🚩 Having women co-founders in the pitch deck but NOT treated as co-founders on the cap table with meaningful equity

— Gabby Cazeau (@gabbycazeau) October 7, 2022

Cap tables speak volumes. Having fair ownership in the business should be table stakes

Pay Me in Equity

by Harlem Capital

By Gabby Cazeau

“I was a co-founder in title, but not on the cap table.”

Since working in VC I’ve heard and seen this countless times before, where women or POC co-founders in a company are not fairly compensated in equity for what they’ve put into the business.

Raising VC funding and building a company are hard enough. Investors ask founders to do and be all things at once to hit that heralded unicorn status. Founders put their heart, soul, capital, and time into their companies. And despite that, most startups fail. When startups do succeed, the payoff can be big. But imagine doing all that work and at the end, not getting to benefit from that huge outcome.

One big red flag I see in potential investments: Having women co-founders in the pitch deck but NOT treated as co-founders on the cap table with meaningful equity. Cap tables speak volumes. They reflect value and your team values. Having fair ownership in the business should be table stakes for anyone who is willing to start the long journey of being a startup founder. If you show me your cap table and I’ll show you who has more power and leverage — whether it’s investors or founders, or between the founding team themselves.

Giving women and people of color a title, but not meaningful equity, is not change. Outside of the startup world, you can replace ‘equity’ with ‘power’ or ‘resources’ or ‘authority’. But it all adds up to the same thing: window dressing that upholds the same power structure that prevents underrepresented groups from owning their future.

If we care about making systemic change in this industry, it starts with looking at who owns what’s being built.

Cap Tables and Ownership

First, what is a Cap Table? A Cap Table (capitalization table) details who has ownership in a company — founders, investors, employees, etc. It’s a spreadsheet showing the value of that ownership and the types of ownership held by different parties, whether stock, convertible notes, or equity grants. Equity ownership is a powerful tool because it aligns incentives across all parties to work towards success because if the company does well, everyone benefits.

But when it comes to deciding equity among co-founders, that’s a tricky question. There is no magic formal to determine equity between co-founders. And for each person you ask, there’s a different framework and pros/cons for that framework. Some like Mike Seibel at YC advocate for an equal 50/50 split. Others advocate for a negotiated approach, where you take into account the different contributions co-founders bring to the business (time, money, IP, technical know-how, etc.) and use that to determine the right split.

I took an *unscientific Twitter poll* on this question:

In practice, 50/50 equity splits are not common. Data from Carta shows that only 32% of two-founder companies choose an equal equity split.

There’s no clear answer for which type equity split is right. But what is clear across the board, is that truly unfair partnerships create an unstable foundation that can lead to additional conflict, investor scrutiny, and make success even more difficult. If co-founders aren’t incentivized adequately you set yourself up for potential challenges down the line. One of the biggest reasons companies fail is due to co-founder conflict — don’t let this be one of the reasons that leads to that.

Note that I said fair, not equal. Co-founders usually will have different amounts in equity. What I’m talking about are what’s truly unfair, where it’s clear women and POCs are getting 5–10% of equity even though they were 1) core builders in the launch phase of the company and 2) are presented as true co-founders in the business.

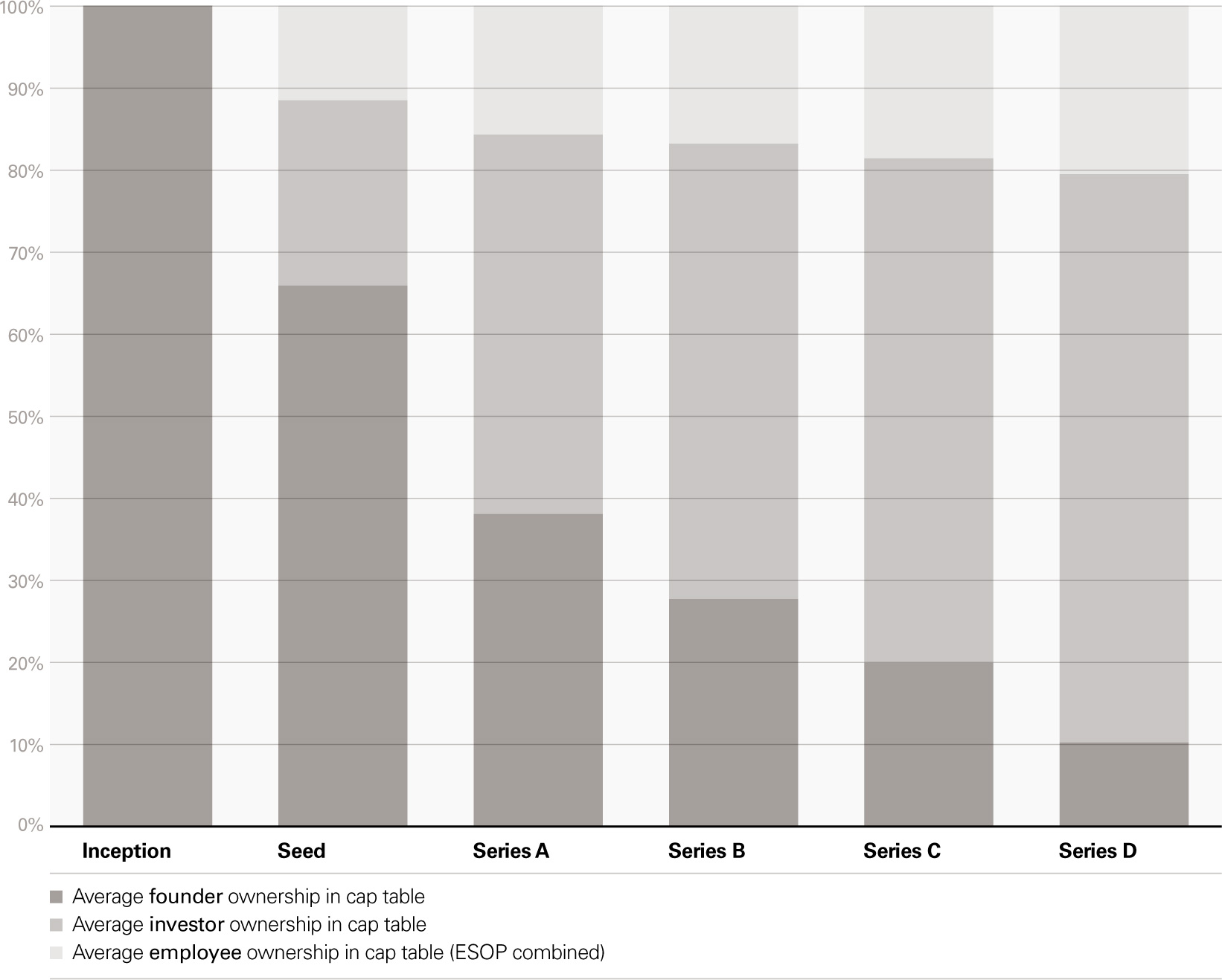

It’s helpful to look at founder ownership in context to the stage of the business. Index Ventures shared some great benchmarks for founder ownership in the cap table from inception to Series D. As seed investors, we get concerned when founder ownership dips far below averages. I’ve passed on investment opportunities where the equity balance was significantly off for the stage of investment or between co-founders and where there wasn’t a path to help adjust that.

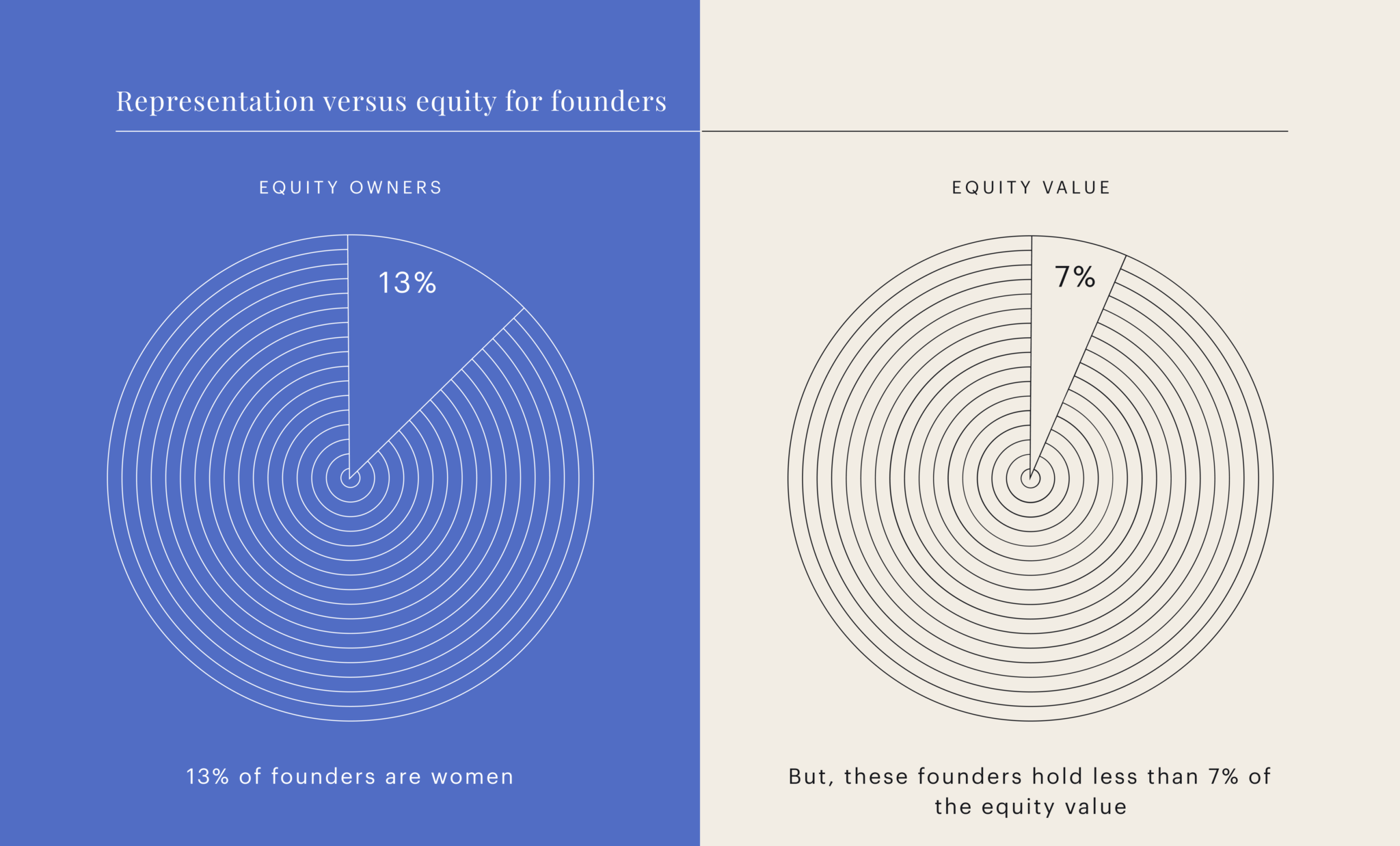

Perhaps no company is better situated to help us understand where we are today then Carta. Carta is an ownership and equity management platform trusted by thousands of founders, investors, and employees. They literally see and manage all the cap tables for private companies from the smallest seed to the series E unicorn. Carta published a report in 2019 that analyzed equity distribution by gender. What did they find?

They found that “women founders represent 13% of all founders, and they hold 7% of founder equity value. This means that women founders own just 48 cents on the dollar in equity for every dollar men founders own.” While there isn’t data on this, I do think we’d see similar insights for diverse founders as well.

Moving Forward

I care about making meaningful change in this industry. That means ensuring that when I invest in a company, that women and POCs have adequate equity in the business, both between founders and relative to the stage of investment. Cap tables really do reflect what you value and how much your value the various stakeholders in the business. I think investors should ask founders about their cap table, to suggest adjustments when things look off, and make sure the right incentives are in place for founders and employees. I encourage founders to have the tough conversations about equity as early as possible, to make sure that you’re aligned with one another.

Below are a few resources here for founders to help work through equity splits and cap tables:

Cap Tables

Splitting Equity Between Co-Founders

- YCombinator Perspective

- Carta’s Perspective

- HBS Startup Guide on Equity

- Harvard Business Review “The First Mistake Founders Make”

- Silicon Valley Bank Perspective

- How to Split Equity from Mercury

Employee Options / Equity Calculators

Events

- Carta Equity Summit 2022 — In December 2022, Carta is hosting its annual Carta Equity Summit — a free, virtual event for the brightest minds in the venture ecosystem committed to creating more access to equity ownership. At the Summit, Carta will release its annual report detailing equity ownership by race, gender, geography, and ethnicity.