What’s all the talk about Ethereum?

by Harlem Capital

When discussing blockchain, Ethereum comes up frequently along with Bitcoin. One could argue that Bitcoin has received most of the spotlight with ardent followers like Jack Dorsey and Elon Musk. However, it looks like it’s ethereum’s time to shine. Ethereum is emerging as the blockchain that can support and run a myriad of evolving use cases.

Link to full report here.

What exactly is Ethereum?

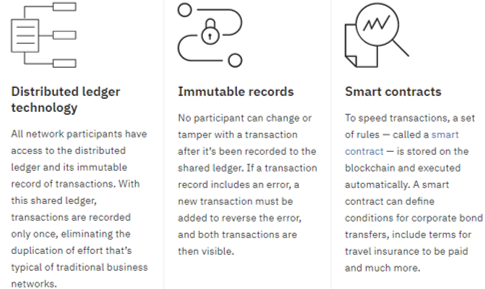

The concept of Ethereum as a platform was first proposed in a 2013 white paper by Vitalik Buterin, a 17-year-old computer programmer. Following a period of online crowdfunding in 2014, the platform was developed and launched in July 2015. Ethereum is the world’s programmable blockchain. It is a community-run, decentralized network that powers the cryptocurrency Ether (ETH) and can be used to create and run specialized digital applications. Blockchains are ideal for delivering the critical information that individuals and businesses rely on because they provide immediate, shared, and completely transparent information stored on a ledger that can be accessed only by permissioned network members.

Key Elements of the Blockchain. Source: IBM

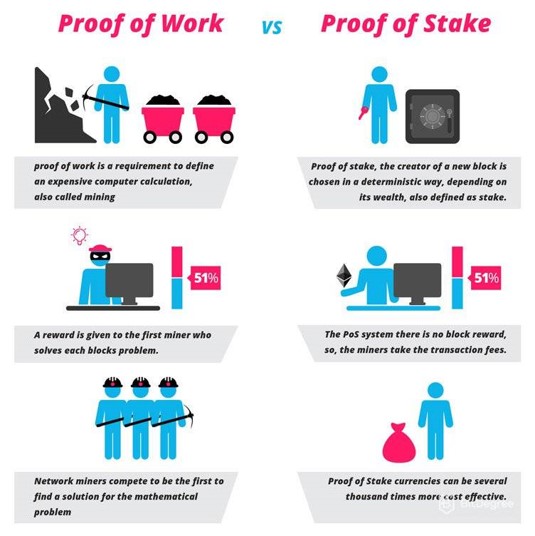

Ethereum currently uses the Proof of Work (PoW) mechanism when mining. Mining refers to gaining cryptocurrencies through a transactional process that involves the use of computers and cryptographic processes to solve complex functions and record data to a blockchain. PoW has proven to be controversial due to environmental implications. It requires a significant amount of computational energy to do the mining work. However, ethereum has been in the process of transferring to Proof of Stake (PoS) which is less carbon-intensive. This will be known as Ethereum 2.0.

Source: BitDegree

What makes Ethereum different?

As mentioned, Ethereum is a programmable blockchain. In contrast, Bitcoin is only a cryptocurrency (digital money) with its singular use case to be an alternative to traditional currencies. Ethereum offers cryptocurrency in ETH but also powers decentralized applications (dapps) related to NFTs (non-fungible tokens) and DeFi (decentralized finance).

NFTs and DeFi are only the beginning. Earlier this year Axie Infinity garnered significant attention through its introduction of the play-to-earn model and the immense traction it has produced. Axie is a gaming platform powered by ethereum. It is interesting and exciting to see what else will be developed on ethereum.

Trends and Shifts

The following are just a handful of trends that impact the future of Ethereum:

- Decentralized Identity Management: For enterprises, blockchain is offering a way to securely establish a “decentralized identity,” giving users more control over when, where, and with whom they share their credentials

- “Tokenizing” a person’s identity can give them more convenience and control over how they share credentials and who has access

- Blockchain-Fueled AI: Introducing machine learning algorithms on a set of new, far-reaching data will drive more effective pattern matching and predictive analytics for individuals and enterprises

- Cryptocurrency to Mainstream: Companies are adding Bitcoin and other cryptocurrencies to treasury holdings and government central banks are backing digital currencies (or introduction their own CBDCs (Central Bank Digital Currencies)

- Government Regulation / Taxation: Governments of different countries are creating tools to monitor and regulate cryptocurrency transactions

How Harlem Capital feels about Ethereum

Harlem Capital is bullish on Ethereum and wants to support entrepreneurs creating in this space. Companies that are focused on blockchain development will deliver significant value due to their focus on securing personal information, increasing transaction transparency, and discovering new, scalable use cases for the technology. Cryptocurrency startups are increasing access and efficiency around payments while providing an opportunity for users to transact in a decentralized environment.

Furthermore, both blockchain and cryptocurrency-focused organizations offer LPs / investors the ability to gain exposure to a nascent industry that is typically not correlated with the general market, with the potential to deliver outsized returns.

While we expect the space to continue to rapidly evolve and develop, we hope that this report has been helpful to put the market into context. We look forward to meeting the next generation of diverse founders innovating in the space. If you are a blockchain entrepreneur, we would love to connect with you!

Thank you to our interns Derek Oliver and Sharlene Guiriba for their help with this report,