10 Quotes to Live By: Gems from Harlem Capital

by Harlem Capital

At Harlem Capital, we’ve been fortunate to meet billionaires, world class investors, incredible founders, and others at the top of their fields. We’ve learned so much from others since we started this journey in late 2015, but our learning accelerated exponentially during our fundraising journey in 2018-2019.

This post shares the 10 most valuable “gems” we have learned so far.

1. “Advice is cheap, get the money”

At the end of a pitch with a legendary private equity investor, we closed with “we would love for you to be an investor…or an advisor.”

He replied “advice is cheap, get the money” with a serious face. This one sentence forever altered our lives.

One of the world’s best investors thought our strategy had potential. With his validation, no one could convince us otherwise. The remark changed our tactical approach to fundraising, leading us to never soften our requests.

When you are fundraising, it is best to focus on raising money. Advice is valuable before you raise and after you raise, but don’t ask for advice from potential investors. When you believe you will be successful with or without the potential investor, it changes the power dynamic in meetings. Any wise investor wants to back someone who is confident in their idea.

You want to stay in the investor’s psychological “investment bucket” instead of their “mentee bucket” to increase their chances of writing a check. The time to accept advice from an investor is after they have committed to invest.

Note: standing your ground is a delicate balance and you always want to be respectful because it is a small world.

2. “It’s a small world” and the power of warm introductions

The world is smaller than you think, but the investment world is even smaller. Our trajectory was being shaped years before we founded Harlem Capital. The relationships we built during the first years of our career all came into play as we were growing the firm.

We were only able to get into certain rooms because of relationships we had nurtured over time. Warm introductions were essential for us. Most people have good intentions, but it is extremely difficult for well-known people with capital to sort through the numerous requests they receive. Warm introductions can put people in the “place of yes” and make serious consideration more likely.

As a start-up or first-time fund manager, your track record is limited, so investors are only betting on you and your strategy. Your reputation and reference checks are paramount and you can’t build that overnight.

3. “Winners win”

This is Harlem Capital’s new favorite quote in 2020 which rose to the surface during this challenging year.

People want to work with and support those who they perceive as already successful. Having traction, momentum, a brand, and strong advisors increases people’s desire to work with you.

In VC, the best firms see the best deals which increases their chance of great returns which leads to them being a better firm…

It can be incredibly frustrating when you’re outside of this machine, but it is a nice seat when you’re inside. If you are starting from scratch the quickest way to build a platform is by having smart and notable people supporting you.

When you get to this winning position, don’t fall into the trap of thinking that merit got you there. There are many smarter, more hardworking people who were hindered by timing or external forces.

4. “Don’t angel invest for financial reasons”

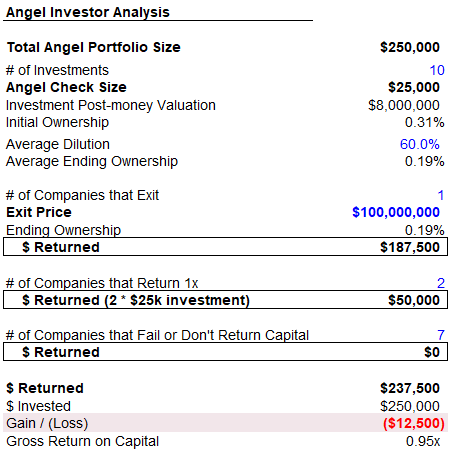

We started Harlem Capital by angel investing in start-ups. Angel investing became a learning tool, networking platform, and fun activity. But, we don’t recommend angel investing with the expectation of financial gain because…

a) The math is not in your favor. Start-ups have a high chance of failing. If they do sell for a high price, you likely won’t own enough to receive a life changing return. You have to take a lot of bets and have enough ownership (write a big enough check, early enough) to make real money. And that’s if you’re lucky

b) Unless you have experience as an investor or operator, you don’t know what you don’t know. Also, the deals available to you may not be the best ones out there. The founders most positioned for success will have funding, so be wary of adverse selection if someone really wants you to invest

If you do decide to angel invest, be very selective and only invest money you can afford to lose.

5. “It’s hard to make money as a VC”

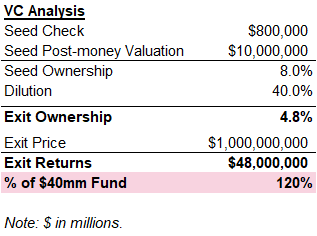

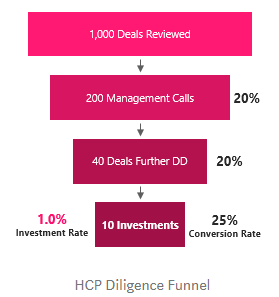

Even VC backed start-ups have a high failure rate. To make money as a VC investor, you need an adequate level of diversification and have to make most of your return from the few investments that “win” and exit. Simply put, your VC firm needs to own enough of a winning company so that a liquidation event is meaningful.

Check out our detailed post on VC math.

We were fortunate enough to learn the importance of ownership early from our advisors, but there are fund managers who have raised multiple funds that still don’t fully appreciate this concept.

6. “Put yourself in the other person’s shoes”

While the vast majority of our interactions with entrepreneurs have been positive, there have a few instances where entrepreneurs get confrontational after we tell them we are not moving forward with an investment.

These negative interactions are most likely to occur when the entrepreneurs are not familiar with the VC model and take our decision personally.

It is often not the entrepreneurs fault. Minorities have been underfunded but also haven’t generally been in the information flow in the closely-held world of VC. Most funds are opaque about their investment lens on their website and only occasionally give tactical advice on podcasts and during interviews.

In general, it takes humility to acknowledge that you may not know the person’s business across the table from you.

Like most VC firms, we only invest in 1 in 100 companies, so we have to pass on many deals that from the outside may look like they fit our investment criteria. Your business could be great and could still not be a fit for us. Keep building!

7. “Just in case vs. just in time” and being a top decile networker

The “just in time” style of networking is what most people do — taking a transactional approach and reaching out to someone when they need something.

“Just in case” style networking is taking a long-term approach. If you keep long-term priorities in mind and treat every person well, you will be amazed at what happens. Strategically, it takes time for people to like and trust you. Only then, will they go out of their way to be helpful or lend their reputation on your behalf.

Three other tips to being a top decile networker paraphrased from Chris Fralic at First Round Capital:

a) Do what you say you’re going to do — following through is imperative to people trusting your word and building strong relationships

b) Double opt-in intros (asking both sides before introducing someone) — When introducing two people electronically, extend them both the courtesy of being able to accept or decline the introduction. ALWAYS. Most people prefer this style of introduction because it gives them the ability to a) decline a conversation that isn’t a fit for them or b) push to a time where they are less busy. It avoids putting someone in a position where they feel obligated to take a meeting without genuine interest. If someone agrees to a double opt-in connection, there’s a much higher chance they engage

c) Close the loop — after someone makes a connection for you, let them know the outcome. Circle back someone after they help you with a relationship connection. A “thank you for this connection” or “call went well” is helpful, but if you are more detailed, it can help the connector refine their approach in the future.

8. “You can only give advice as far as you’ve gone”

Fundraising was difficult in the beginning. Henri and Jarrid were 26 and in the first year of business school when gearing up for the fund launch. We reached out to former colleagues, professors, friends, family, and even other investment professionals to invest or provide advice. We got a lukewarm response at best.

Some examples of the responses we received:

“Why don’t you work at another VC firm get more experience first”

“Diversity isn’t investment strategy, what is your industry focus?”

“Why don’t you wait until graduate business school?”

Eventually two things hit us:

a) The generic mass market advice may be good for most, but is not relevant for us given our mission and sense of urgency

b) Most people are risk adverse. Despite their success, many people have only worked their way up established organizations and have not been entrepreneurial. Others have been entrepreneurial, failed, then sought security.

Most people weren’t qualified to give us helpful advice based on their own professional experiences. Conversely, when we were able to get in front of billionaires who took entrepreneurial risks, they instantly understood our strategy and were more supportive.

Investment pioneer Henry Kravis co-founded KKR when he was 32 and Ray Dalio started Bridgewater when he was 26 and never ran a company beforehand.

If you have a strong vision and the timing is right, it can pay to go against conventional wisdom.

9. “Good communication is essential”

When we look back at our most helpful LPs, strongest portfolio company entrepreneurs, and best interns, they are all great communicators. Now, “overcommunication” is our #1 value at Harlem Capital and a key factor to our effectiveness.

Internally, it is important to be responsive so everyone is in the loop. By having a culture where we are expected to reply to messages within minutes to hours it ensures that we can make decisions quickly, create quick feedback loops, and minimize bottlenecks.

Externally, our responsiveness to others (primarily via email) helps us not miss great opportunities and instill confidence in others. We have won some our best deals and achieved press / event opportunities by being on top of our inbox. By responding to every LP or potential LP within 48 hours, we signal that we are well organized and effective enough to manage institutional capital.

One of the reasons we were excited to partner with TPG was because of their responsiveness. The firm has a culture of overcommunication and we were amazed as we realized top executives would reliably reply to us within hours. Our standards have forever increased as we realized the power of this workstyle.

10. “Why YOU?!”

During one pitch at the Harvard Club in NYC early in our fundraising journey in 2018, a potential investor stood up from the table and shouted “Why you?!” multiple times. We were surprised and stunned that he raised his voice. We presented a laundry list of answers, but the individual was not satisfied.

Though this individual did not invest, he provided us with valuable feedback. Anyone raising money should be able to answer the question “Why YOU?! Because any investment in an early stage company or first time fund is a bet on the team. As a VC you are people betting on people. You are not only selling your abilities, but also selling your ability to assess others.

Now our answer is simple: we are the right people, tackling the right opportunity, at the right time. And we’re prepared to back it up with examples.

Conclusion:

Over the last few years, the Harlem Capital team has learned a great deal and used this knowledge to adapt quickly. We began with a strong vision, but needed the help of supporters to make it a reality.

Part of our mission of changing the face of entrepreneurship is sharing information that could be helpful to others. Our hope is some of these lessons can get you one step closer to achieving your goals. Keep on building!

Thanks to our Managing Partner, Jarrid Tingle, for writing this piece.