Harlem Capital Top Ten 2020 Macro Demographic Trends to Watch

by Harlem Capital

Harlem Capital is committed to understanding broad macro demographic trends — how the population’s characteristics such as age, ethnicity, gender, marital status, income, education levels, and living status evolve over time — in order to make informed investment decisions based on the trajectory of consumer behavior and new market opportunities. We are particularly curious about upcoming shifts in business and society as they relate to women and minority populations and believe as investors it is important to have an educated perspective on such trends. We are excited to share a high level summary of our internal report findings, which include a curation of the top macro demographic trends we have been exploring to help improve our own investment theses.

The ten trends we analyzed included:

Below are some of our key findings, and if you are curious to learn more check out the full report on our website.

Trend Summaries

1 / The new consumer is focused on experiences rather than things and is asset light largely due to rising debt; its influence is driven by women and increased minority purchasing power.

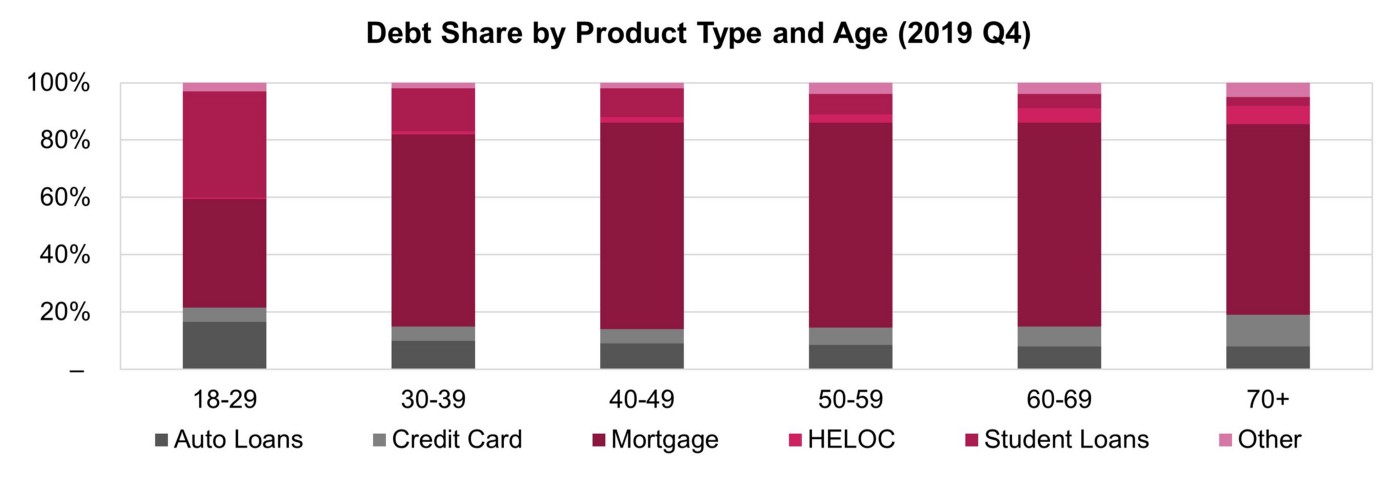

2 / There is an emerging consumer debt crisis — $14T in consumer debt now exceeds the 2008 peak — generating unequal outcomes based on income, age, and race.

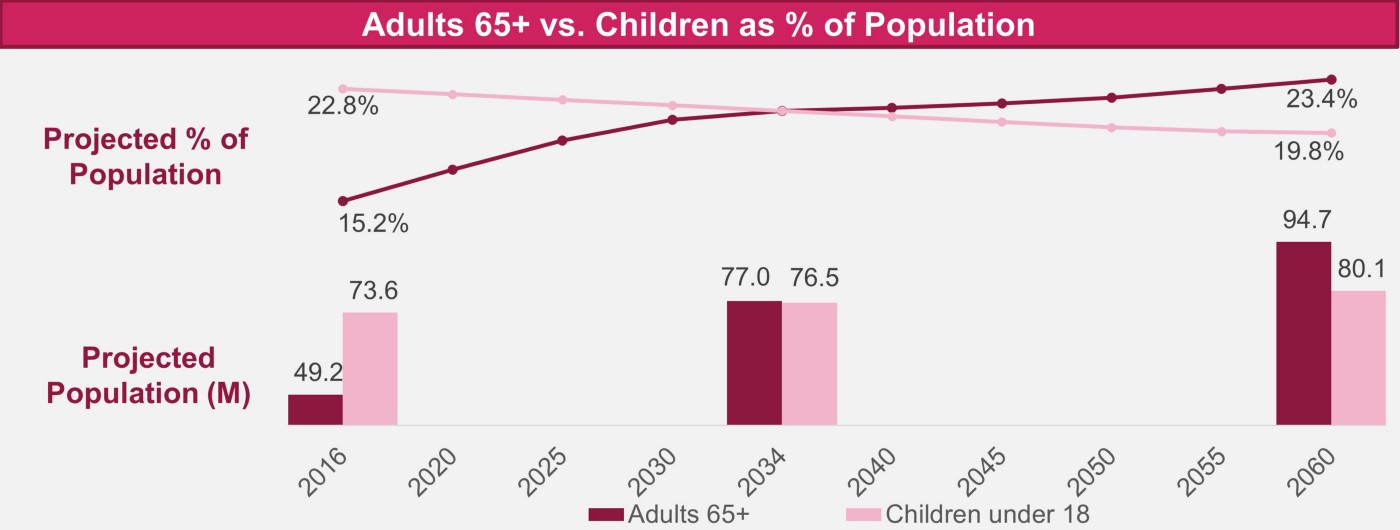

3 / An aging population (adults 65+) will outnumber children by 2034. The Baby Boomer generation is driving 42% of consumer spending, holds over 50% of wealth, and will pass on $30T.

4 / The Hispanic population is projected to be the largest racial or ethnic minority group in the U.S. by 2020 and the most economically influential group since the Baby Boomers having generated over $2.3T in GDP as of 2017 vs. $19.4T total.

5 / Millennials are now the largest adult generation in the United States. Their consumption and investment habits are distinct: a reflection of Millennials’ racial diversity (43% are non-White) and socioeconomic position (middle class status is harder for Millennials to achieve as average net worth is below $8k, largely due to student loans, rising rents and home prices, and higher healthcare costs).

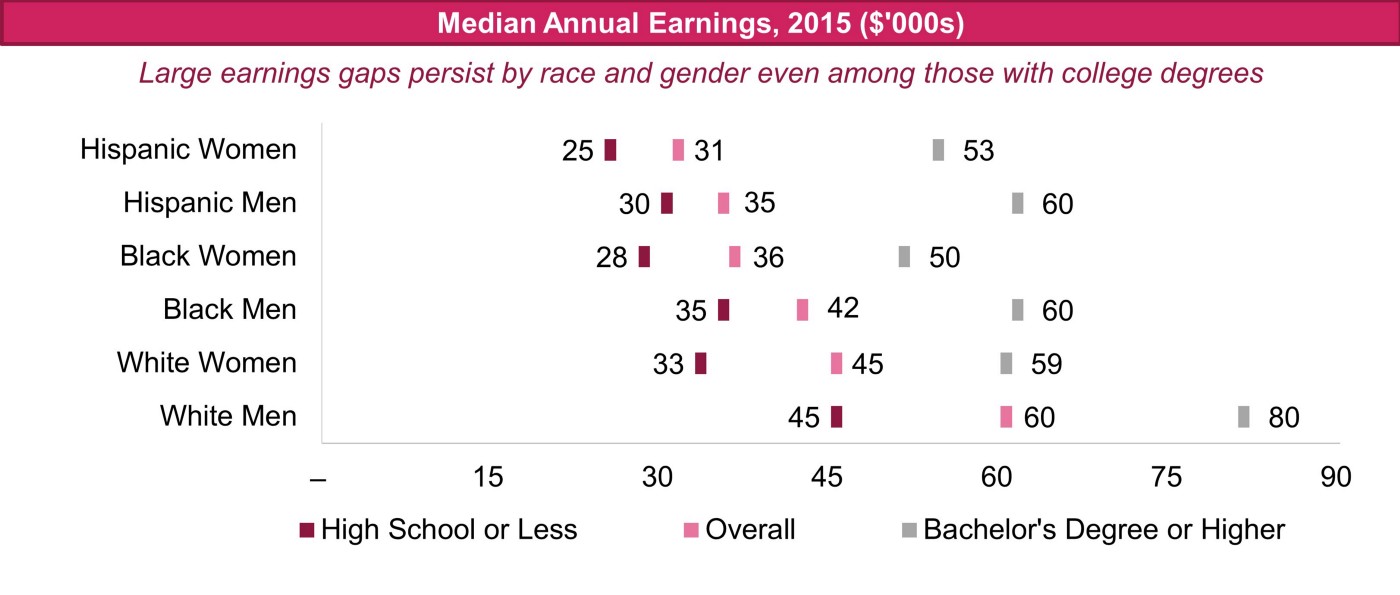

6 / The gender gap persists as women continue to drive decision making and degree attainment, but remain underrepresented in the workplace, earnings, and wealth accumulation — this trend is exacerbated further for women of color. Further, women are the primary breadwinner in 40% of families, but they still spend ~2x caregiving time vs. men.

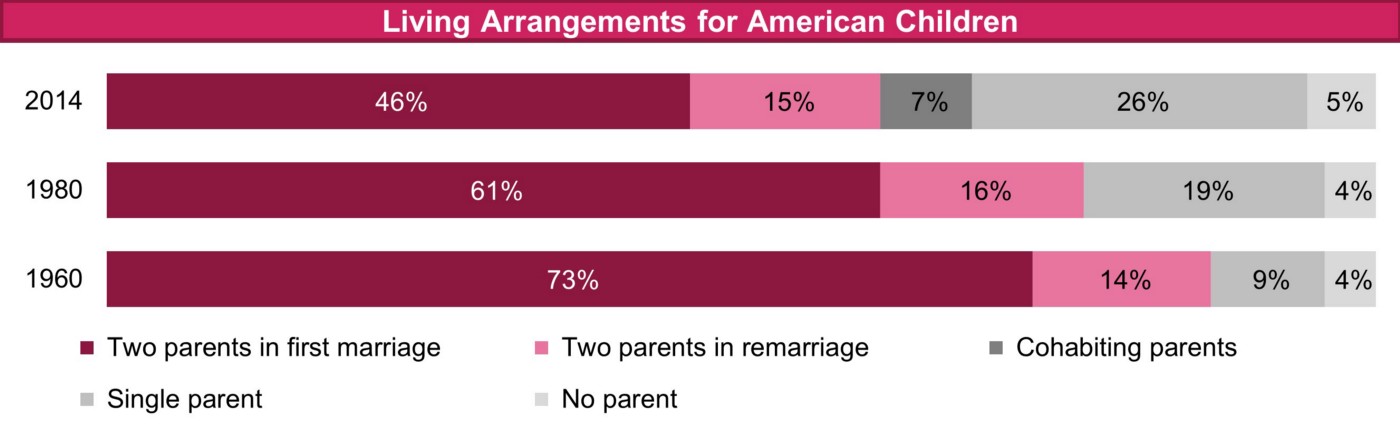

7 / From decreasing birth rates to communal living and growing rates of single parenthood, the American family is changing — and such trends will continue to have vast economic implications.

8 / Artificial Intelligence (“AI”) and automation will create more jobs than it will destroy, but its near-term implications for menial tasks and under-skilled American workers are troubling. Potential AI-related workforce displacement by 2030 is estimated to be as follows: Hispanic (26%), African American (23%), Asian (22%), White (22%).

9 / Income disparity has long been an appropriate focal point, and the gap between those at the top and the average American worker has widened dramatically in recent decades: for example, in 2018 households in the top 20% of earners (incomes >$130,001 per year) represented 52% of all U.S. income — up 9% since 1968.

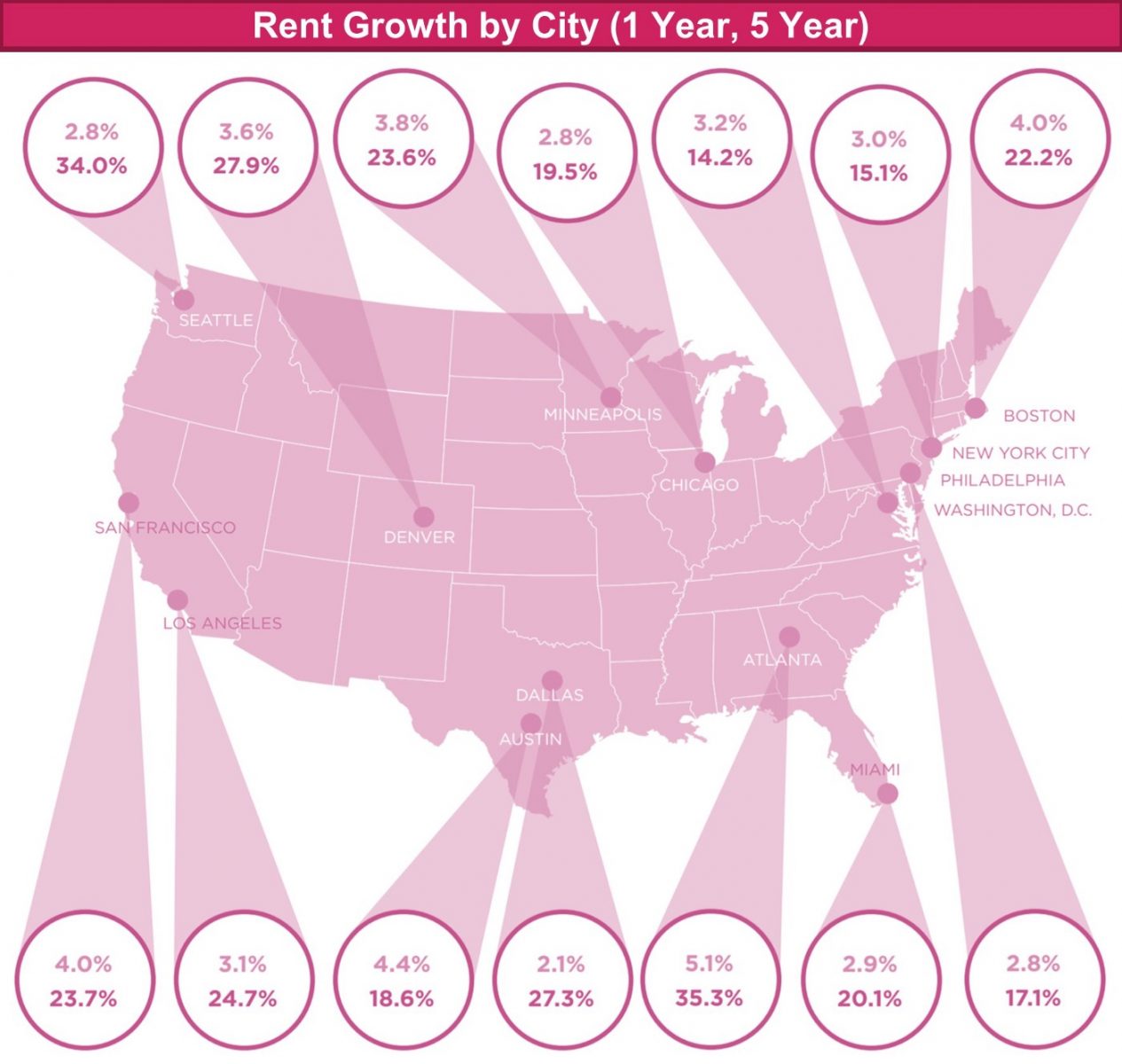

10 / Urbanization in the U.S. is widespread: externalities include escalating rent prices and increased pressure on minority communities in low-income neighborhoods. Adding to this, by 2050 90% of the U.S. will be concentrated in urban areas.

Trend Implications

These macro demographic trends are only a snapshot of select attitudes and behaviors among a population, but they present interesting implications, challenges and opportunities for the future. While we’ve considered what the aforementioned trends mean for the future of business and society, our hypotheses will require much adaptation over the coming weeks and months in light of the current COVID-19 pandemic, unfolding as of this publication. We have aimed to provide a point-in-time view that is subject to change as these unprecedented times unfold.

Future of Work

- Childcare workforce needs spike

- Demand for STEM professionals will increase

- Appetite for remote work explodes

Future of Consumer Financial Well-Being

- Unsecured debt burdens society, driving renting & sharing consumers

- Children are viewed as a luxury

- FinTech and Services demand will rise

Future of Consumption

- Businesses are more nimble in adapting to generational nuances

- Co-living and sharing models foster unique consumption patterns

Future of Education

- Revitalized education system reliant on public / private partnerships

- STEM student demand grows

Future of Healthcare

- Regulations become more agile across acute diseases and mental health

- Infectious disease professionals increase

Future of Politics

- Rise of progressive political engagement

- Legislative reforms focused on income inequality, loan forgiveness and UBI

- Urbanization exacerbates ideological divides

Future of Infrastructure

- Premium to be placed on smaller cities

- Commercial innovation in service delivery in high-density metropolitan areas

- Infrastructure investment grows, particularly in IoT

COVID-19 Considerations

Policies will be enacted to ensure pandemic impacts –societal and economic– will “never again” occur as they have under COVID-19. The Corona Virus crisis will accelerate:

- The implementation of remote work and learning

- Demand for highly skilled STEM and healthcare workers

- Threats to consumer financial stability and the need for UBI

- Healthcare regulation revisions (from insurance to FDA approval timelines)

- Rise in mental healthcare issues among younger generations

- A reduction in consumer spending due to unprecedented unemployment

- Co-living and suburban dwellers

- Improvements in infrastructure — from public health facilities to IoT

Methodology

Data gathering topic areas focused primarily on how top trends in the U.S. impacted people by Age/Generation, Ethnicity/Race, Gender, and Region. We collected insights from a variety of secondary resources such as the U.S. Census Bureau, Federal Reserve, Nielsen, Pew Research Center, The Brookings Institute, university research centers, and leading media publications.

Head over to our website to review the more detailed report, and to stay up to date on Harlem Capital news, subscribe to our monthly newsletter.

Thank you to Kelly Goldstein and Dominique Keefe for their work on this.