First 90 Days After your Seed Round – Part 1

by Harlem Capital

By Harlem Capital Partner Gabby Cazeau

Congrats! You’ve just closed your Seed round and ended the fundraising process. But the secret is that closing the round is really just the beginning where the real work begins. Founders underestimate how important the 90 days post-close are for building a strong foundation for your relationship with your investors.

In this two-part series, we’ll walk through what to do in your first 90 days with your investors to set yourself and your company up for success.

Here’s what to do in your first 90 days with your investors.

1. Reset and Reflect

2. Align Expectations for North Star Goals

3. Set your Communication Cadence

Let’s dive in!

Reset and Reflect

Just after you fundraise is a great opportunity to reset before focusing on what’s next. You’re now both on the same team and can be transparent about the process. Ask your investors questions to understand more about why they invested, what risks they see going forward, and how you might navigate them.

Since this is your seed round, you’ll be fundraising again in 18-24 months for your Series A. Now’s a great time to get your investors feedback on the fundraise process, pitching, and what you’ll need to improve ahead of the next round. You can also share your feedback to investors about how their process worked for you in the founder seat, so they can improve as well. Now’s the time before diving in to capture any key lessons before moving forward.

Align Expectations for North Star Goals

One thing that is great about the investor – founder relationship is that there’s clear alignment of incentives. Both founders and investors have equity in the company and with that equity comes significant financial returns for both groups if the company performs well. So what’s great is that everyone wants to move in the same direction: up and to the right! But it’s not always clear what financial goals each side wants. One thing to do is to align on your desired outcomes, or north star goals for the company.

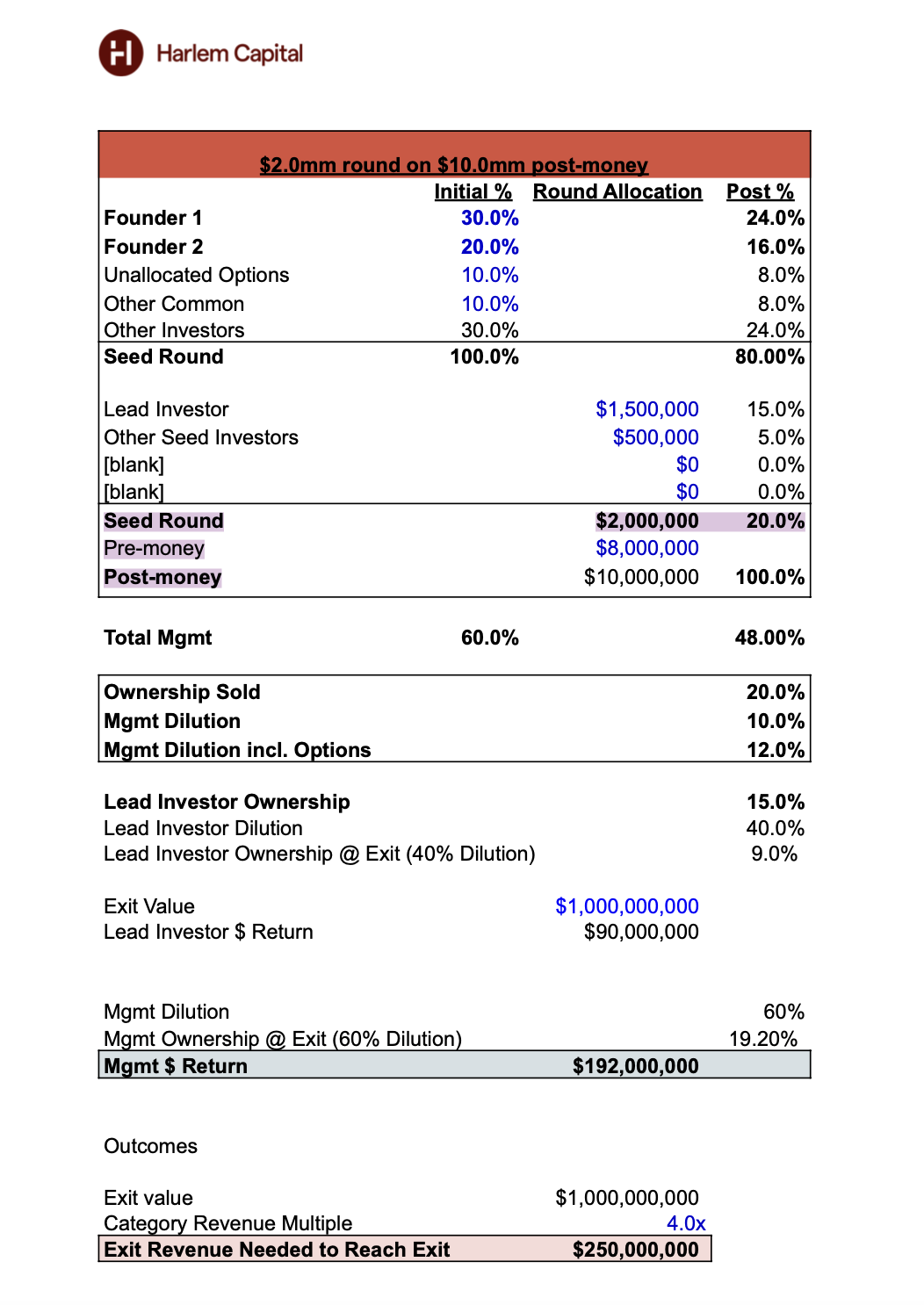

One way to do that is to use a model to map out what exit returns would look like for you AND your investors. You can use this to have a discussion with your investors to see how this matches their expectations for your company and what it means for their fund.

Download this example model here: Exit Outcomes Model

In this example, for a Seed round of $2mm raised at a $10mm post-money valuation, a $1B exit (with standard dilution), founders and investors both have a great return. But given the category multiple is 4x, it requires a significant revenue scale to achieve that outcome. You might have thought $100mm in revenue is enough, but in this case, it’s $250mm needed.

If the investor has a $200mm fund, then this outcome, while strong, isn’t enough to return the fund. So that investor would likely have different expectations for your company. Overall, it’s important to make sure you’re both in sync on expectations for what’s needed at scale.

Set your communication cadence

The hallmark of any good relationship is open communication. Investors can handle bad news and the ups and downs that come with entrepreneurship. Your company is one across a portfolio, so investors have seen a whole spectrum of challenges and expect them!

But what often hurts that relationship is surprises, getting inaccurate information, or worse, no information at all. Also, VCs have a fiduciary duty to their investors (LPs) to know what’s happening with their various portfolio companies. So it’s really important to set the framework for how and when you’ll communicate with investors.

So it’s key to set your communication cadence. This may vary based on the stage of the business where pre-seed companies may need to work with investors more closely and later stage companies less frequently.

Here’s a list of the things to set:

- Frequency of calls with lead investor (biweekly, monthly, quarterly?)

- Frequency of update emails to core investors (monthly, quarterly?)

- Fastest way to reach each other and how you prefer to communicate (Slack, email, text?)

Here are some best practices at the Seed Stage:

- Monthly meetings with lead investors

- Monthly update emails to core investors

- Quarterly update emails to all investors

Anecdotally, one of the common attributes we see in successful founders is great communication. Identify what works best for you and your investors, and stay consistent! This resource from Visible VC for Monthly Update templates make this super easy.

Taking these proactive steps in the first 90 days sets a strong foundation for the collaboration between investors and founders. Stay tuned for part 2 for the next set of actions to focus on.

Follow @HarlemCapital across all social platforms for more insights. And don’t forget to subscribe to Road to 1,000, our monthly newsletter!