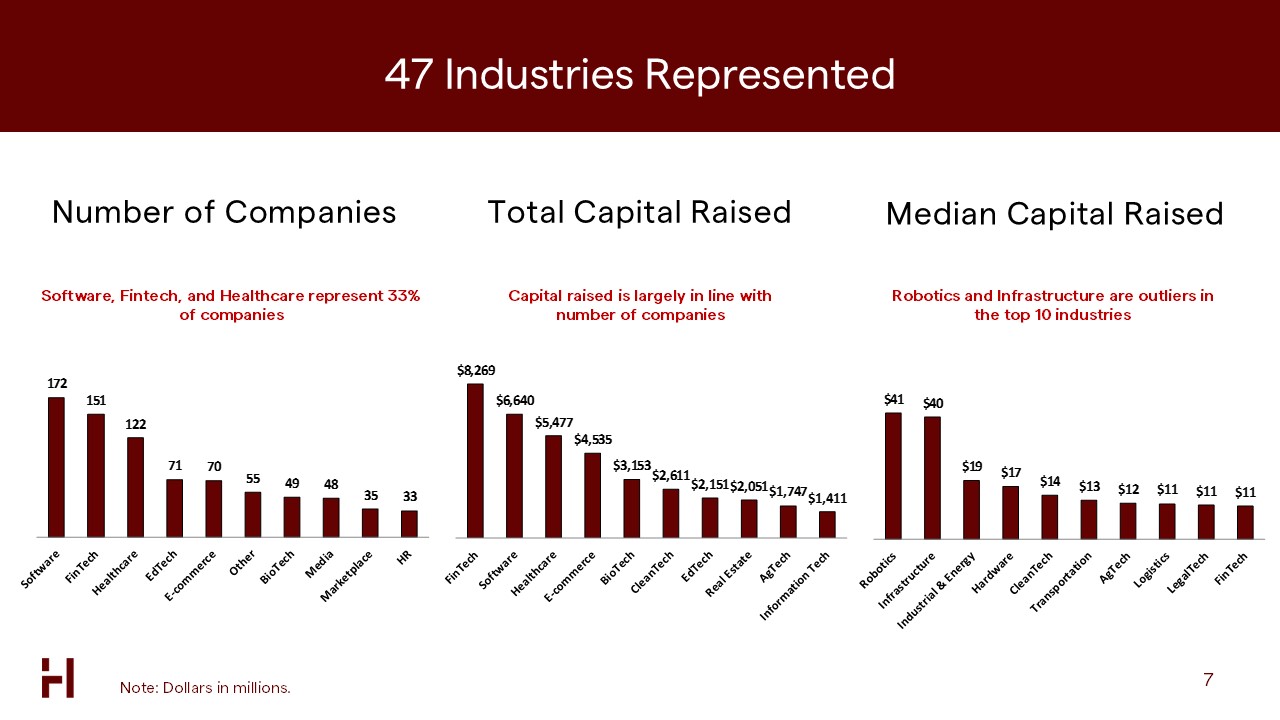

What industries are they in?

The top industries remain software, fintech, and healthcare, accounting for 33% of all companies and $20.4 billion in total funding.

- Robotics leads with the highest median raise at $41 million.

- Marketplace startups have gained traction, joining the top industries list.

- Big data & information tech saw a decline compared to last year.

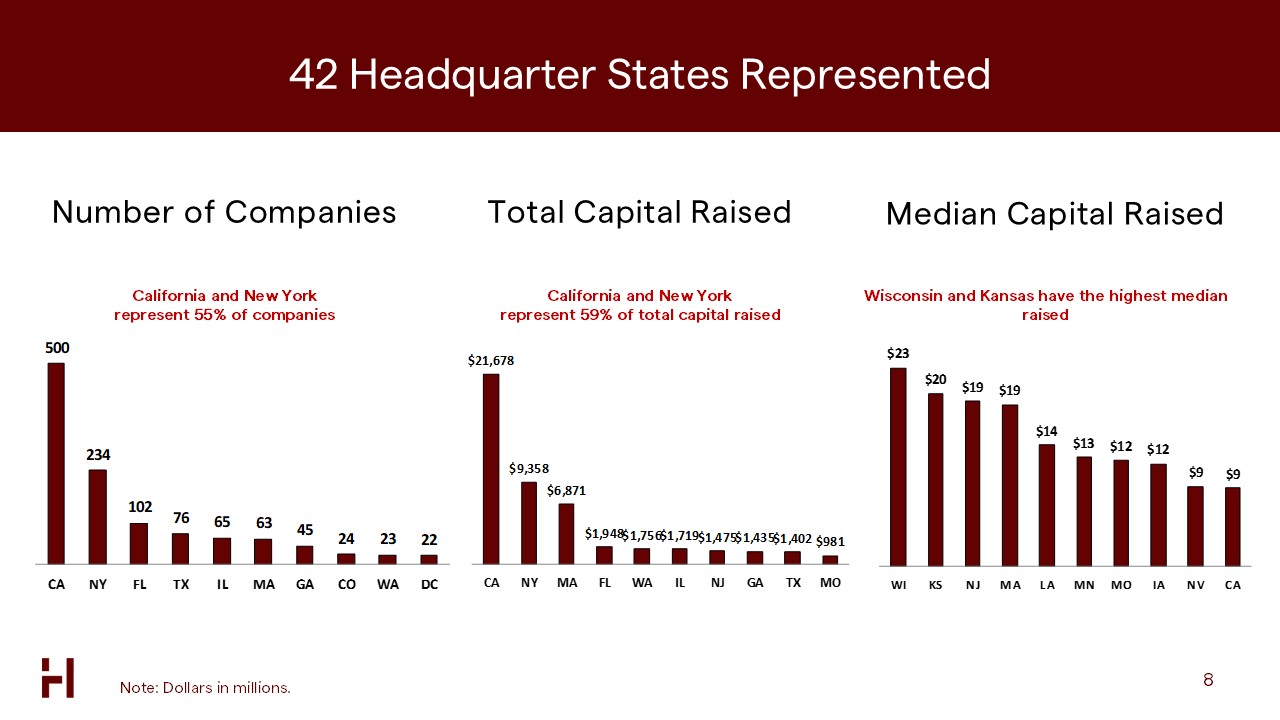

Where are these companies headquartered?

55% of companies are headquartered in California & New York. These states also dominate funding, securing 59% of total VC dollars, with California alone capturing 41% of total dollars. Wisconsin ($23 million) and Kansas ($20 million) hold the highest median raise among all states.

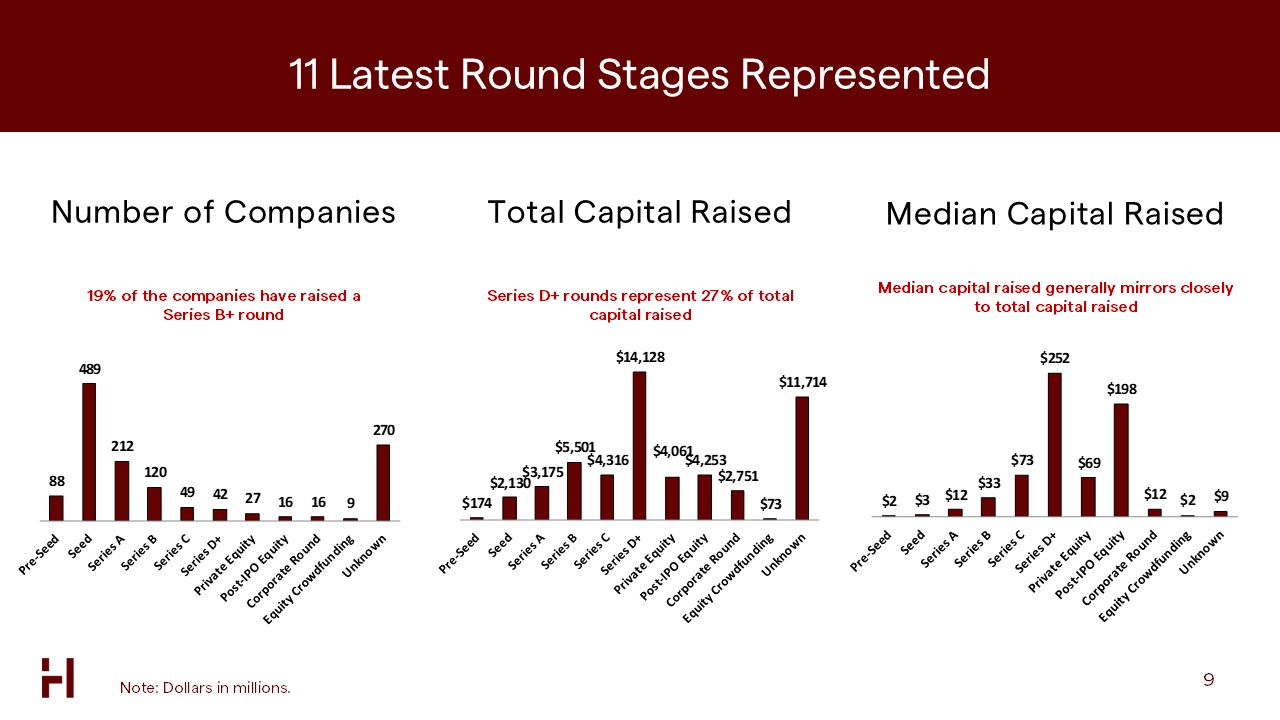

What round stages are represented?

This report spans 11 funding stages, with Series B+ rounds comprising 19% of the dataset.

Late-Stage Funding Trends:

- Series D+ rounds account for 27% of total capital raised.

- Top 10 largest rounds in 2024 totaled $1.9 billion, making up 64% of all capital raised (up from 50% in 2023).

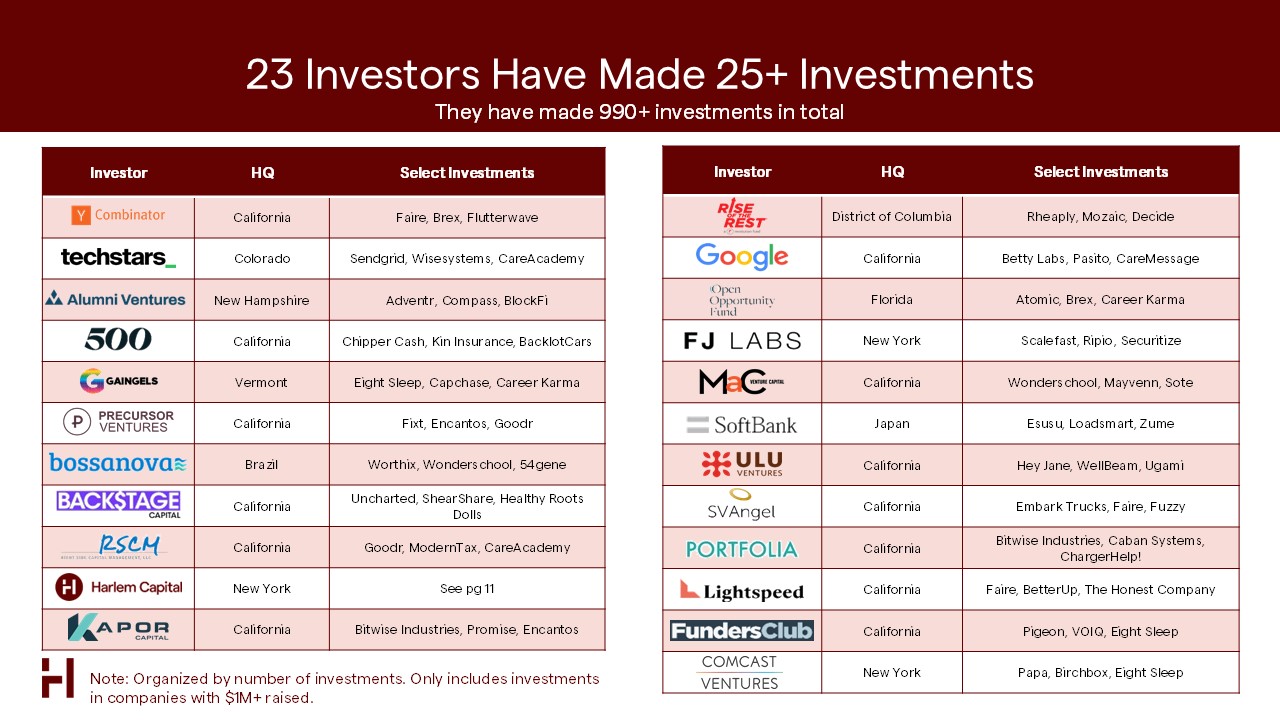

Who are the most active investors?

The report tracks 6,000+ investors across 1,338 companies.

- 23 investors have made 25+ investments, totaling 990+ deals.

- These investors include accelerators, diverse-led funds, corporate venture arms, and multi-stage firms.

- Harlem Capital has made 39 investments into Black & Latino founders, backing 2.9% of companies in this report with $281 million in capital.

Who are the diverse unicorns?

There are 42 Black & Latino-founded unicorns that have collectively raised $24 billion, reaching a combined valuation of $125 billion.

- 2 new unicorns added: Helion Energy & Twelve.

- Median capital raised: $470 million.

- 33% reached unicorn status by Series D.

- Median founding year: 2015.

Where are they based?

- 60% are headquartered in California & New York.

Education & Work Experience

- 89% of unicorn founders have undergraduate degrees, and 58% have graduate degrees.

- 5+ attended Harvard, Stanford, or MIT.

Why now is the best time for Harlem Capital

We believe 2024 marked a critical turning point – for both the venture market as a whole and diverse founders. Here’s why:

1. A new technology shift

Historically, major technological shifts have defined new waves of breakout companies. The transition from the internet to cloud computing, then to mobile, and now to AI represents the next big inflection point. AI is already transforming industries, and diverse founders are increasingly at the forefront of these advancements.

2. The first wave of top diverse founders

The past decade has seen the largest cohort of diverse founders ever gain traction. Many are now moving into growth and late-stage rounds, with Black and Latino unicorns raising a median of $470 million. This means we are entering a phase where diverse founders will lead some of the next generation’s most valuable companies.

3. Harlem Capital’s deepest network ever

Our network of diverse founders and investors is stronger than ever:

- We have seen 56% of all Black and Latino U.S. seed deals in the last 12 months.

- We saw 50% of all women-led pre-seed and seed deals in the first half of 2024.

- Our ability to source and invest in underrepresented founders at scale has never been greater.

4. A market bottom and the next bull cycle

We believe 2024 was near the bottom of the VC bear market, creating a rare opportunity to invest ahead of the next upcycle. While capital remains scarce, history shows that investing at market lows generates the strongest long-term returns. With the rise of AI and an unprecedented wave of top diverse founders, we are well-positioned to capture the next decade’s bull market.

Harlem Capital is Becoming a Home for Winners

We are still in the early innings of recognizing diversity investing as a crucial asset class. These groups, particularly Black women, remain underfunded yet have collectively generated $100B+ in value. We also continue to believe that this list will represent $1T+ in value by 2030. It is our mission at Harlem Capital to serve these founders at the earliest stages and we’re excited that we represent 39 companies on this list.

Harlem Capital is a launchpad for the best and brightest founders. Our ecosystem is built for those who have an idea that can change the game, refuse to accept the status quo, are ready to lead and scale against all odds.

When you step into our world, you are not just backed by capital. We are your partners through investments, programming, events, and brand building, helping you become a force multiplier and rewrite history.

One of our core beliefs is that Data Drives Decisions, so this data will hopefully help more funds find incredible founders as well as showing founders that they aren’t alone. There are now over 1,300 Black & Latino founders that have raised $1M+ of venture funding.

We didn’t have the data to prove our diversity thesis 7 years ago, but now the data is clearer than ever before.

Check out the airtable to see the full list of 1,338 companies.

About Harlem Capital Partners

Harlem Capital (HCP) is an early-stage, diversity-focused venture capital firm. HCP makes initial investments of $1mm to $2.5mm in U.S. seed rounds for 10-15% ownership.

Stay updated on Harlem Capital news by subscribing to our monthly newsletter, follow us on LinkedIn, X, and Instagram.