5 Lessons From 5 Years of Harlem Capital

by Harlem Capital

December 2015 – A group of friends met in a Harlem living room for their first meeting as an angel syndicate. We had decided we would each invest $10,000 into startups. Little did we know we would end up each investing significantly more and creating our dream jobs. The past five years of Harlem Capital has been an incredible journey of personal and professional lessons so we wanted to share some of them with the community that helped create them, you all.

5 Lessons From 5 years:

- Brand MATTERS

- It’s ok to Learn on Someone Else’s Dime and Time

- Find the Gaps and Launch

- The Path is Not Linear

- Build Internal Processes to Scale

Origin Story

We met in 2011 during a diversity program called MLT, which we highly recommend for college students. Post college, we all moved to NYC to start our careers in investment banking. After two years we had left investment banking, started in private equity and were asking ourselves,

“Why aren’t we doing what we do at work for ourselves?”

Something that we aren’t trained to do as employees. We were helping others have equity and ownership, but had none ourselves.

For more details on the origin story check out this podcast episode.

Lesson 1 – Brand MATTERS

Our first question in that Harlem living room was,

“How do we convince founders to take our money?”

The reality is we were 25 year olds writing $25k checks ($5k each) so we knew our money alone wouldn’t be enough. Although it was meaningful for us, it was relatively small dollars to most founders. As a result, we decided to create an LLC so that we could pool our money together instead of individual $5k+ checks. After a few hours of brainstorming and research, we came up with the name Harlem Capital Partners. We all lived in Harlem and to us it represented the Black Renaissance and Black excellence. We then created a logo, website and business cards for roughly $1k. This was a meaningful investment to us at the time, but one that would change how others perceived us as young Black boys with capital. In investing and life, perception is reality. We needed people to perceive us as a legit VC fund even though we were a group of friends angel investing.

The brand grew and became validated by others such as Black Enterprise and Forbes, which were our first major publications. Don’t underestimate the power of external validation. There is no doubt the market perceived us differently once we had press. However, you will get to a point where you use your platform to tell your own story. We are fortunate to be at a point where we can launch things like our newsletter and podcast to still reach thousands.

We should note that a brand is not a website or logo, it is your daily actions to others and what people say about you when you aren’t in the room.

Lesson 2 – It’s Ok to Learn on Someone Else’s Dime and Time

The first 3.5 years we were either working full-time jobs or students in business school. The messaging today can so often be, if you are serious then you have to quit your job and go all in. This is a PRIVILEGE that is not a reality for many, especially those of color. For the first 2 years we were working 60+ hours a week, but when our bosses left we would order dinner and start our night shift on Harlem Capital. We printed off decks and used the conference room to have investment debates. Then in business school we got three of our courses to be class credit for working on Harlem Capital. We also received an entrepreneurship fellowship, which allowed us to fundraise during the summer instead of interning. Ultimately, you must do what is best for YOUR circumstance, not the norm. Many told us business school was unnecessary, but it gave us time, knowledge and connections. Your job is to filter advice from various people and make a decision.

Lesson 3 – Find The Gaps And Launch

Fall 2017, Jarrid and I entered business school as roommates and started recruiting for investor roles. After working on Harlem Capital on the side and working at a Black owned private equity fund, there were two criteria we were searching for in a new role.

- A fund with at least one Black investment Partner

- A fund with some diverse founders in their portfolio

We quickly realized that there were very few funds with Black Partners and most that had them were managing their own funds with no associate roles. We also realized the majority of funds had almost no diversity in their portfolio, particularly by race versus gender.

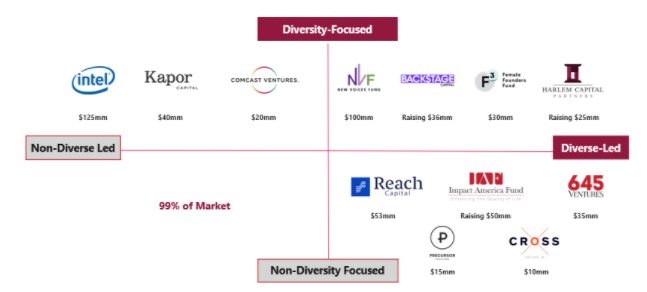

So after creating the above chart in 2018, it was clear that the only option was to turn Harlem Capital into a fund. But going from friend’s angel investing to raising an institutional fund is a BIG jump that is hard to understand until you do it. But similar to what we ask our founders, we asked ourselves,

“Why are we uniquely positioned at this moment to invest in diverse founders?”

Our answer to ourselves was we had built a brand, seen hundreds of deals and built scalable internal processes. It is more important that you answer this question for yourself more than for others. Several of our mentors and peers told us we didn’t have enough experience and there was no need for a diversity fund. But we were on the ground as angel investors seeing the pipeline and the gaps for diverse founders. Two key gaps we saw were:

- Diverse founders weren’t raising as much capital as they needed or wanted

- Diverse founders were taking twice as long to their close rounds

As a result, we wanted to raise a fund that had the ability to write $750k checks to enable us to lead rounds, which helps founders close their rounds substantially faster given the number of co-investors in the market. To some, we looked like a charity, but we only needed a few to believe in us. Expect to have many doubt you, it means you are on to something.

Lesson 4 – Your Path is Not Linear

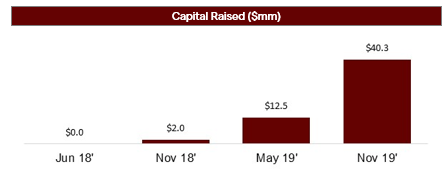

After deciding to launch the fund we spent our business school summer raising, but came back to campus in the fall with only $3mm committed. We started recruiting for jobs as we hadn’t raised enough to cover our expenses. But then we got our first $1mm check from a legend investor and decided we had to stop recruiting and take the leap of faith. At some point others may have more faith in you than yourself. That $1mm check was worth $10mm of validation for us.

We took that million and had our first close of $2mm in November 2018. Most gave us advice to not have a first close of less than $7.5mm or 30% of our $25mm target. However, we wanted to start deploying capital and proving to the market that we had access and could get into deals. It was a bet and one that thankfully paid off in our favor. Those inflection points are critical to your path, but you will have to take the risk for them to happen.

We could have never imagined going from $2mm to $40mm in 12 months. We often predict our future based on our past in a linear line, but our paths are not linear.

Lesson 5 – Build Internal Processes to Scale

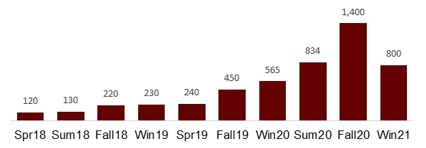

One of our core values is “Process is Religion”. No other process has had a bigger impact on the firm than our intern program. It started three years ago to help prepare for fundraising, but has grown to ten classes and 5k applicants.

The interns enable us to do a lot of work outside of deals to help expand the diverse ecosystem, such as our research reports, newsletter and podcast. It has also led to both of our senior associates as well as investors at other funds. We are often asked,

“How do you manage so many interns without distracting the firm?”

The intern program wouldn’t be possible without a few key things:

- It is a priority for the Partners

- We involve the entire team (juniors to seniors)

- We have a detailed onboarding process in place

- Have weekly check in calls

- Include the interns on as many calls as possible

- Do feedback with them twice a class

It took a lot of up front time and energy to develop the above processes, but long term it has led to infinite upside. It is often easier to put in processes for quantitative things like deals, but much harder for qualitative things like talent. However, people are the most important process to scale. We will continue to double down on the intern program. Summer 2021 application is open until February 17th.

Conclusion

These past 5 years have taught us so much, but we know the next 5 years will be even more insightful. What worked in the past won’t work in the future so we will have to continue to evolve. It is our goal to build an institution to outlast us and continue serving diverse founders for generations to come.

Thanks to our Managing Partner, Henri Pierre-Jacques, for writing this piece.