Supply-Chain Tech in Ecommerce

by Harlem Capital

Few things have brought the vulnerabilities of supply chains to the forefront of the consumer’s mind than the pandemic. What used to be a hidden process, where you didn’t notice it as long as it was working, is now a powerful differentiation tool as customers are brought along the journey of fulfillment through visibility into delivery estimates, shipping tracking notices – up to the day they receive their merchandise.

Ecommerce brands have the data to make better product, inventory and marketing decisions, but small and large brands alike are now competing with increasing customer expectations of quick, free shipping thanks to the likes of Amazon. Unlike Amazon, however, they do not have the volume or high-tech, automated warehouses to do so sustainably. And so, they give up their control of the customer experience to third party logistics providers who will at best meet expectations and provide an intentionally unremarkable experience, or at worst ruin their hard-earned customer’s loyalty and impression of the brand.

These evolving dynamics culminate into the following 5 industry issues we see being solved by current and future supply chain technologies:

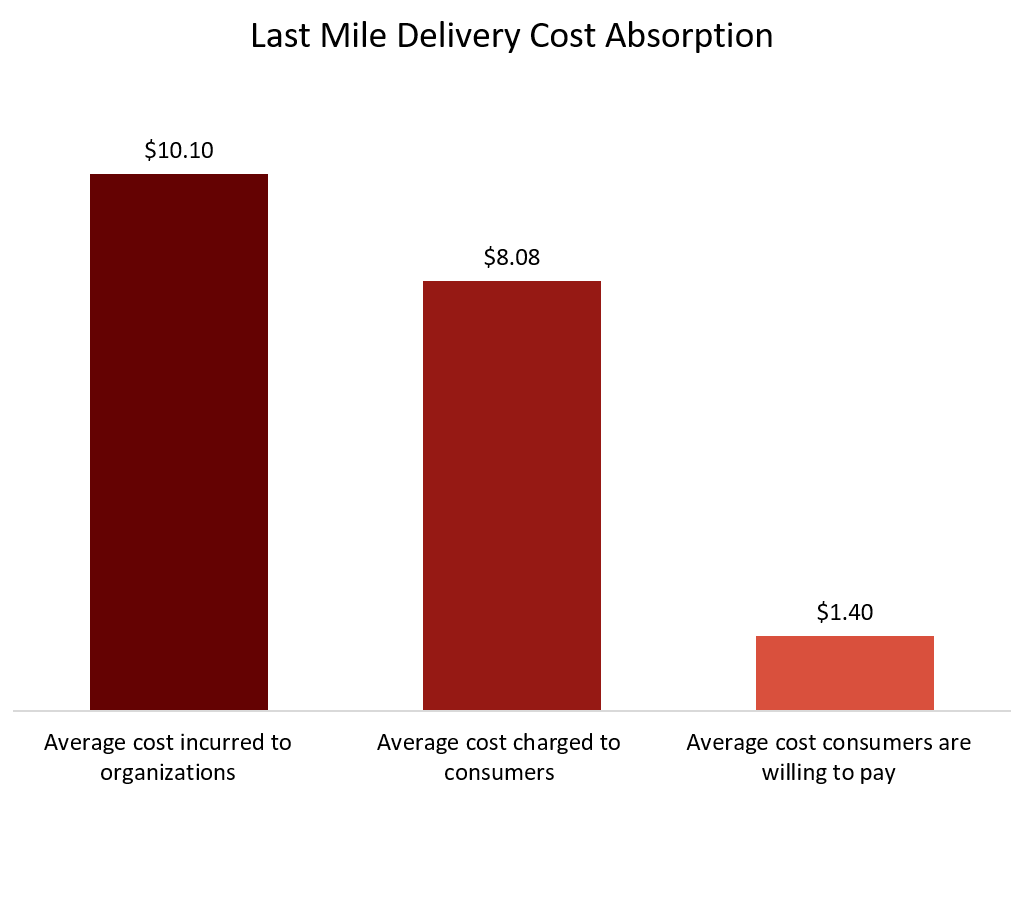

- 1) Unit economics are strained as labor regulations supporting gig economy workers and consumer expectations of next-day delivery put pressure on already low margins. Globally, businesses spent over $86B on last-mile delivery in 2017, which accounts for 28% of the total transportation cost associated with a product. Transportation itself comprises upwards of 60% of supply chain costs.

Source: Capgemini Research Institute

- 2) Lack of visibility and siloed data across the supply chain results in $144B of lost revenues annually due to stock-outs and constrains the ability to assess risk exposure. The competing priorities of net working capital preservation vs. flexibility/buffer room to respond to demand shocks come into the forefront.

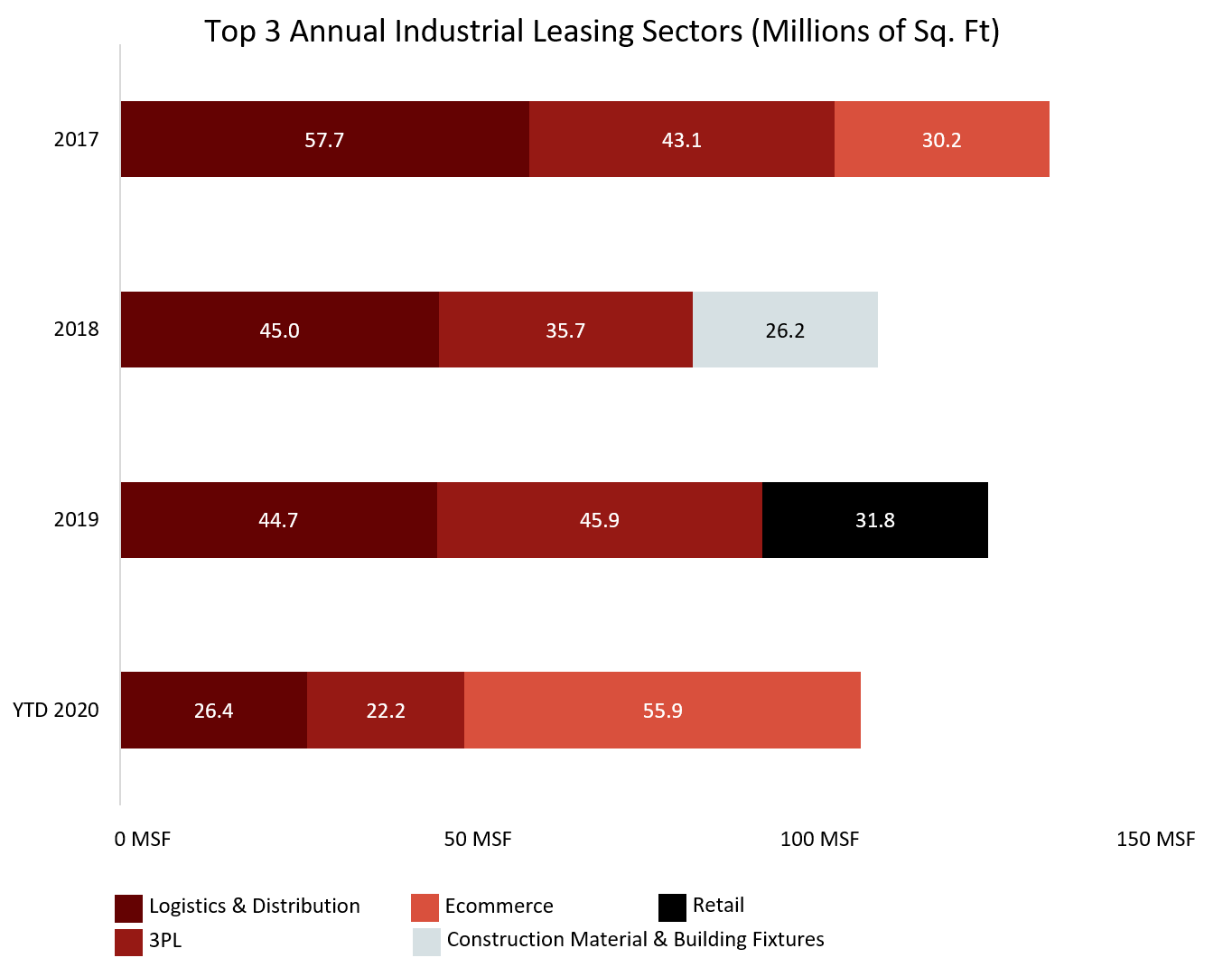

- 3) Retailers are facing warehouse scarcity and cost pressure. Retailers use an estimated 1.25M sq.ft. of warehouse space for every $1B in sales, according to CBRE. With global ecommerce growing at 20-28% per year pre-COVID, pricing and availability is set to become a real challenge. This is further exacerbated as logistics providers are pressured to localize their supply chain assets in expensive, urban areas closer to the customer in order to decrease last mile costs and meet compressed delivery times.

Source: JLL Research

- 4) Supply chain disruptions due to reduced labor supply, COVID-19 and trade disputes has highlighted a need for supply chain technologies and automation to ensure business continuity. However, the high fixed cost nature of the fulfillment business does not allow SMBs to compete and adapt to shocks.

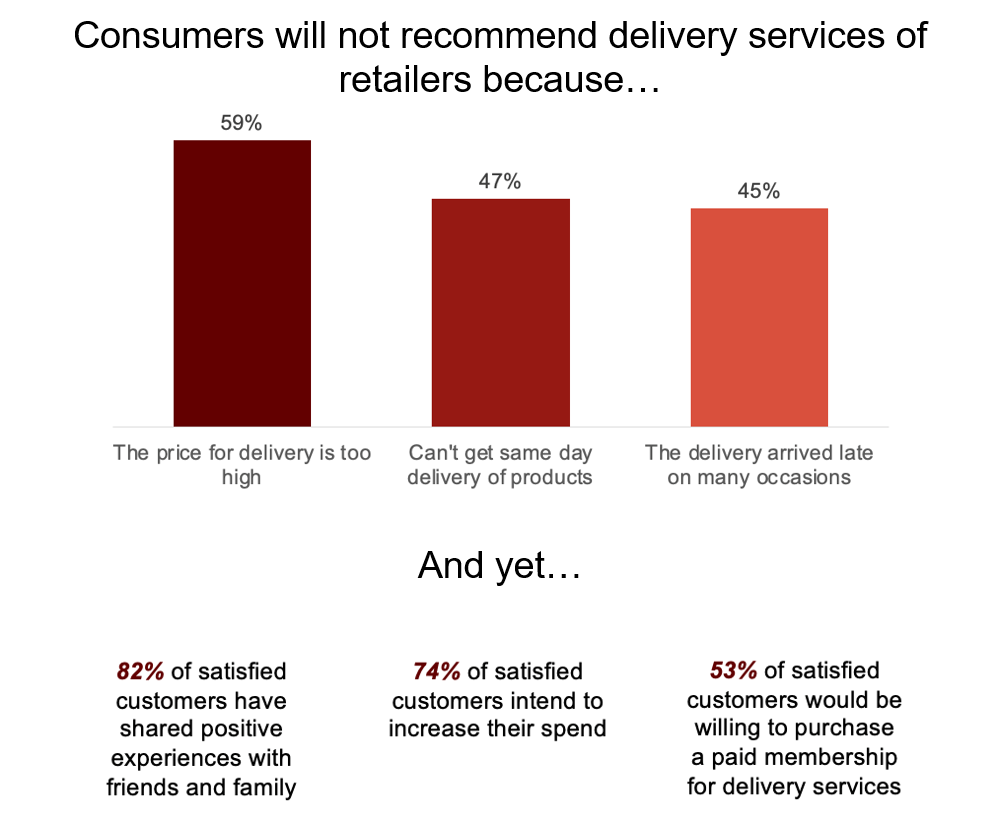

- 5) Disintermediated customer experiences threaten online brands who invest heavily on user experience but relinquish control to a 3rd party for fulfillment. Last mile delivery platforms own the customer in an increasingly commoditized space.

Trend Implications

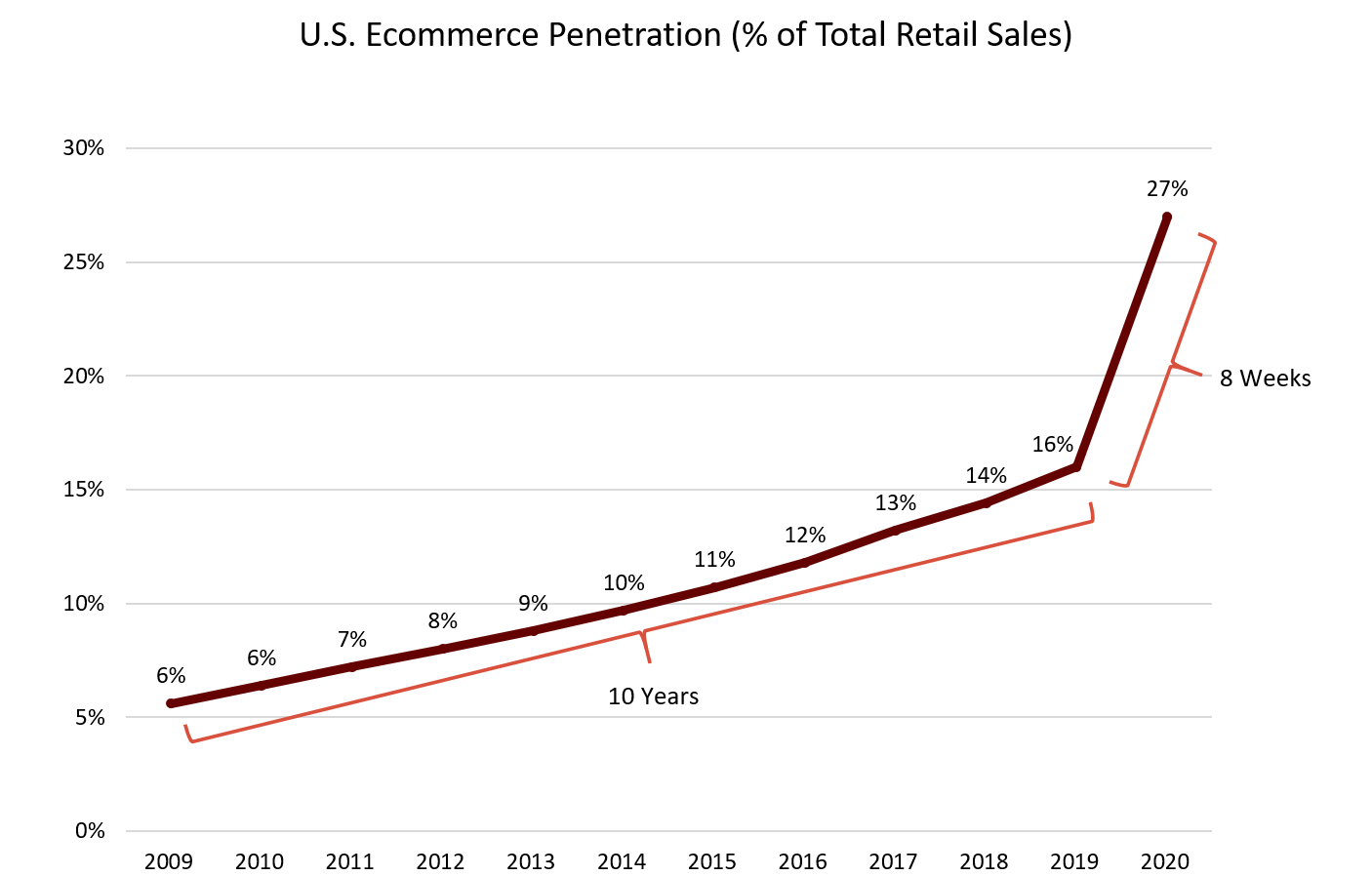

These evolving dynamics present interesting opportunities as companies try to build more visibility, flexibility and resilience into their supply chains. We see from a dramatic growth in sales through online channels that the pandemic has pulled forward a lot of the supply and demand that was expected to move online by several years, much of which is expected to remain. The proliferation of SaaS/IoT has primed players across the supply chain to participate in digitizing their industries and enable collaboration.

Source: Acuity Insights, July 2020

In these unprecedented times, 3 areas of interest arise:

1) Microfulfillment and Supply-Chain-as-a-Service

- Smaller retailers cannot compete with current logistics infrastructure and speed, and will need to rely on microfulfillment to combine the proximity of localized stores with the efficiency of large, automated warehouses

- New pricing and service models like SCaaS will allow retailers to own the customer, sell across multiple channels from any source and turn previously fixed costs into variable subscription costs that are easily scalable to respond to seasonality and demand shocks

- Companies innovating in the space: Takeoff, Fabric, Bond, Darkstore

2) Supply Chain Integration & Visibility

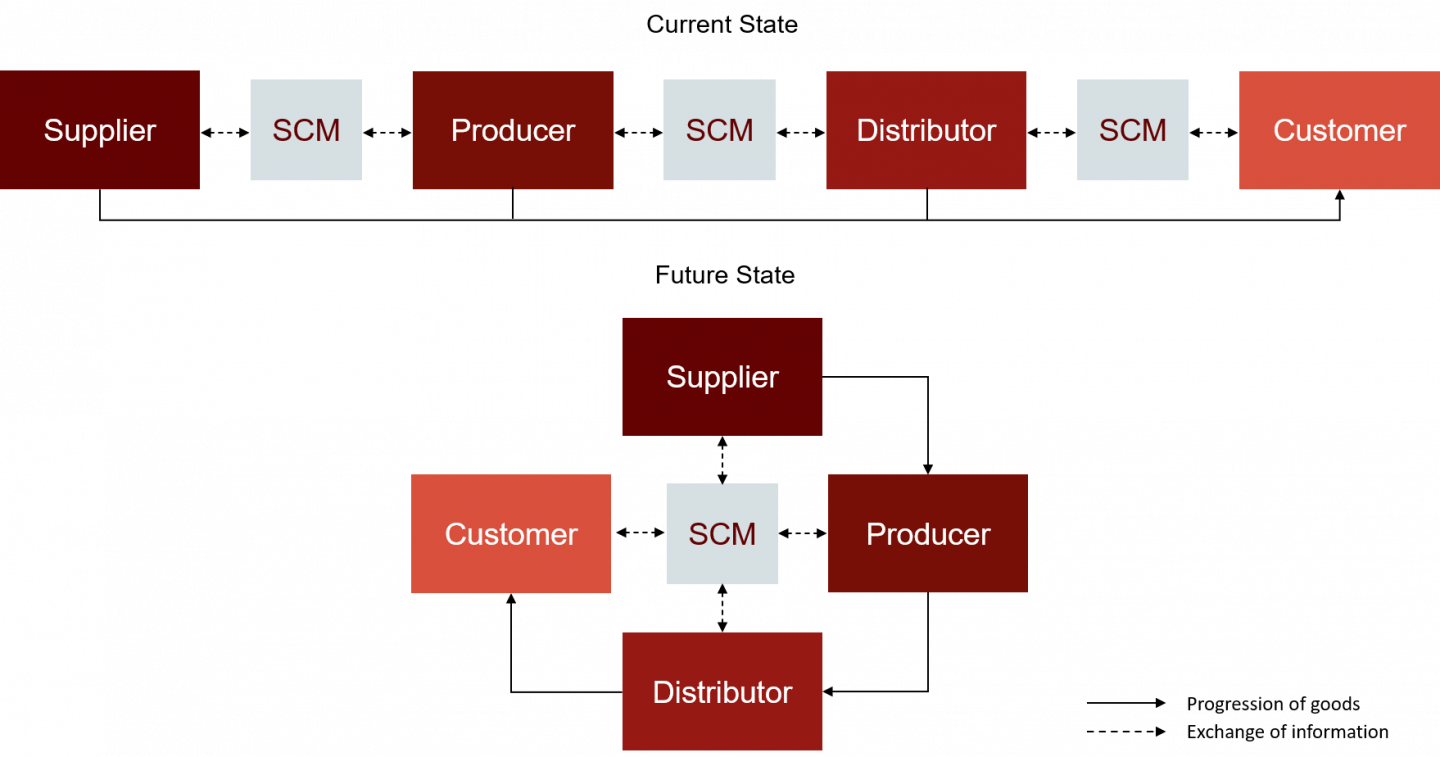

- It is not good enough for companies to manage their data in a silo. Companies that can provide end to end platforms or centralization/integration across multiple combination of supply chain management (SCM) software for each participant in the supply chain will unlock valuable predictive/AI analytics capabilities for inventory and risk management

- Companies need good data on demand and inventory velocity if they want to leverage microfulfillment. With a smaller space, it’s crucial that they make good stocking decisions and know their customers on a hyper-local, neighborhood specific level

- Companies innovating in the space: Convey, Interos, Resilinc, Project 44

Future State: Players across the supply chain have centralized or integrated systems to allow for full visibility and inventory, risk management.

Source: PitchBook

3) Software for Warehouse Automation

- Though robotics remains a huge area of focus in the warehouse automation space, many players are developing non-compatible technologies in parallel and startups in the space face significant partner risk as incumbents develop or acquire in-house warehouse automation capabilities

- There is a need for companies providing the infrastructure behind the robotics technology – a hardware agnostic AI software that can quickly teach and integrate robots as they’re deployed to a rapidly growing number of warehouse facilities of varying capacity, size, location and product types

- Companies innovating in the space: OSARO, Covariant

While the scope of this analysis intentionally excludes the significant impact of drones, autonomous vehicle capabilities and other capital intensive industries on supply chains across the globe, these 3 spaces are poised for exciting developments as new delivery methods are tested, customers behaviors rapidly shift and new business models are experimented with. We look forward to meeting the next generation of diverse founders innovating in the space.

Full Report:

2020.10.29-HCP-Supply-Chain-Tech-Industry-Report-v14-BlogYou can download the report here. Thanks to our Fellow, Vivien Sung, for writing this piece. To stay up to date on Harlem Capital news, subscribe to our monthly newsletter.